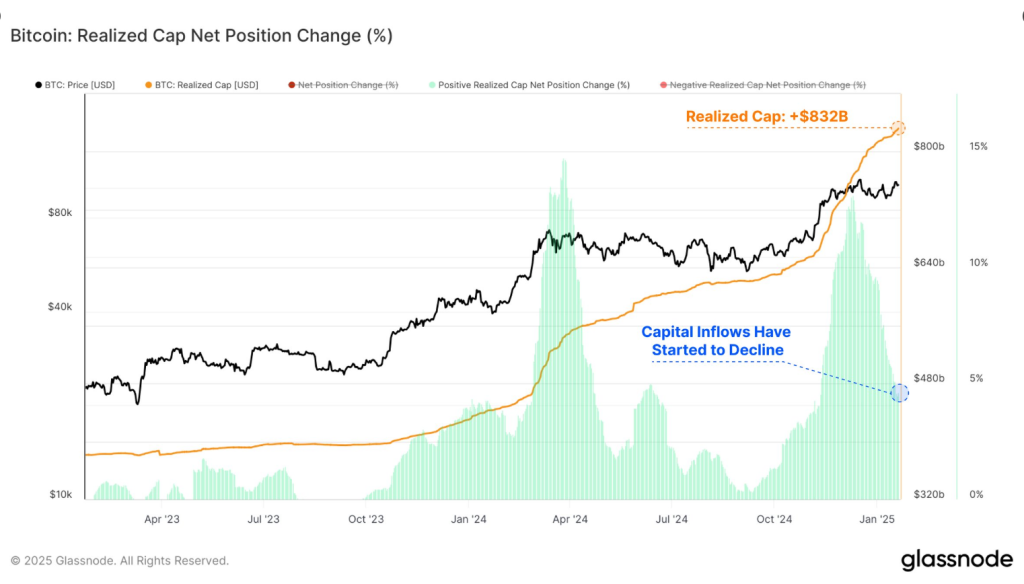

Bitcoin just hit a major milestone: its realized capitalization topped $832 billion! This is a big deal, even though new money flowing into Bitcoin has slowed down a bit after it crossed the $100,000 mark.

What is Realized Cap, Anyway?

Forget the usual market cap number. Realized capitalization is a more accurate way to value Bitcoin. It uses the price each Bitcoin was last bought for, not the current market price. This gives a better picture of where the money is actually going – are long-term holders cashing out, or are new investors piling in?

Mixed Signals from Capital Inflows

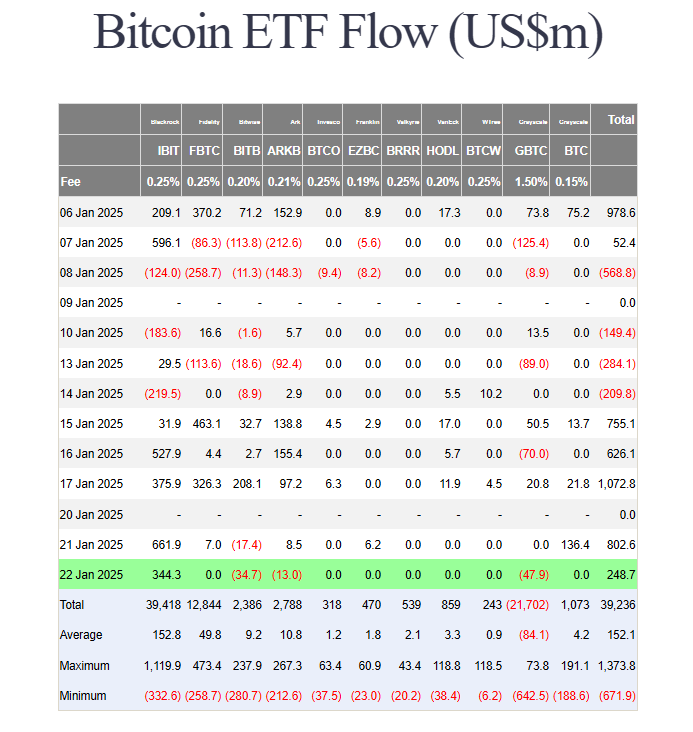

Things are a bit mixed when it comes to new money. Bitcoin ETFs (like stocks, but for Bitcoin) saw a huge outflow of $1.21 billion recently, making some people think institutional investors were losing faith. But then, BAM! Over $3 billion flowed into those same ETFs a few days later. So, while there are short-term ups and downs, the demand for Bitcoin is clearly still strong.

Long-Term Holders are Key

The big story here is long-term holders. They’re holding onto their Bitcoin, and even selling some for profit, which boosts the realized cap. Plus, new investors are buying in, often at higher prices. This shows Bitcoin isn’t just for short-term traders; it’s becoming a long-term investment, like gold.

Looking Ahead

While the rising realized cap is great news, slower inflows are something to watch. If that trend continues, it could be a problem. But for now, Bitcoin hitting new highs even with slower money coming in shows it’s becoming a more mature and stable asset.