Russia’s central bank has released a report showing Bitcoin as the top-performing investment in 2025, significantly outpacing traditional options like gold, stocks, and bonds.

Bitcoin’s Stellar Performance

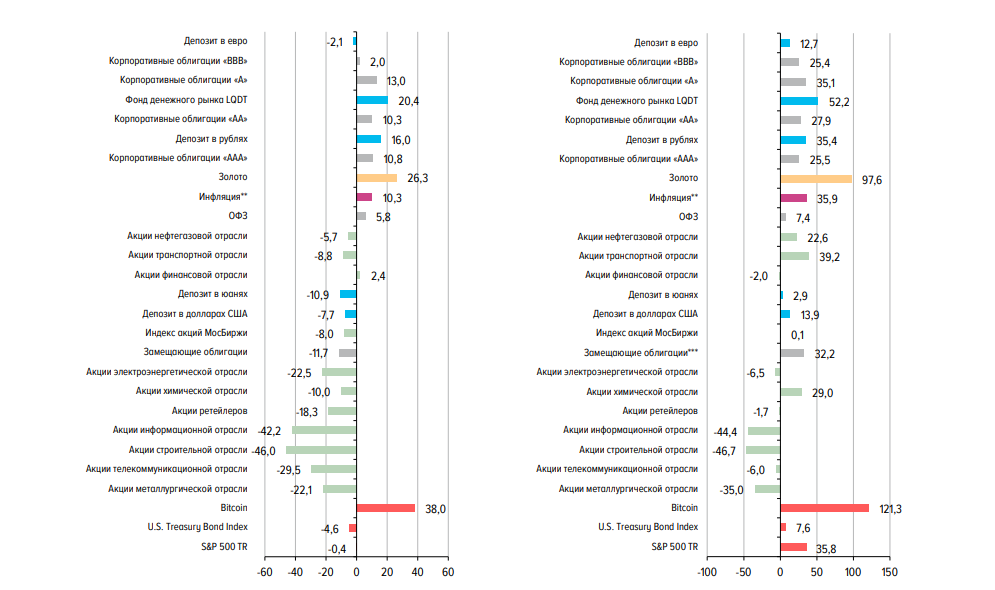

Bitcoin’s performance has been nothing short of spectacular. The report highlights a nearly 40% return over the past year and a whopping 121% cumulative return since 2022. This dwarfs the gains seen in gold and corporate bonds, with gold only managing single-digit increases. This impressive growth has attracted investors seeking higher returns than those offered by traditional banking or stock funds.

Navigating the Volatility

The report also acknowledges Bitcoin’s price volatility. The first four months of 2025 saw a significant 20% drop, causing anxiety among some investors. However, a strong rebound in April, with gains exceeding 10%, eased concerns. This highlights the inherent risk and potential for rapid price swings in the cryptocurrency market.

Factors Fueling Bitcoin’s Rise

Several factors contributed to Bitcoin’s surge in popularity and value:

-

Increased Accessibility: The emergence of Bitcoin exchange-traded funds (ETFs) in places like the US and Hong Kong has made it easier for mainstream investors to access Bitcoin through familiar brokerage accounts, eliminating the need for complex crypto wallets and trading platforms.

-

Global Uncertainty: Global economic uncertainty, fluctuating currency values, and low yields on bank deposits have driven investors to seek higher-return alternatives. In Russia, the weakening ruble has pushed some towards dollar-denominated assets like Bitcoin.

-

Growing Adoption:

Countries like Kyrgyzstan and Ukraine are exploring the use of cryptocurrencies in their budgets, while firms like Cantor Fitzgerald are considering Bitcoin as a hedge against market volatility.

High Rewards, High Risks

While Bitcoin delivered impressive returns (38% in 2025), the report underscores the significant risk involved. The 19% price drop earlier in the year serves as a reminder of Bitcoin’s volatility. Experts still recommend limiting cryptocurrency exposure in a diversified investment portfolio.