Bitcoin took a nosedive, dropping to $86,099 on February 26th. This caused a massive $1.06 billion loss in market value and sent shockwaves through the crypto world.

Liquidations and Bearish Sentiment

Coinglass reported a staggering 230,000 liquidated positions that day. Open interest plummeted to 5%, showing investors were quickly getting rid of their leveraged bets. A huge 14.2% surge in Bitcoin flowing into exchanges pointed to panic selling. Negative funding rates further confirmed the shift in investor sentiment – nobody wanted to bet on Bitcoin going up.

Massive Losses for Bitcoin Holders

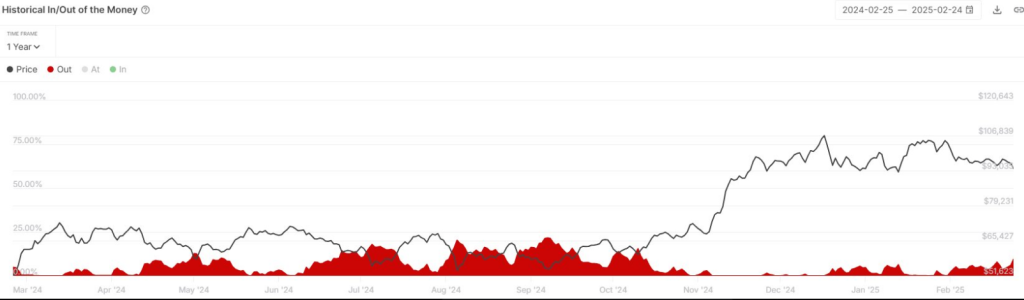

With Bitcoin briefly dipping below $90,000, the pain was widespread. Thousands of positions were liquidated, and Bitcoin ETF funds saw a $1.1 billion outflow over five days, with a particularly brutal $516 million lost on February 24th alone. IntoTheBlock highlighted that a concerning 12% of all Bitcoin addresses were underwater – the highest unrealized loss percentage since October 2024.

Crypto Stocks Take a Hit

The Bitcoin slump didn’t just hurt individual investors. Crypto-related stocks got hammered. Michael Saylor’s MicroStrategy, holding a massive Bitcoin portfolio, saw its stock price plunge 11% in 24 hours, down 55% from its peak. Other crypto stocks followed suit: Robinhood dropped 8%, Coinbase fell 6.4%, Marathon Digital lost 9%, and Bitdeer plummeted 29%.

Ripple Effects in Traditional Markets

The Bitcoin downturn wasn’t isolated. Traditional markets felt the chill too, with the Nasdaq Composite falling 2.8% and the S&P 500 dropping 2.1%. The US Dollar Index strengthened, suggesting investors were seeking safer investments. Adding to the bearish pressure, Bitcoin whales offloaded over $1.2 billion worth of Bitcoin.

Why the Drop?

Analysts pointed to macroeconomic factors as the main culprit. The lingering effects of President Trump’s tariff announcements and ongoing US-China tensions are making investors nervous, prompting them to reassess their long-term strategies.