Bitcoin’s price has bounced back, climbing to around $85,020 in the last day – a 1.2% increase! This reverses some recent losses, and analysts are getting excited.

Signs of a Bitcoin Rebound

While Bitcoin is still down slightly over the past week (3.4%) and month (9.5%), there are positive signs. A strong one-day price jump wiped out the previous three days’ losses. Plus, the Relative Strength Index (RSI), a key indicator of momentum, bounced off its support level – often a sign of an upcoming price surge.

The $100,000 Hurdle

Analysts at TradingView see a major hurdle: a falling trend line starting from January 20th. This resistance level also lines up with the 50-day moving average, and Bitcoin has already tested it four times. However, if Bitcoin breaks through, a price target of just under $100,000 is in sight. This aligns with a key Fibonacci level often watched by traders. A successful breakthrough could signal a long-term bullish trend. This fifth attempt at breaking the resistance is crucial.

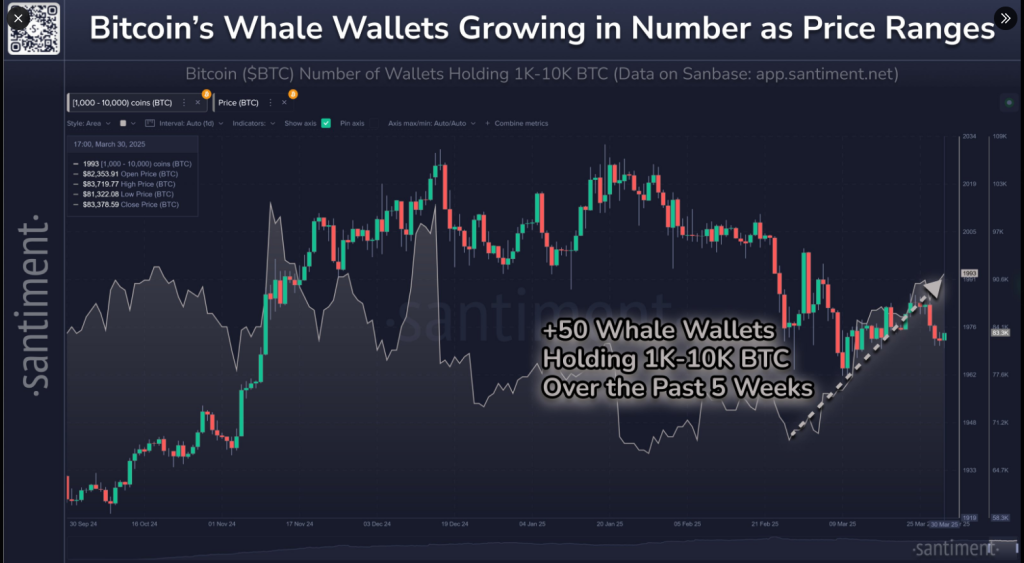

Whales Are Getting Bullish

Large Bitcoin holders (those with 1,000 to 10,000 Bitcoin) are accumulating more coins. The number of these wallets hit a high of 1,993 on March 31st, the highest since December 2024! This increase, about 2.5% in five weeks, suggests growing confidence. This accumulation reduces the circulating supply of Bitcoin, potentially driving prices up if demand remains steady or increases.

Moving Off Exchanges: A Bullish Signal?

The movement of Bitcoin to and from exchanges is also positive. Net flows dropped 38% in the last 24 hours. This suggests traders are moving their Bitcoin off

exchanges, indicating they’re holding rather than selling. Large holders (“whales”) are closely watched because their actions often reflect sophisticated market analysis. Their current behavior is considered a bullish signal. /p>

/p>