Bitcoin’s price took a major tumble recently, dropping over 15% and briefly dipping below $80,000. Let’s break down what happened and who felt the pinch.

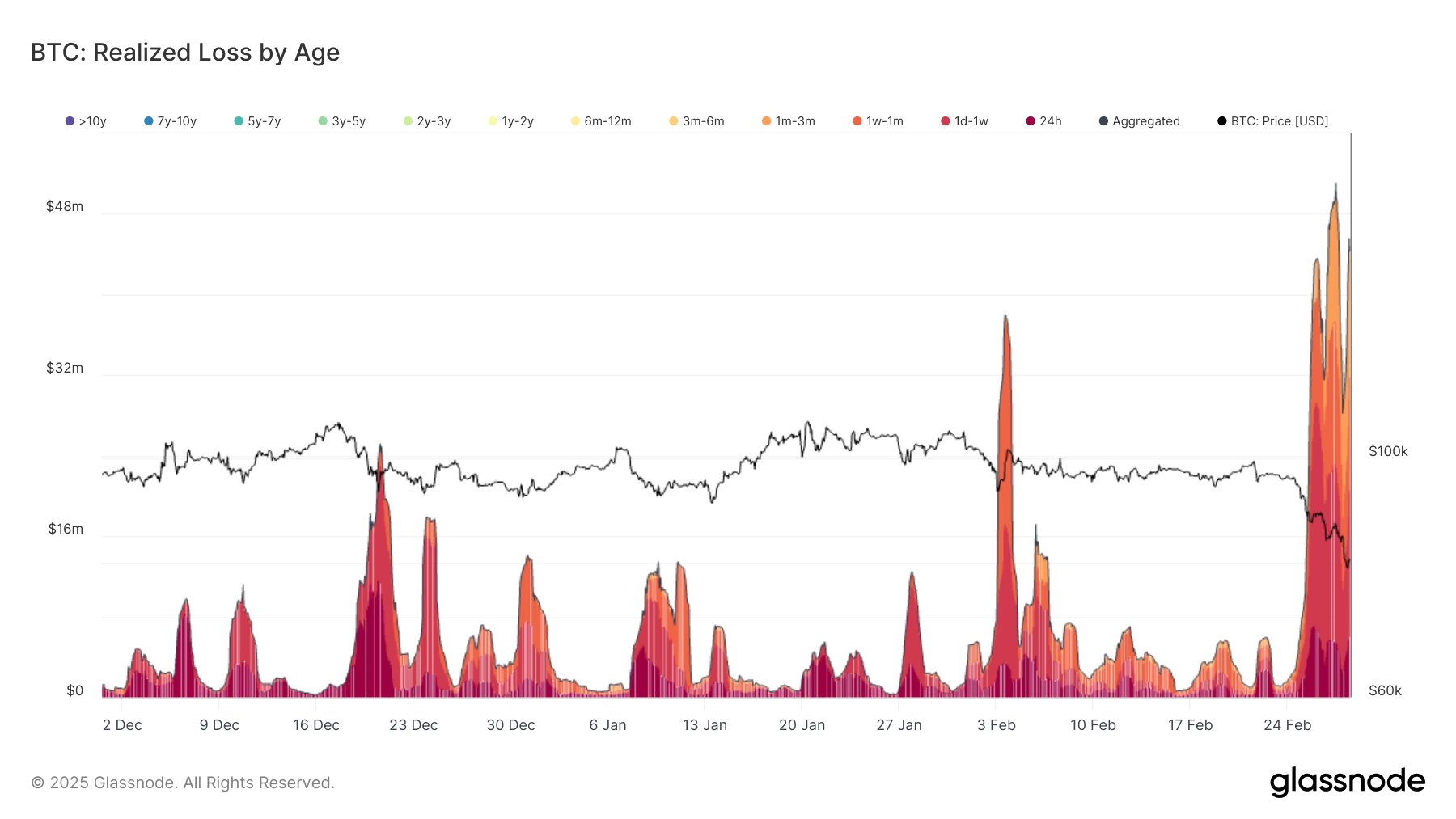

Short-Term Holders Take the Hit

The recent sell-off hit short-term Bitcoin holders (those who bought recently) the hardest. Data from Glassnode shows that these investors experienced massive realized losses. The biggest losses were among those who bought within the last week:

- 1-day to 1-week holders: Lost a whopping $238.8 million.

- 1-week to 1-month holders: Lost $187.6 million.

- 1-month to 3-month holders: Lost $132.4 million.

- 24-hour buyers: Lost $104.9 million.

Even those who held for 3-6 months saw a significant jump in losses, a 95.4% increase from the previous day. The overall loss rate hit a staggering $57.1 million per hour at the peak of the sell-off. The 1-day to 1-week holders were the biggest contributors to this, losing almost double the rate of the next largest group.

Long-Term Holders Remain Calm

Interestingly, long-term holders (those who’ve held for 6-12 months or longer) barely felt the impact. They showed minimal losses, suggesting confidence in Bitcoin’s long-term prospects. This suggests that the recent drop is more of a short-term correction than a sign of a larger market crash.

Current Situation

Bitcoin’s price has recovered slightly since the sell-off, but it’s still down around 11% for the week. The market remains bearish, but the resilience of long-term holders offers a glimmer of hope for a future rebound.