Bitcoin’s price has been on a rollercoaster lately. After a dip below $90,000, it shot up nearly 10% in a week! This surge has some analysts buzzing, especially about the big players in the Bitcoin game – the whales.

Whale Watching: More Big Fish in the Sea

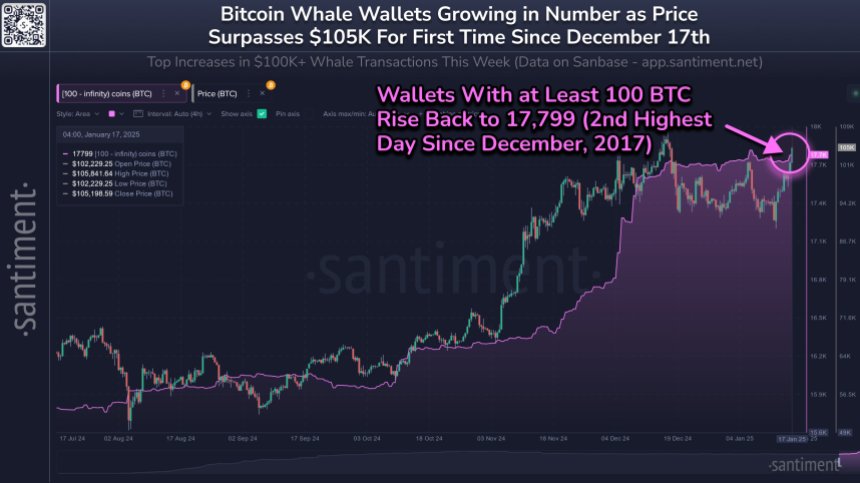

According to Santiment, a blockchain analytics firm, the number of “whale wallets” (those holding at least 100 BTC) is climbing. Right before Bitcoin hit a recent high of over $105,000, the count reached almost 18,000. This is a big deal because whale accumulation is often seen as a bullish signal – a sign that things are about to get even better for Bitcoin.

These whales are buying near Bitcoin’s all-time high, suggesting they expect even higher prices in the future. This optimism is fueled by several factors.

Reasons for the Bitcoin Hype

-

Trump’s Crypto Promises:

With Donald Trump’s inauguration on the horizon, many investors are hopeful about his pro-crypto stance. Rumors of a national Bitcoin reserve and changes to regulations are driving excitement.

With Donald Trump’s inauguration on the horizon, many investors are hopeful about his pro-crypto stance. Rumors of a national Bitcoin reserve and changes to regulations are driving excitement. -

Spot Bitcoin ETFs: The success of Spot Bitcoin ETFs in their first year (a whopping $37.1 billion in net inflow) has investors bullish. Predictions suggest they’ll even surpass gold ETFs in net assets in 2025, potentially boosting Bitcoin’s price and adoption significantly.

Bitcoin’s Current State

At the time of writing, Bitcoin is trading around $104,000, with a daily trading volume of over $65 billion. While things look good, it’s worth noting that Bitcoin’s relative strength index (RSI) is nearing “overbought” territory (69.16), which could mean a price correction is on the horizon. Despite this, Bitcoin remains the dominant cryptocurrency, holding over half of the total crypto market cap.

A Potential Supply Shock?

There’s also talk of a potential supply shock. Apparently, ETFs bought more Bitcoin in December than was actually mined that month, which could further impact prices./p>