Bitcoin is at a crucial point, hanging on above a key support level. Let’s look at what a seasoned crypto trader thinks might happen next.

Technical Analysis: What the Charts Say

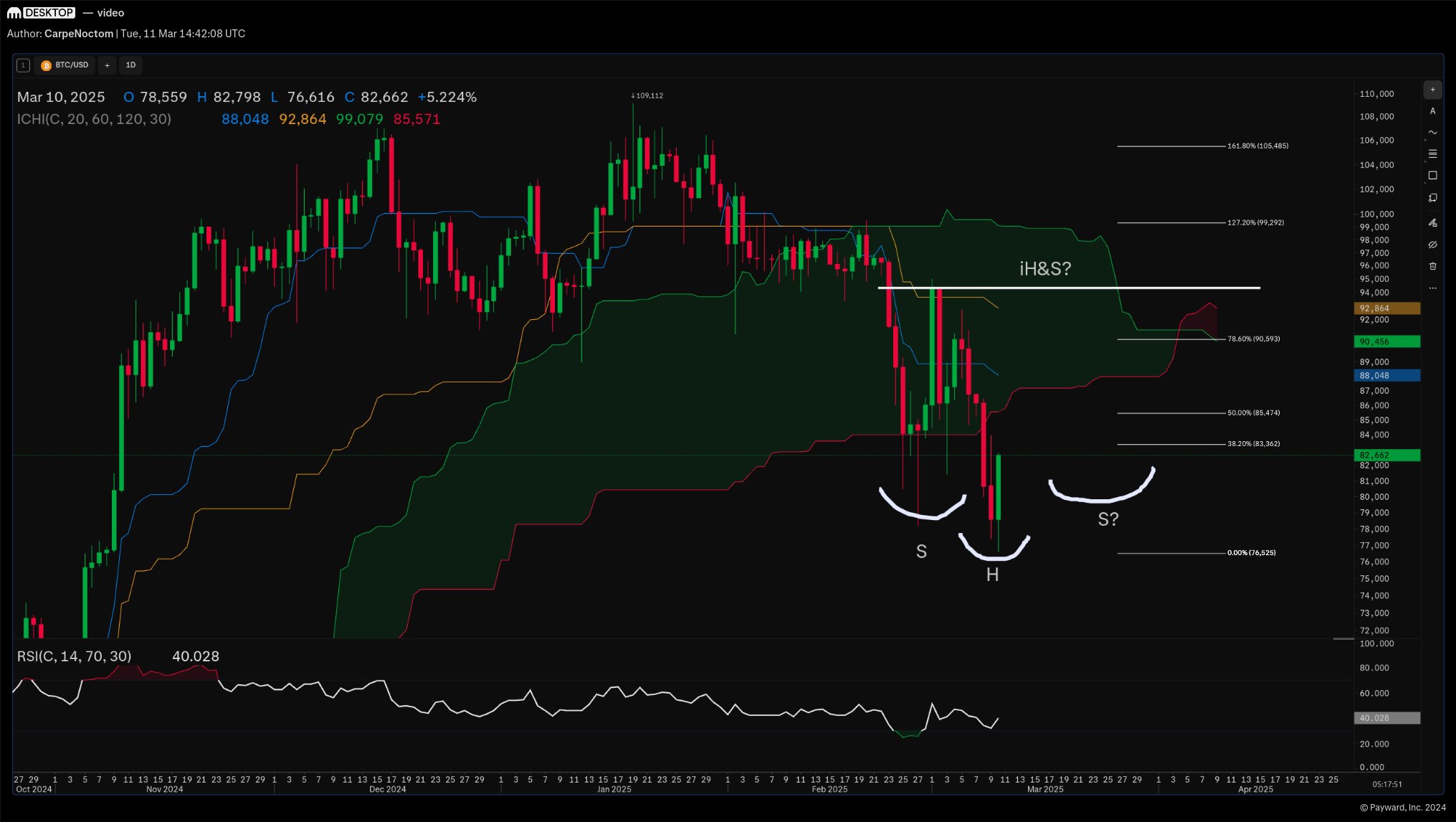

Crypto trader Josh Olszewicz recently analyzed Bitcoin’s charts, focusing on several key indicators:

-

RSI and Volume Divergence: Olszewicz spotted a bullish divergence in both RSI (Relative Strength Index) and trading volume. This means the price is making lower lows, but the RSI and volume are making higher lows. Historically, this suggests a potential price reversal. He noted that this pattern is similar to what happened in August and September, hinting at a possible upward swing.

-

Candlestick Patterns: The charts are showing some interesting candlestick formations. Specifically, Dragonfly Doji candles (small body, long lower wick) combined with bullish engulfing candles often signal that sellers are losing steam and a reversal might be on the way. A “green Dragonfly” would be a particularly strong sign.

-

Inverse Head and Shoulders (iHS): Olszewicz hinted at the early stages of an iHS pattern forming. This is a bullish reversal pattern, but it’s still too early to say for sure. A break above the pattern’s neckline would be a strong confirmation.

Trader’s Advice: Patience and Prudence

Olszewicz emphasizes the need for caution and discipline:

- Avoid Over-Leveraging: Don’t bet the farm on one trade. Keep your risk manageable.

- No Revenge Trading: Don’t try to recoup losses quickly; this often leads to more losses.

- Careful with Dollar-Cost Averaging: Just because something is cheap doesn’t mean it’s a good buy. Technical analysis is still crucial.

The Outlook: A Waiting Game

While the overall economic picture is still unclear, Bitcoin’s technical indicators suggest a possible rally in the coming months. March and April could be key. However, Olszewicz advises focusing on high-probability trading setups rather than speculative bets. The best strategy might simply be to wait for clearer signals.

In short: Bitcoin is at a crossroads. While there are some positive technical signs, it’s too early to declare a definitive bottom. Patience and careful risk management are key. At the time of writing, Bitcoin was trading around $81,599./p>