Bitcoin took another dive recently, dropping below $80,000. Is this the lowest it will go? Let’s look at some data.

Decoding the Bitcoin NVT Golden Cross

A financial analyst looked at something called the Bitcoin NVT Golden Cross. This is a complicated-sounding indicator, but basically, it compares Bitcoin’s market value to its transaction volume. Think of it like this: if the value is high compared to how much trading is happening, it might be overvalued. The opposite could mean it’s undervalued and ready to bounce back.

The NVT Golden Cross uses a short-term and long-term average to predict tops and bottoms. Historically, there are two key zones:

- Above 2.2 (red zone): Usually signals an overvalued Bitcoin, potentially leading to a price drop.

- Below -1.6 (green zone): Often indicates a bottom, suggesting a potential price increase.

Recently, the NVT Golden Cross plummeted into the green, or bottoming, zone, hitting -2.4. While this is a bullish sign, it’s not quite as low as some previous bottoms. So, we might see Bitcoin fall a bit further before it starts to recover.

Other Indicators and Support Levels

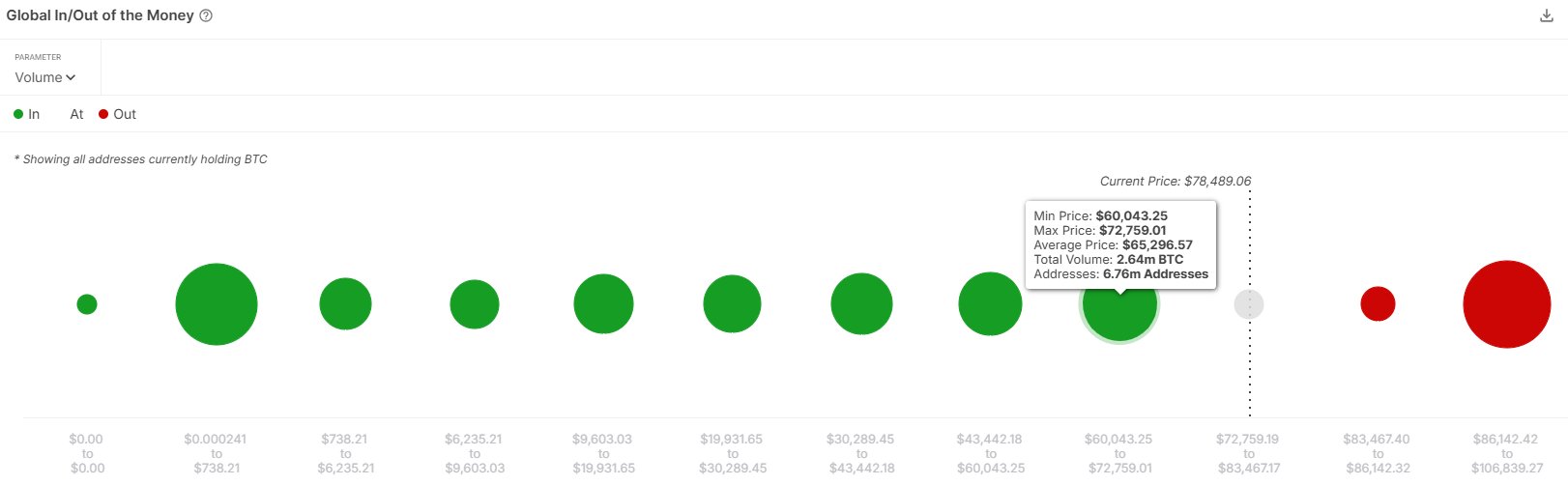

Another platform, IntoTheBlock, suggests that Bitcoin might find some temporary support around $72,000. If the price keeps dropping, this could be where it temporarily stops falling.

Current Bitcoin Price

After the recent drop, Bitcoin is currently trading around $81,600. Whether this is the bottom remains to be seen.