Bitcoin recently hit a new high of $122,838, but it’s now trading around $118,000. Despite this slight dip, the overall market sentiment is still very positive.

Greed is Good (But Not Too Good)

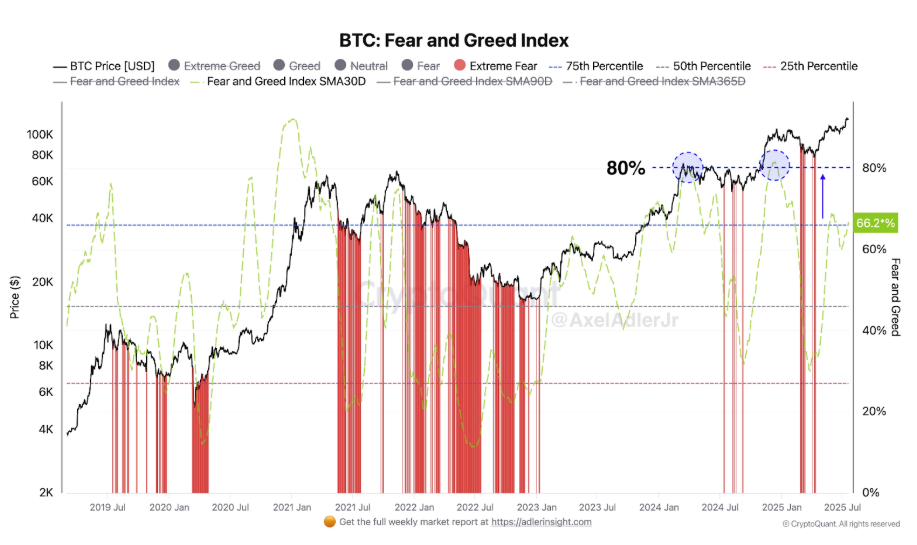

The Fear & Greed Index shows Bitcoin’s greed level at 68, indicating bullish sentiment. While this is in “greed” territory, it’s not yet at the extreme levels (75-80%) seen before previous price peaks. This suggests there’s still room for growth before a potential market correction. Analysts believe that continued consolidation and price increases without hitting extreme greed levels could lead to sustained growth.

Technical Analysis: Resistance and the Road to $200,000?

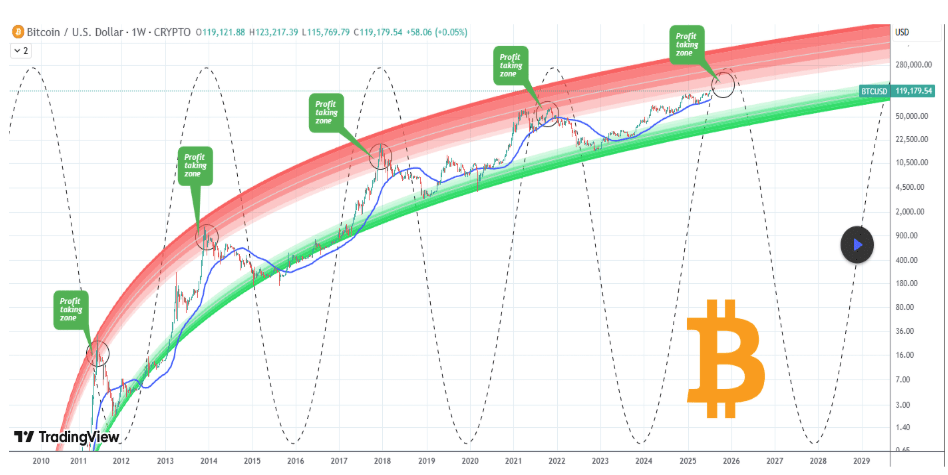

Bitcoin’s recent price action shows it briefly touched a key resistance zone, a pattern seen in previous bull markets. This resistance zone is predicted to be the final build-up phase before another significant price increase.

One analyst, using the Logarithmic Growth Curve (LGC), predicts Bitcoin’s peak for this cycle will be between October and November 2025, potentially reaching anywhere from $140,000 to $200,000. This prediction depends on factors like potential US interest rate cuts in September.

Currently, Bitcoin is trading around $118,152. The overall outlook remains bullish, but the potential for a correction shouldn’t be overlooked.