Trump’s Win Sends Bitcoin Soaring

After Donald Trump won the 2024 US presidential election, Bitcoin went on a wild ride. The price skyrocketed to a new all-time high of $75,407, fueled by excitement over Trump’s pro-crypto promises. He’s pledged to make Bitcoin a national treasure, fire the head of the SEC (the agency that regulates crypto), and generally make things easier for the crypto industry.

A Big Warning from an Economist

But not everyone’s celebrating. Renowned economist Henrik Zeberg thinks Trump’s economic policies could actually lead to a recession, which would crash Bitcoin and the entire crypto market.

The Smoot-Hawley Connection

Zeberg is worried about Trump’s plan to replace taxes with tariffs. He says this could be like the Smoot-Hawley Tariff Act of the 1930s, which is widely blamed for making the Great Depression even worse. This act raised tariffs on imported goods, causing other countries to retaliate, which choked off global trade and led to widespread unemployment.

A Short-Lived Surge?

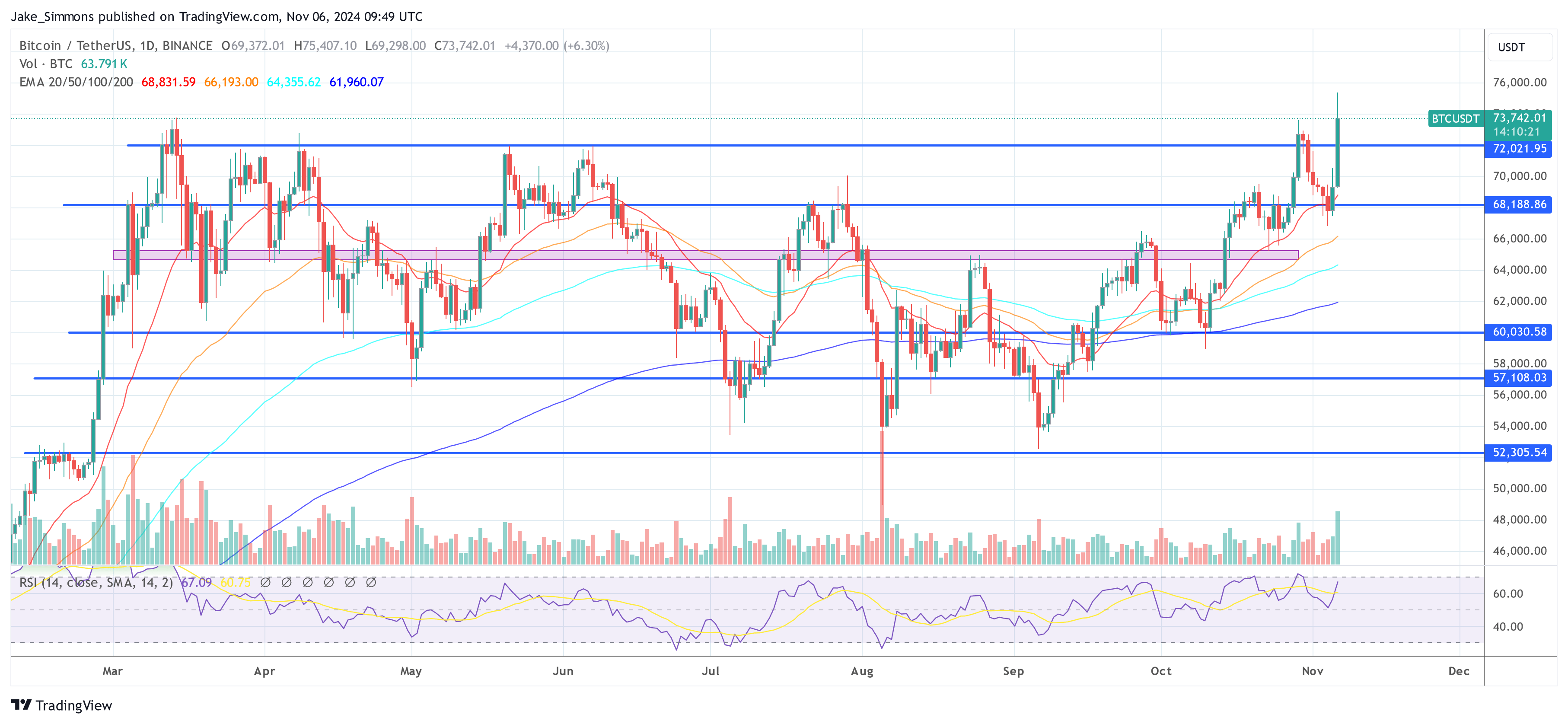

Despite his concerns, Zeberg thinks Bitcoin could see a massive, but short-lived, price spike. He’s using Fibonacci extension levels, a technical analysis tool, to predict this.

Fibonacci Levels and the Blow-Off Top

Zeberg says Bitcoin could reach $114,916 before crashing. He sees this as the “blow-off top,” the peak of the bubble.

He’s also identified other key levels:

- $77,437: Initial resistance after the recent price surge.

- $85,205: Minor resistance as the price climbs.

- $107,435: A crucial psychological and technical threshold.

- $123,148: A possible overshoot beyond the primary target zone.

Zeberg thinks Bitcoin could rise by 58% in just three months, which is a super-fast increase.

What’s Next for Bitcoin?

It’s still early to tell if Zeberg is right. But his warning serves as a reminder that even in a bull market, things can change quickly.