Bitcoin’s price has been on a bit of a rollercoaster lately. Let’s dive into what’s happening.

A Week of Ups and Downs

Last week saw Bitcoin climb slightly (about 1.10%), but the overall picture is still uncertain. Economic news, especially from the US, is making things unpredictable. While Bitcoin briefly touched around $95,000, it’s currently trading closer to $86,000. Nobody’s quite sure what’s next.

The $98,000 Wall

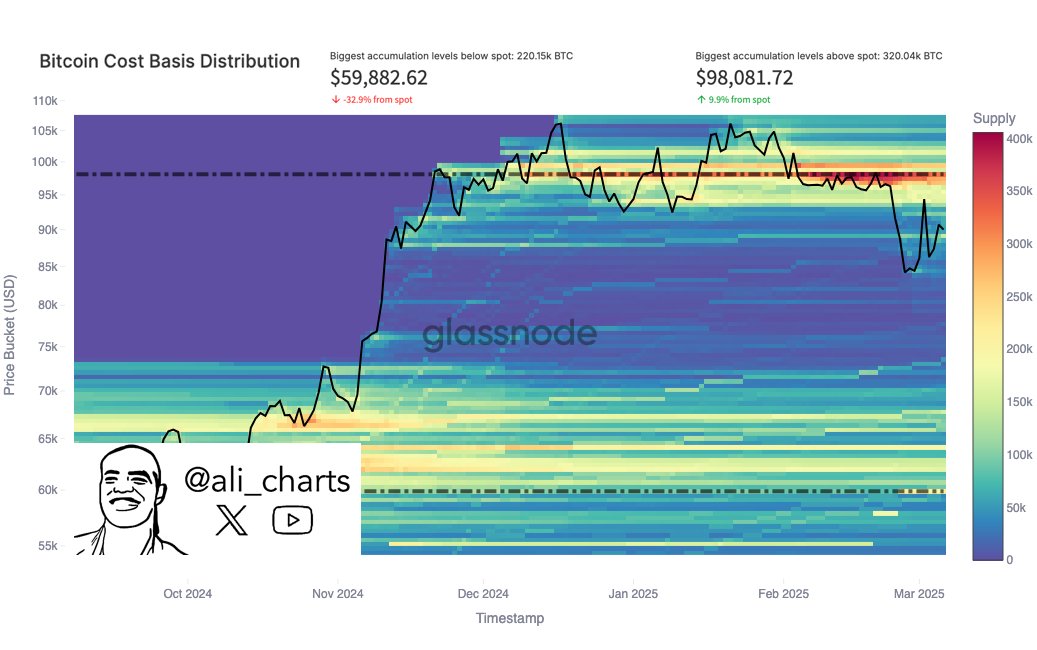

Analyst Ali Martinez points to a key resistance level at around $98,081. His analysis looks at the “cost basis distribution” – basically, where people bought their Bitcoin. A large number of Bitcoin were purchased around $98,000. If the price hits this level again, these investors might sell to avoid losses, preventing Bitcoin from going much higher.

However, if buyers can push the price past $98,081, a return to $100,000 and even a new all-time high is possible.

Potential Support and a Scary Drop

On the flip side, if Bitcoin continues to fall, Martinez identifies significant support around $59,882. A lot of Bitcoin was bought at this price, so long-term holders might buy more to protect their investments, causing a bounce. But, a break below $59,882 could trigger widespread panic selling – that’s a scenario nobody wants.

The Current Situation

Currently, Bitcoin is trading around $85,995, down slightly from recent highs, and trading volume is also down. Even with positive news like the creation of a US Bitcoin reserve, the market remains volatile. The next few weeks will be crucial to see which way the price moves.