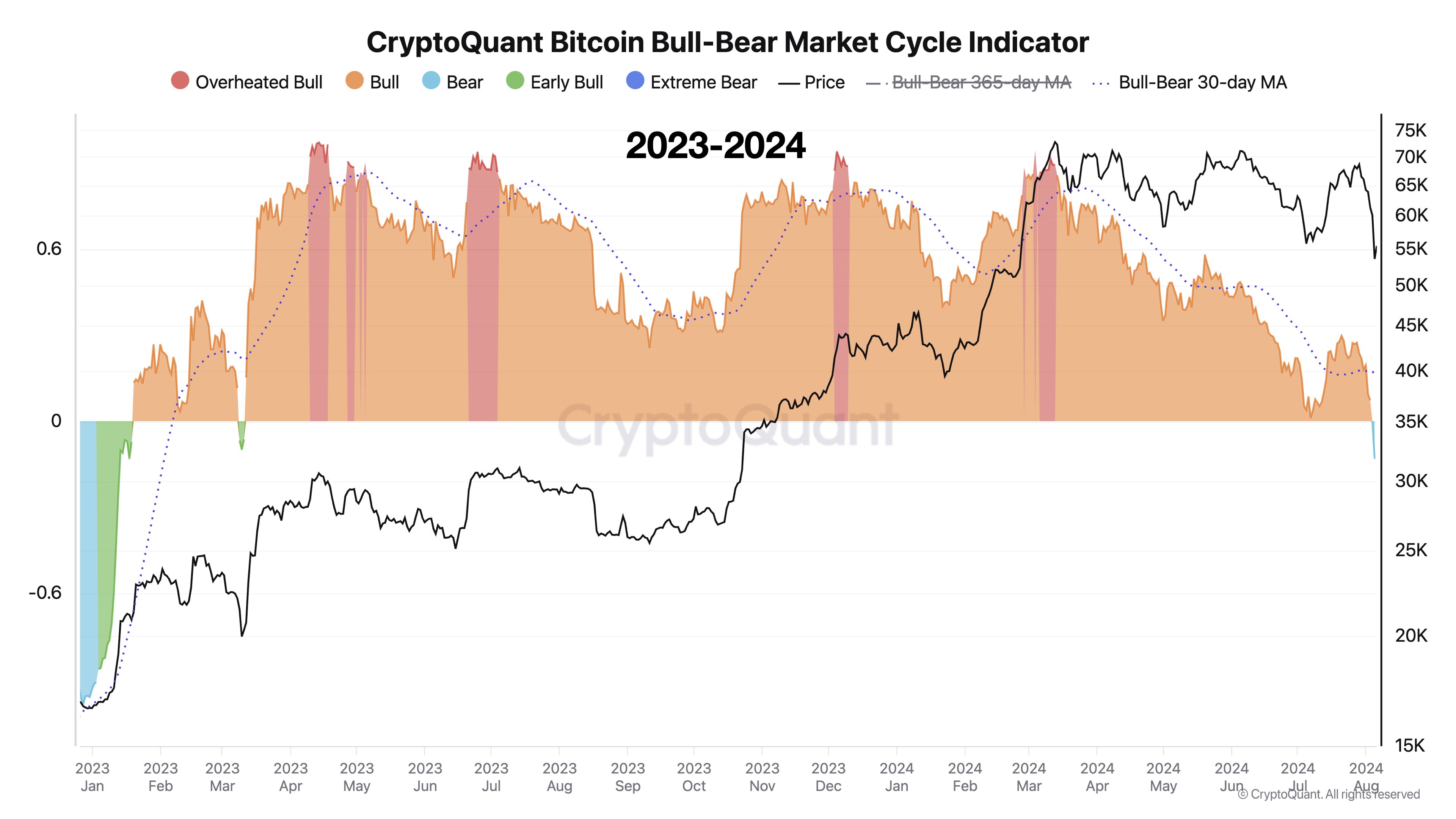

CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator is flashing red, suggesting that Bitcoin has entered a bearish phase.

This indicator, developed by the analytics firm CryptoQuant, uses on-chain data to track Bitcoin’s market sentiment. It essentially measures whether Bitcoin is in a bull market or a bear market.

How Does It Work?

The indicator is based on the P&L Index, which combines various on-chain metrics related to profit and loss. When the P&L Index crosses above its 365-day moving average, it indicates a bullish phase. Conversely, when it drops below the moving average, it signals a bearish phase.

The Current Situation

The indicator has recently dipped below the zero mark, indicating a bearish transition for Bitcoin. This is the first time since January 2023 that the indicator has given this signal.

Temporary or Long-Term?

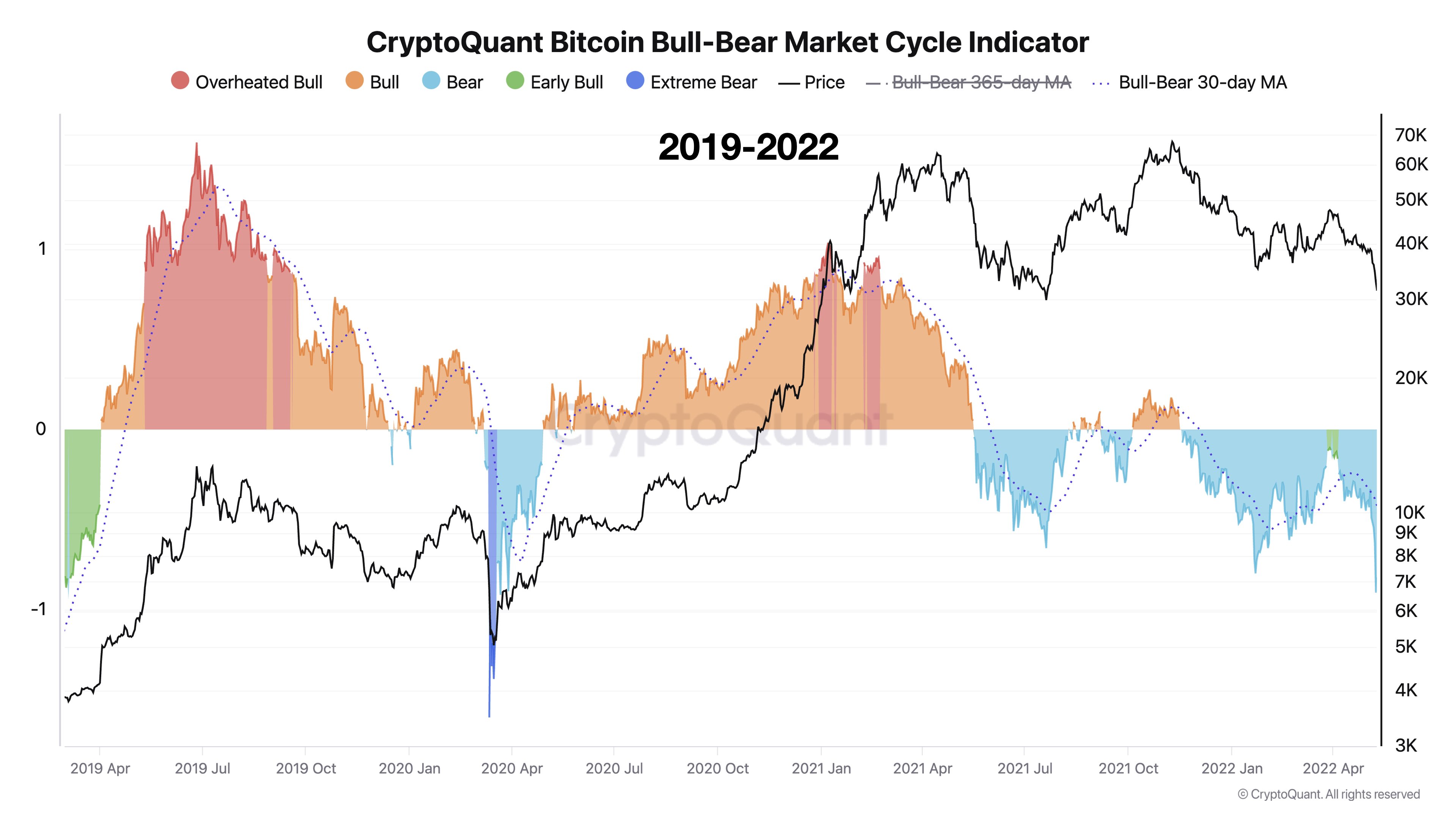

It’s important to note that this bearish signal doesn’t necessarily mean a prolonged bear market. Historically, the indicator has flagged temporary bearish phases during events like the COVID-19 crash in 2020 and the China mining ban in 2021.

What’s Next?

Only time will tell if this bearish phase will be short-lived or if it signals a more significant downturn for Bitcoin.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading below $57,000, down almost 14% in the past week.