Bitcoin had a fantastic 2024, beating out major investments like gold and various stock market indexes. Let’s dive into the details.

Bitcoin’s Stellar Performance

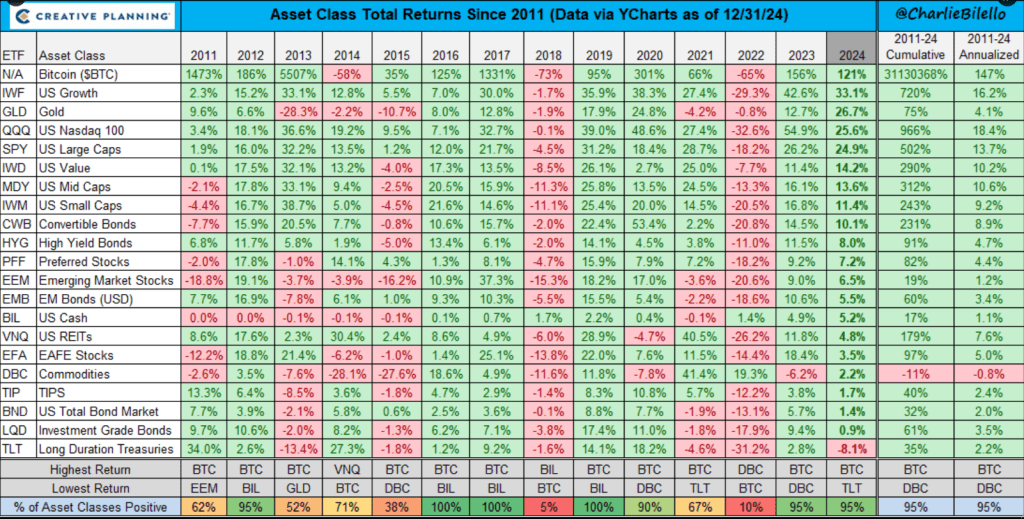

Analysts are super excited about Bitcoin’s performance in early 2025, building on its strong finish to 2024. It significantly outperformed traditional assets like gold, which only saw a 26% return. Other investments also lagged behind: the Nasdaq 100 gained 25%, large-cap US stocks 24%, mid-caps 13%, and convertible bonds a mere 10%. Bitcoin’s success is partly due to positive market conditions, including Donald Trump’s election win.

A Look Back: Bitcoin’s Long-Term Performance

While 2024 was impressive, Bitcoin’s overall track record since 2011 is even more remarkable. It’s consistently been a top performer, except for a few years with negative returns (like the -73% drop in 2018). However, there were also years with absolutely massive gains—over 1000% in some cases! For example, in 2011, Bitcoin yielded a whopping 1437%, far surpassing even long-term treasuries.

Volatility: The Bitcoin Double-Edged Sword

Despite its impressive returns, Bitcoin’s volatility remains a key concern. While 2024 saw its price more than double, from around $40,000 to between $95,000 and $97,000, those price swings can be dramatic. For example, it briefly hit $100,000 before dropping back below that mark. Other cryptocurrencies, like Ether, also experienced significant gains and volatility.

The Bottom Line

Bitcoin’s 2024 performance was undeniably impressive, outshining traditional investments. However, potential investors should be aware of the inherent risks associated with its volatility. While past performance doesn’t guarantee future results, Bitcoin’s track record is certainly something to consider.