A major US investment bank, H.C. Wainwright & Co., is predicting a huge jump in Bitcoin’s price. They’ve bumped up their forecast for Bitcoin’s price at the end of 2025 from $145,000 to a whopping $225,000!

Why So High?

The bank’s prediction is based on several factors:

- Spot Bitcoin ETFs: The increased availability of Bitcoin ETFs in the US could bring in a flood of institutional money.

- Institutional Adoption: More and more big companies and investors are getting into Bitcoin.

- Improving Market Conditions: They’re expecting better global economic conditions and less regulatory uncertainty.

The Fine Print: It Won’t Be Easy

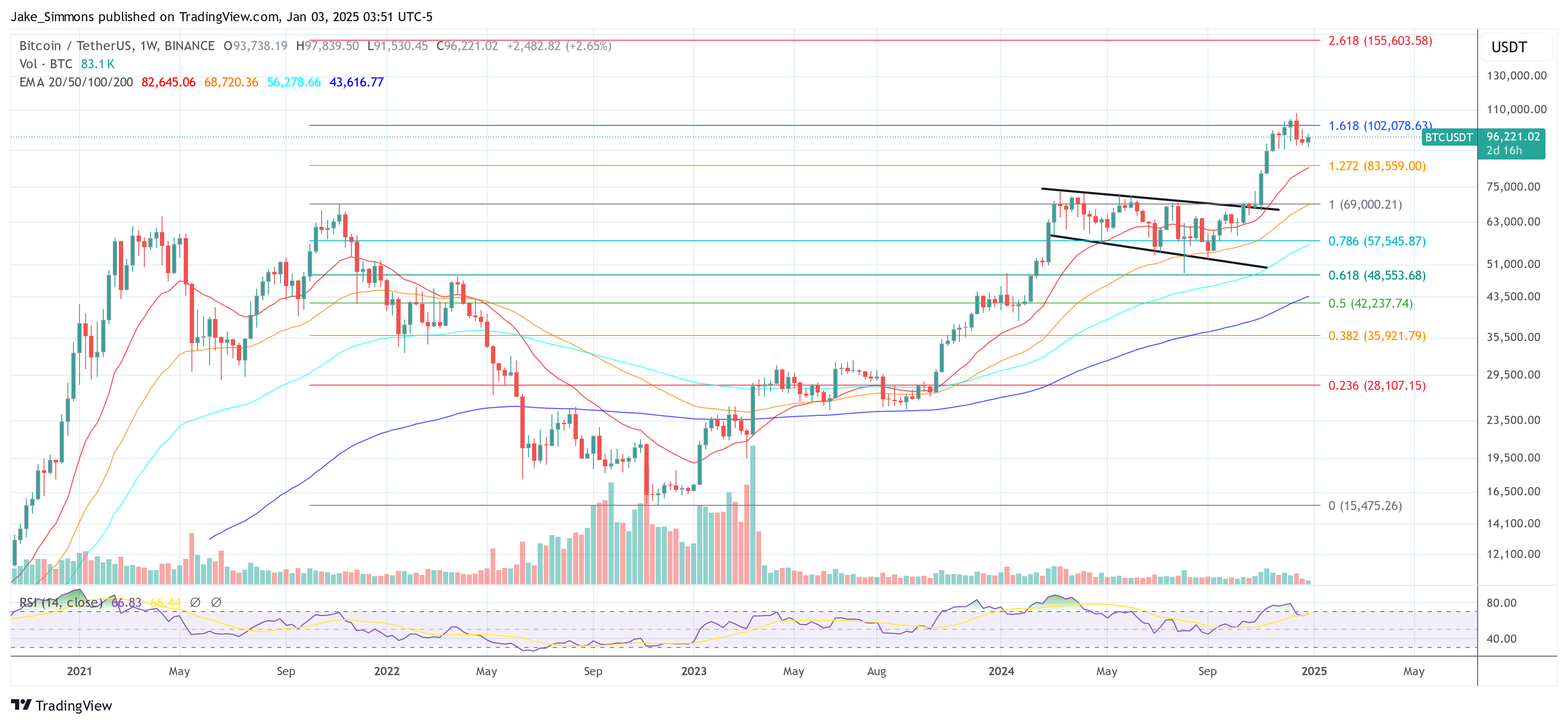

H.C. Wainwright acknowledges that Bitcoin’s journey to $225,000 won’t be a straight line. They expect some significant dips along the way – maybe even down to the $70,000 range in early 2025 – before another price surge. This is due to Bitcoin’s historical volatility and its connection to overall market trends.

The Big Picture: Market Cap and Dominance

If Bitcoin hits $225,000, its total market value would be around $4.5 trillion – about 25% of gold’s current market cap. This represents a massive 113% increase from current levels.

The bank’s prediction doesn’t even include a potential game-changer: the US government adopting Bitcoin as a reserve asset. If that happens, Bitcoin could go even higher!

They also predict Bitcoin’s dominance (its share of the total crypto market) will fall to 45% by the end of 2025 (from around 56% now). Despite this, they see the entire crypto market growing to roughly $10 trillion by the end of 2025, up from today’s $3.6 trillion.

Good News for Bitcoin Miners

This price surge would be great news for publicly traded Bitcoin mining companies, potentially leading to significant increases in their valuations.

(Note: At the time of this writing, Bitcoin was trading at approximately $96,221.)/p>