Bitcoin is making headlines again, and some analysts believe a major price surge is imminent. Let’s dive into what’s driving this excitement.

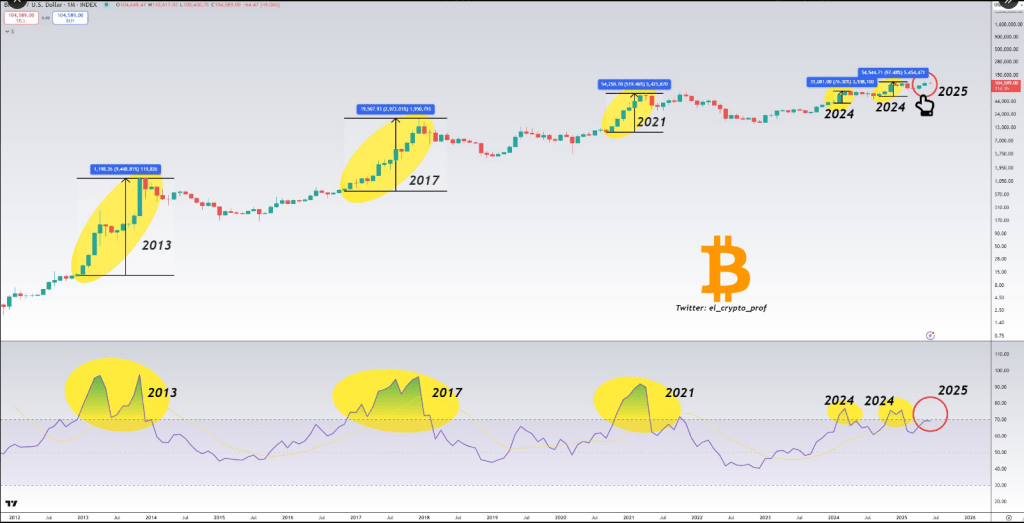

RSI: A Historical Indicator?

Analyst Moustache points to Bitcoin’s monthly Relative Strength Index (RSI) as a key indicator. Historically, when the RSI hits “overbought” territory (meaning it’s unusually high), major price rallies have followed. Looking back at past instances:

- July 2013: Bitcoin jumped from ~$66 to ~$1,120 after an RSI spike.

- May 2017: A similar RSI surge preceded a rise from ~$1,300 to ~$19,700.

- April 2021 & 2024: Significant price increases followed periods of high RSI.

Currently, the RSI is nearing those same overbought levels, hinting at another potential rally.

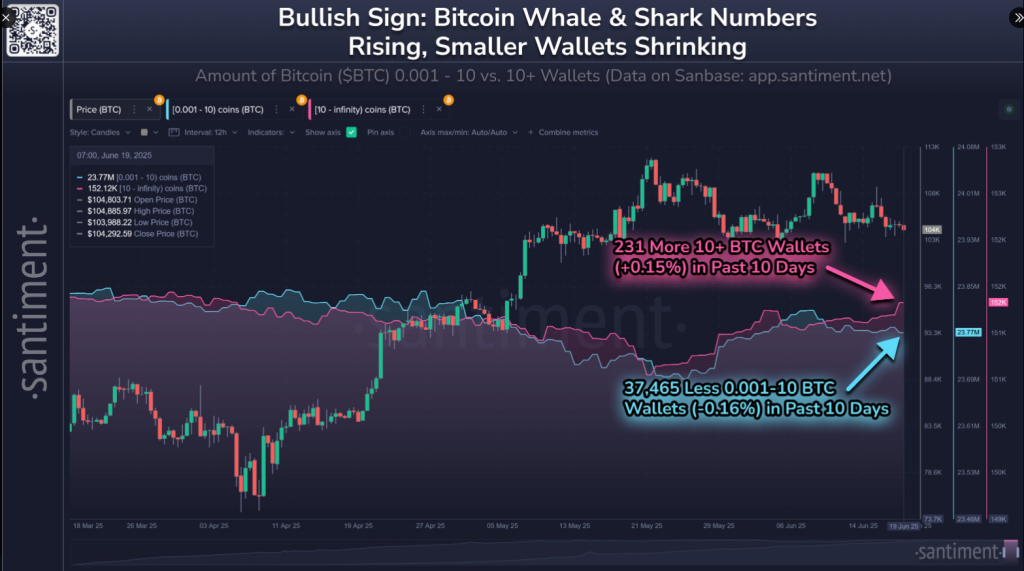

Whales are Buying, Retail is Selling

On-chain data from Santiment reveals an interesting trend: large Bitcoin holders (“whales”) are accumulating, while smaller investors are selling. In the last 10 days:

- Wallets holding 10+ BTC increased by 231 addresses.

- Wallets holding 0.001 to 10 BTC decreased by 37,460 addresses.

This pattern, where whales buy during dips, has historically preceded significant price increases.

Overbought Doesn’t Mean Instant Rocket

It’s important to note that an overbought RSI doesn’t guarantee an immediate price jump. In the past, Bitcoin has sometimes paused or even corrected slightly before resuming its upward trajectory. The current high RSI could persist for some time before a significant move.

What’s Next for Bitcoin?

While technical indicators like the RSI are helpful, other factors will influence Bitcoin’s price. These include:

- Macroeconomic events: Global economic conditions can impact Bitcoin’s value.

- ETF approvals: Regulatory decisions on Bitcoin exchange-traded funds (ETFs) could significantly affect price.

- Regulatory announcements: Government policies and regulations play a crucial role.

The combination of a high RSI and whale accumulation is certainly bullish, but it’s not a guaranteed win. Unexpected news or policy changes could easily shift the market in either direction. For now, the signs are pointing towards a potential Bitcoin liftoff, but investors should proceed with caution.