Bitcoin’s price is struggling, and a recent report reveals a massive exodus of cash. Let’s dive into what’s happening.

A Billion-Dollar Bitcoin Exodus

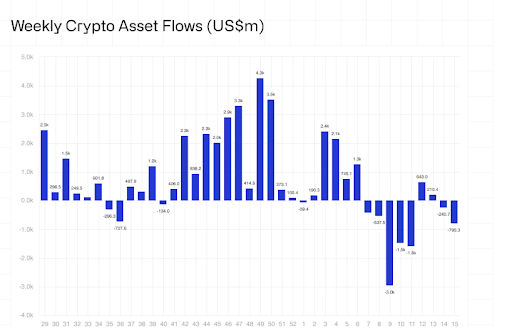

A new report shows a whopping $751 million flowed out of Bitcoin investments last week alone! That’s part of a larger $795 million outflow from the entire crypto market. This is one of the biggest single-week outflows of the year, and it’s happening while Bitcoin’s price is stuck.

This isn’t a one-off event either. Since early February, digital asset investment products have seen a total outflow of about $7.2 billion, wiping out almost all the gains made earlier in the year. This is the third week in a row of declines, with Bitcoin taking the biggest hit.

Overall, net flows for the year are down to a measly $165 million – a huge drop from the billions seen just a couple of months ago. This shows institutional investors are getting nervous.

What’s Causing the Outflow?

Bitcoin is still in a moderately positive position for the year, with net inflows of $545 million. However, the sheer size and speed of this recent outflow are alarming. It suggests big players are pulling back, at least for now. This could be due to profit-taking or worries about the overall economy.

Other cryptocurrencies also saw outflows, though smaller than Bitcoin’s:

- Ethereum: $37 million

- Solana: $5.1 million

- Aave: $0.78 million

- SUI: $0.58 million

Even investments designed to profit from falling crypto prices saw outflows ($4.6 million for short Bitcoin products).

Tariffs and Political Uncertainty

One major factor is the economic uncertainty caused by new tariffs. Investor confidence took a hit after the announcement of new tariffs on imports from Canada, Mexico, and China. However, a temporary reversal of those tariffs did lead to a small rebound in crypto prices and AUM (Assets Under Management).

The Bottom Line

Bitcoin’s price is facing serious headwinds. The massive outflows raise concerns about the future, especially regarding institutional investor confidence. Until the market stabilizes and these outflows reverse, Bitcoin’s chances of hitting new all-time highs remain uncertain.