Technical Analysis

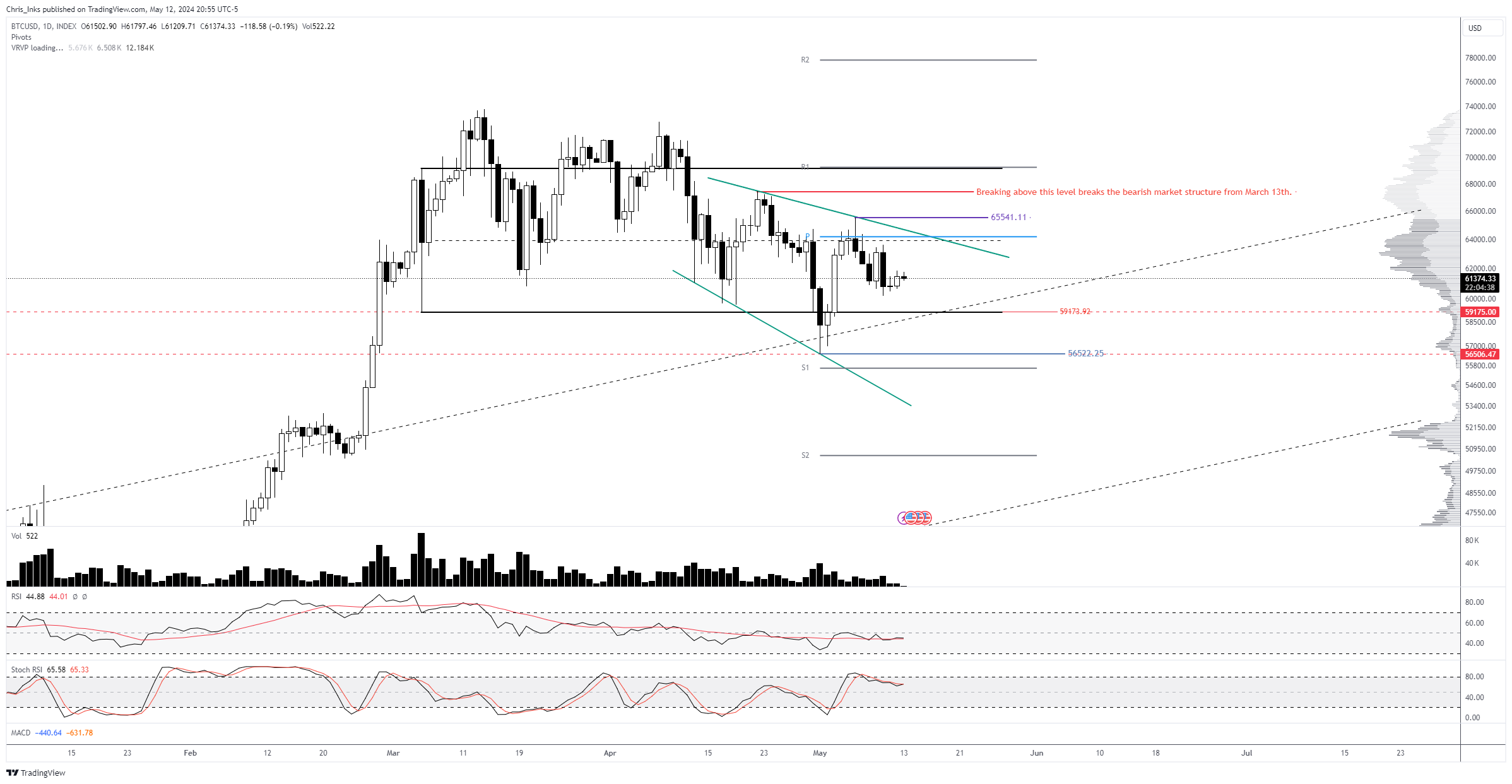

Crypto analyst Christopher Inks has analyzed Bitcoin’s price movements using technical indicators. He identifies key support (S1, S2) and resistance (R1, R2) levels.

Breakout Signal

Inks believes a breakout above $63,000 would signal a reversal from the bearish trend. This level represents a confluence of technical elements, including the daily pivot point and resistance lines.

Resistance Levels

If the $63,000 resistance breaks, the next targets are $65,541, $69,000 (R1), and $78,000 (R2).

Support Levels

The crucial support level is $56,522. A breakout below this level could lead to further declines.

Indicators

The Relative Strength Index (RSI) is around 50, indicating a balance between bullish and bearish forces. The Moving Average Convergence Divergence (MACD) suggests a potential bullish crossover. The Stochastic RSI shows potential for movement in either direction.

Market Dynamics

Inks notes that the supply of Bitcoin has decreased during the bearish trend, which could help stabilize the price.

Conclusion

Inks believes that a breakout above $63,000 could signal the end of the bearish trend. However, a breakout below $56,522 could lead to further declines.