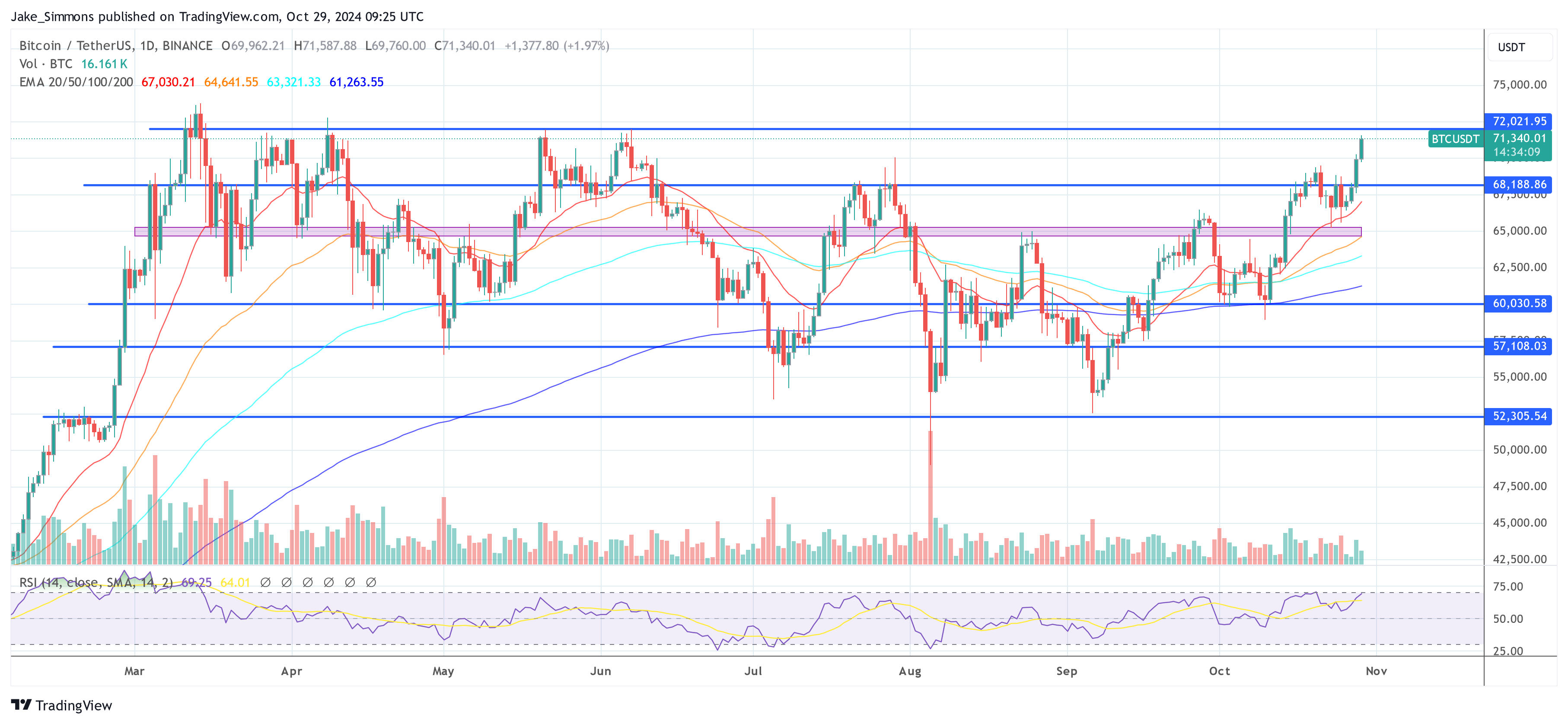

Bitcoin has been on a roll lately, breaking through the $71,000 mark. This surge can be attributed to a few key factors:

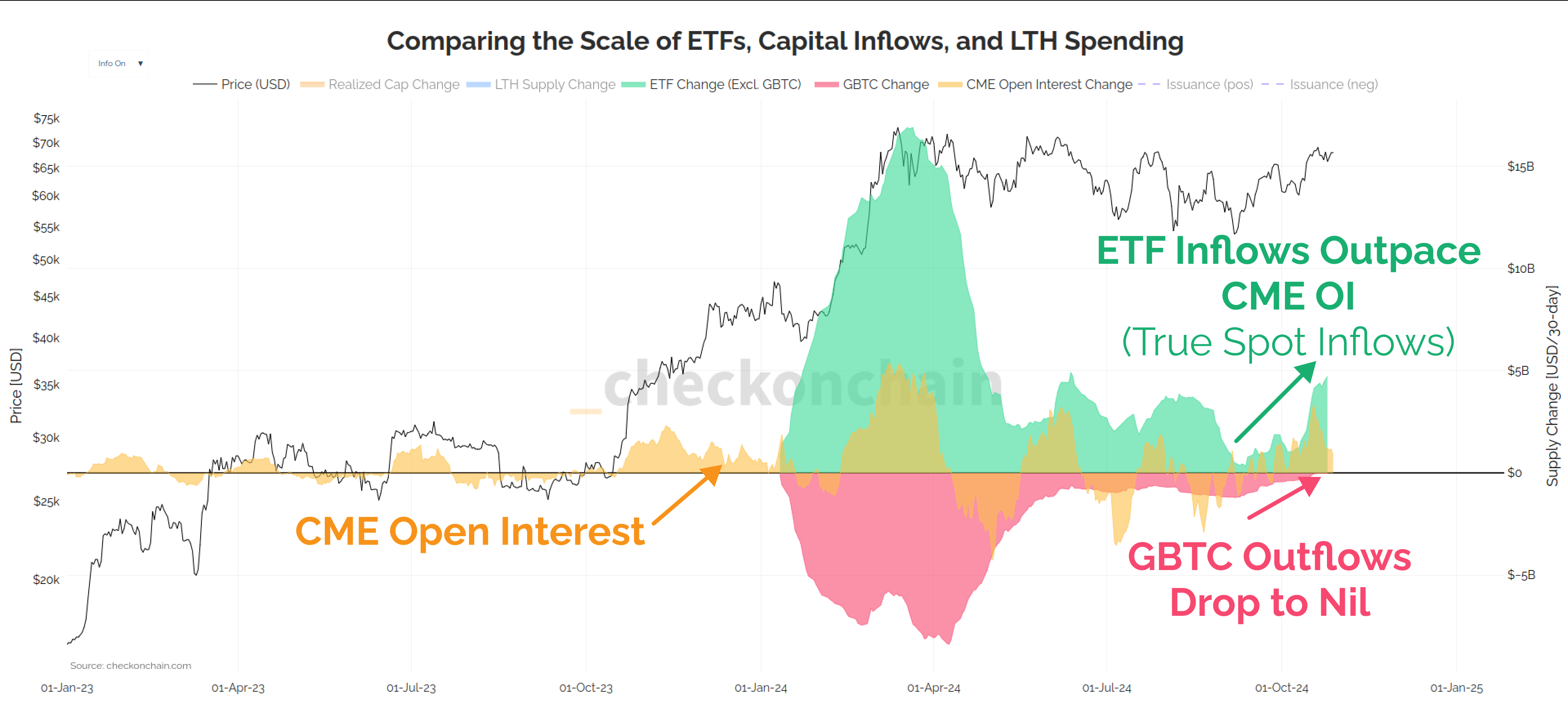

Bitcoin ETFs are a Hot Commodity

Investors are pouring money into Bitcoin Exchange-Traded Funds (ETFs). This massive influx of cash, especially from big players like BlackRock and Fidelity, is directly linked to Bitcoin’s price climb.

Analysts are seeing a shift away from more complex trading strategies towards direct Bitcoin exposure through ETFs. This suggests investors are bullish on Bitcoin and expect it to keep rising.

The “Trump Trade”

The recent surge in Bitcoin’s price also seems to be linked to former President Donald Trump’s return to the political scene. His interview on the Joe Rogan podcast has sparked a lot of buzz, and some analysts believe this is fueling Bitcoin’s rally.

Short Sellers are Getting Squeezed

Many traders were betting on Bitcoin’s price going down, but they were caught off guard by the recent surge. This forced them to cover their positions, which in turn pushed the price even higher.

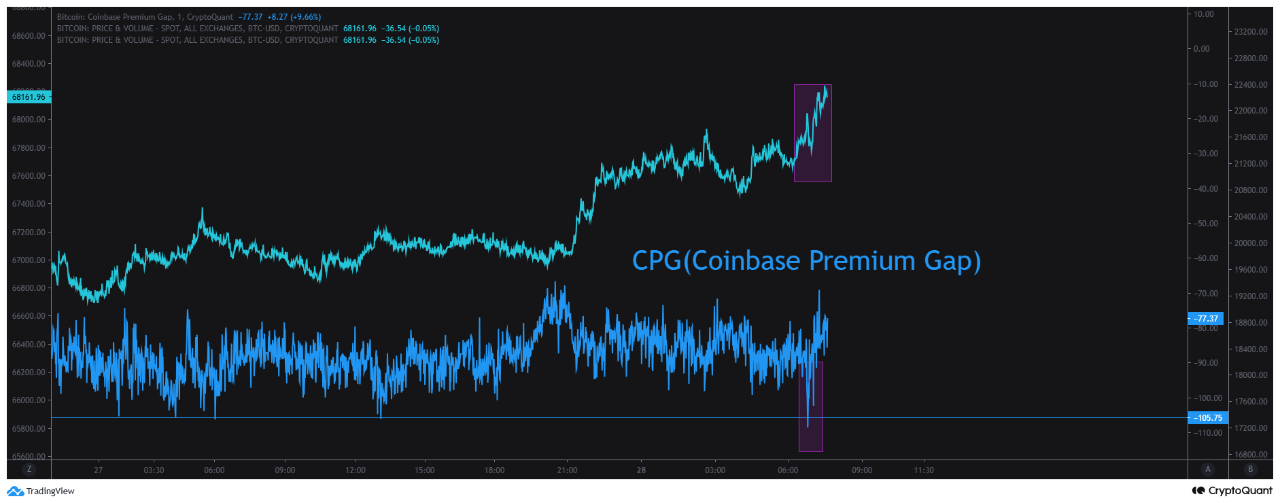

Big Whales are Buying

Large investors, known as “whales,” are also playing a big role in Bitcoin’s rally. Analysts have noticed a significant increase in buying activity from Binance whales, adding fuel to the fire.

All of these factors combined are pushing Bitcoin’s price higher. It’s an exciting time for Bitcoin enthusiasts, but it’s important to remember that the market can be volatile, and prices can fluctuate rapidly.