Bitcoin’s price has been pretty flat lately, struggling to break through $100,000. But some investors are hoping for one last price surge before the end of 2024. Recent data suggests this might actually happen.

A Big Jump in Buying

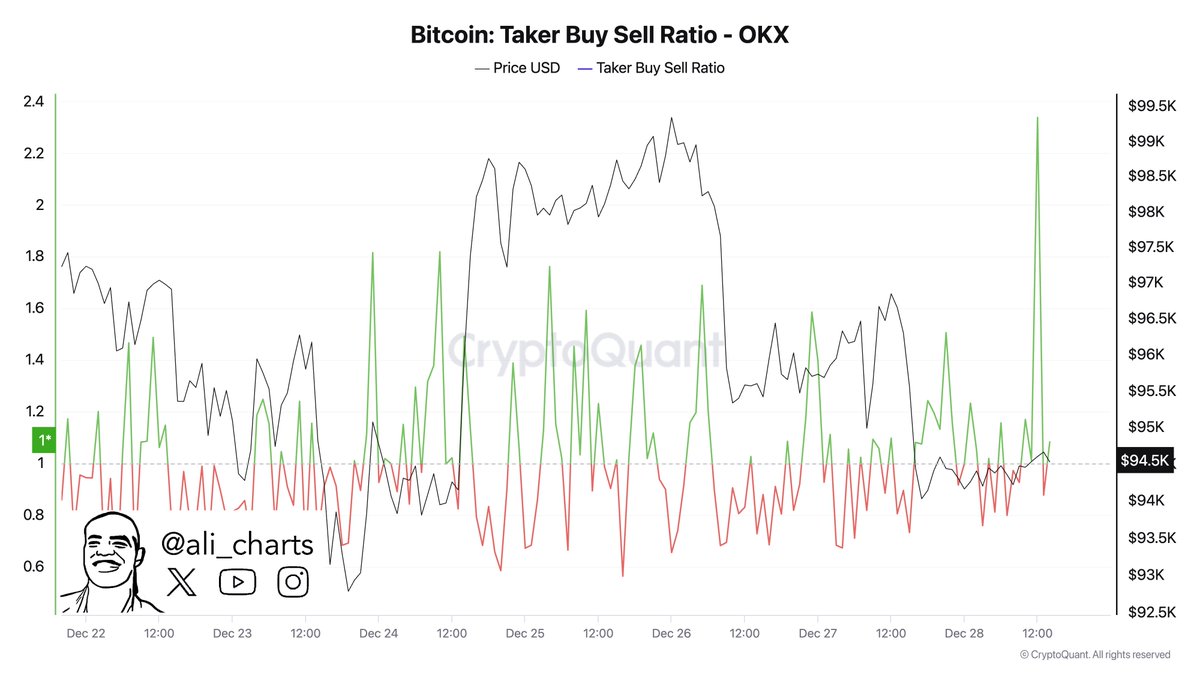

A crypto analyst noticed something interesting: the “taker buy/sell ratio” on the OKX exchange spiked to 2.3! This ratio compares the volume of people buying Bitcoin to the volume of people selling. A ratio above 1 means more people are buying than selling – a very bullish sign. This huge jump suggests a lot of buying activity, potentially pushing the price up.

Bitcoin is Leaving Exchanges

Another analyst pointed out that less Bitcoin is flowing into

What Does it All Mean?

With increased buying pressure and investors holding onto their Bitcoin, the price could be poised for a rise. Bitcoin is currently just under $95,000, and this positive on-chain data could be the fuel it needs to reach that $100,000 milestone.