Bitcoin’s price has been pretty stagnant lately, only inching up 0.95% over the past week. It’s stuck in a tight range between $85,000 and $86,000 after a nice rally in mid-April. But according to analyst Ali Martinez, a major roadblock is ahead.

The $91,000 Wall

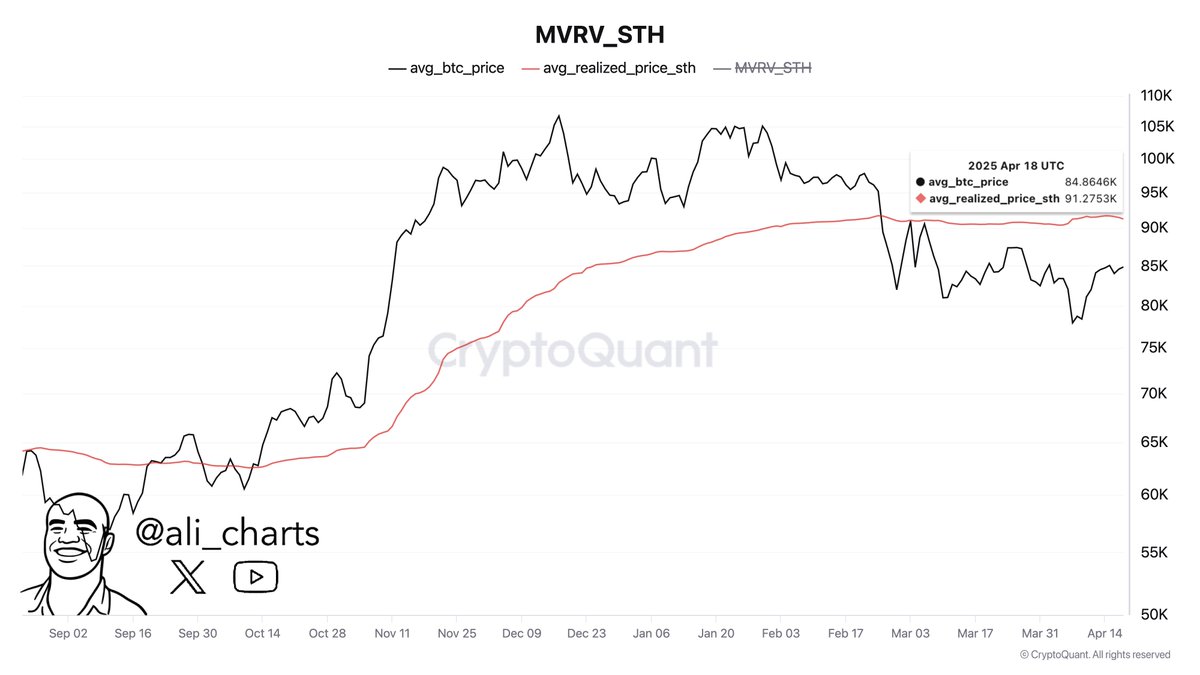

Martinez points to a key resistance level at $91,275. Bitcoin had a great run in early April, jumping 17.33% after hitting a low of $75,000. But the party’s over for now, with the price mostly flat.

This resistance isn’t just some random number. It’s the average price that short-term Bitcoin holders (those who bought in the last 155 days) paid for their coins. This is a significant indicator of market sentiment.

What the Short-Term Holders’ Price Means

When the market price is above the short-term holders’ realized price, it’s usually a good sign. Recent buyers are making money, so they’re more likely to hold onto their Bitcoin. The realized price acts as support.

But when the market price is below the realized price (like now), it creates resistance. Many short-term holders might sell to break even, putting downward pressure on the price. So, breaking through $91,275 is crucial for Bitcoin to really take off.

Bitcoin’s Current Situation

Right now, Bitcoin is trading around $84,872. It’s slightly up for the day but down a bit for the month. The immediate hurdle is $86,000. Breaking through that could lead to a run towards $91,000. However, falling below $84,500 could trigger a further drop to $83,300. It’s a bit of a waiting game to see which way it goes.