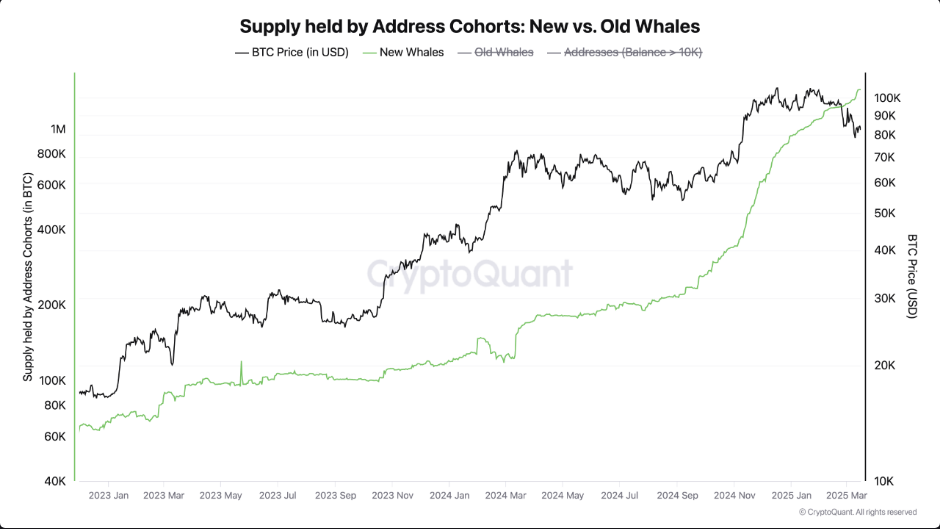

A Million Bitcoins in New Hands

Big money is pouring into Bitcoin. Since late November, wealthy investors have scooped up over a million Bitcoins, adding another 200,000 last month alone. These aren’t your typical long-term holders; research shows most of these “new whales” (owning at least 1,000 Bitcoin each) are relatively new to the game, holding for less than six months. They’re clearly in it for the quick profit. Market watchers see this massive buying as a strong indicator of an upcoming price jump – not in years, but soon.

Market Shake-Up and Trump’s Influence

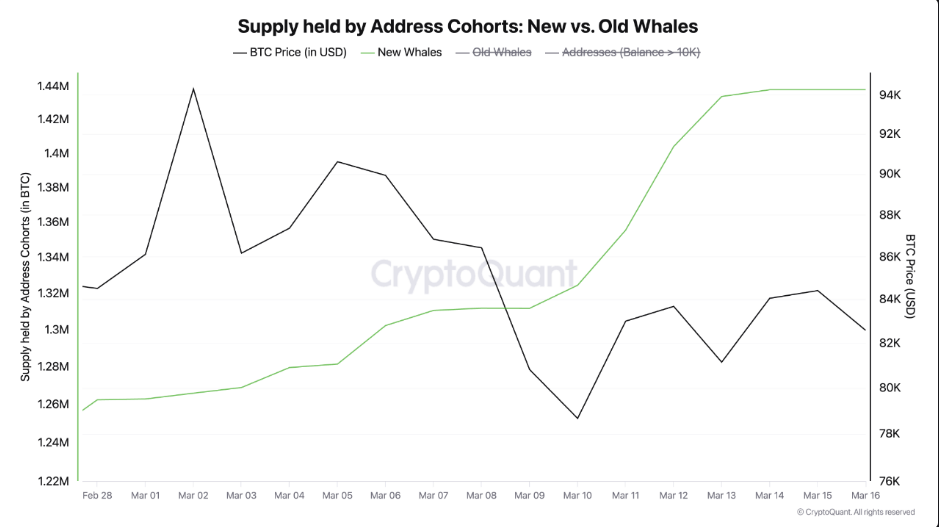

Things got wild in January. Bitcoin futures open interest hit a whopping $33 billion, only to see a dramatic crash. Around $10 billion in bets vanished between February 20th and March 4th. The blame? Many point to the uncertainty surrounding the new US administration’s stance on crypto, causing significant market turbulence. Futures bets saw a 14% drop over 90 days.

History Suggests a Price Jump

This isn’t the first time we’ve seen this kind of market shakeout. Experienced investors know that these major purges often precede significant price increases in Bitcoin. Historically, a combination of large-scale buying and the clearing out of risky investments has fueled sharp Bitcoin price rises.

Could Bitcoin Hit $160,000?

With whales buying at record speeds and market leverage looking healthier, some analysts are predicting a price surge. Could Bitcoin hit $150,000 or even $160,000, breaking all previous records? It’s certainly possible. The simple economics are clear: when millionaires buy up significant portions of a limited supply, prices tend to go up. These new whales have already shifted the supply-demand balance. A crypto fund manager notes that unlike retail investors, these whales aren’t buying to lose money – they see a price increase coming.

The Bottom Line

If this buying spree continues, Bitcoin holders could be in for a big surprise. The question isn’t if the price will rise, but  how much and how fast

how much and how fast./p>