Bitcoin’s price has been bouncing around lately, neither breaking through $100,000 nor falling below $90,000. This has traders on the edge of their seats!

A Bullish Market, But With a Warning

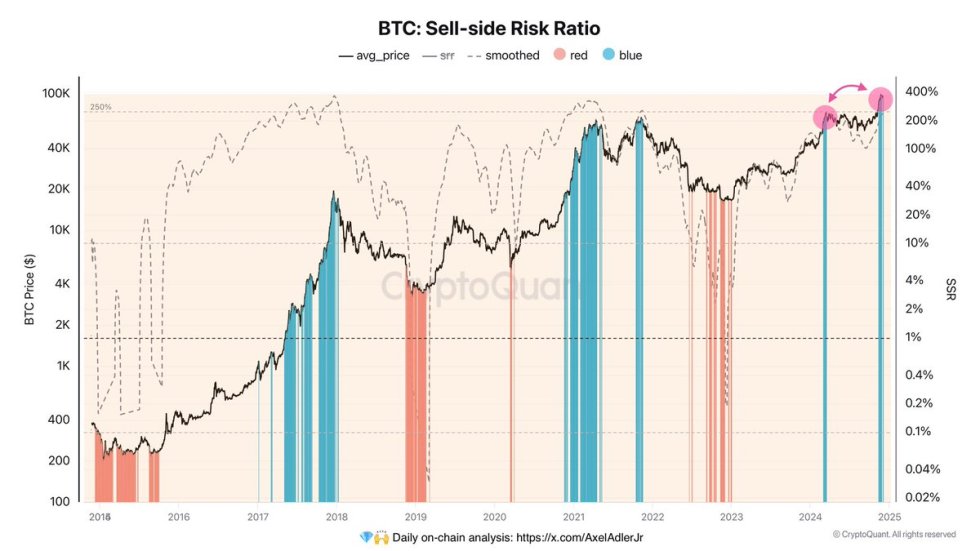

Despite the price uncertainty, the overall crypto market is seeing huge demand, suggesting good things might be ahead for Bitcoin. However, there’s a catch. Data shows a significant risk of Bitcoin holders selling off their coins. This could create some headwinds, even with the strong demand. The next few weeks will be crucial in determining Bitcoin’s next big move – will it finally break $100,000, or will we see a bigger drop below $90,000?

Why This Sell-Off Might Be Different

Bitcoin’s price has skyrocketed since November 5th, gaining 50% before a recent 8% pullback. While long-term holders are showing signs of selling, the current situation is different from a similar situation in March. Back then, selling pressure overwhelmed demand, causing a price drop. This time, new buyers are soaking up the supply from long-term holders, keeping the price up. This suggests Bitcoin could go even higher, potentially reaching $100,000 to $110,000 soon. But, higher prices usually mean more selling pressure, which could lead to a significant correction. It’s not a matter of  if a pullback will happen, but when

if a pullback will happen, but when .

.

The $95,000 Test: Make or Break?

Bitcoin is currently testing a key support level around $95,000. Holding this level is vital for a continued push towards $100,000. If it breaks, we could see further drops, potentially to $90,700 or even $87,602. Conversely, holding above $95,000 could signal a surge past $100,000. The next few hours will be critical in determining Bitcoin’s next move.