Could Bitcoin reach a staggering $10 million per coin by 2035? One expert thinks so.

The Long View on Bitcoin

Joe Burnett, a market research director, has outlined a long-term forecast predicting Bitcoin’s explosive growth. His analysis focuses on two key factors: a massive shift of global capital into Bitcoin, and the accelerating impact of deflationary technology.

Most financial discussions focus on short-term trends. Burnett’s perspective is different; he looks at the big picture, identifying major shifts before they become widely accepted. He argues that the current global financial system—worth roughly $900 trillion—is inherently risky. Assets like gold, real estate, stocks, and bonds are all susceptible to devaluation or dilution due to factors like inflation and increasing supply.

Bitcoin: A Scarce Asset in a Sea of Inflation

Burnett sees Bitcoin as unique. Its fixed supply of 21 million coins makes it immune to dilution. Increased demand directly translates to price appreciation. He uses the analogy of a waterfall: traditional assets are like open reservoirs constantly being filled, while Bitcoin is a closed, finite resource.

The halving cycle further illustrates this. The reward for Bitcoin miners is steadily decreasing, highlighting the diminishing supply of newly minted coins. By 2065, this will be minimal.

While existing models predict Bitcoin reaching around $1.8 million to $2.1 million by 2035, Burnett believes these are too conservative. He argues that accelerating technological adoption and growing awareness of Bitcoin’s properties could lead to much higher prices.

Deflationary Technology: A Powerful Catalyst

Another key driver of Bitcoin’s potential growth is the deflationary impact of AI, automation, and robotics. These technologies dramatically increase productivity and lower costs. Burnett projects significant cost reductions in various sectors by 2035:

- Manufacturing: 3D printing and AI could slash costs tenfold.

- Housing: 3D-printed homes and automated supply chains could make housing significantly cheaper.

- Transportation: Autonomous vehicles could reduce transportation costs by 90%.

Under a fiat system, this natural deflation is often masked by inflationary policies. Bitcoin, however, would allow deflation to run its course, increasing the purchasing power of Bitcoin holders.

Burnett illustrates this by comparing gold’s performance since 1970. While gold’s price has increased significantly, the continuous increase in its supply diluted its value. Had gold’s supply remained fixed, its price would have been much higher. Bitcoin, with its fixed supply, avoids this dilution.

The $10 Million Target: Realistic or Far-Fetched?

A $10 million Bitcoin would give it a market cap of $200 trillion, roughly 11% of global wealth (assuming continued growth). Burnett argues this isn’t unrealistic, especially considering that Bitcoin’s adoption is still in its early stages. He points out that only a tiny fraction of the global population holds significant amounts of Bitcoin.

A key factor is the security budget for Bitcoin – miner revenue. Even at $10 million per Bitcoin, the annual miner revenue would be substantial, but Burnett compares this to the already large and growing global wine market, suggesting it’s achievable.

The Investment Strategy

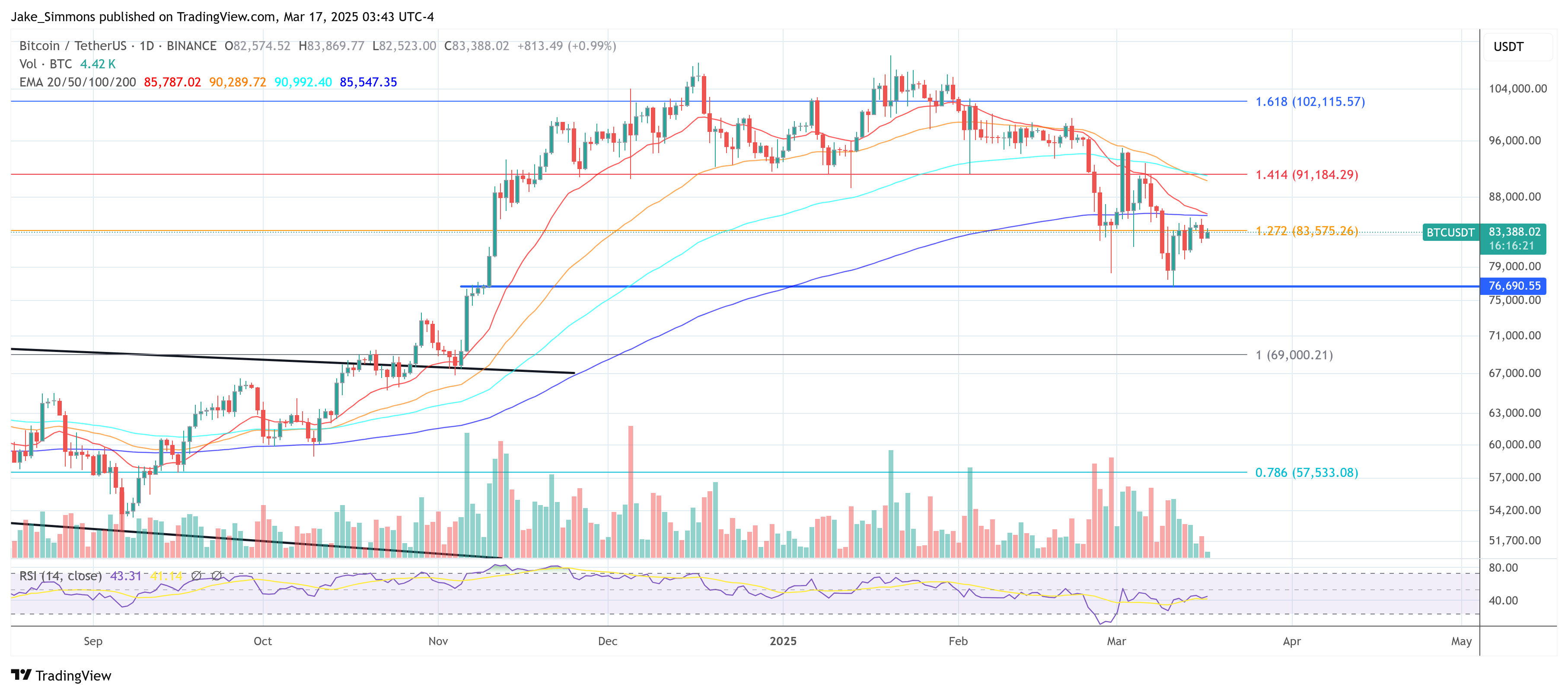

Burnett’s message to investors is clear: focus on the long term, ignore short-term volatility, and invest before Bitcoin’s value becomes universally recognized. The opportunity lies in “front-running” the massive capital migration expected to flow into Bitcoin as awareness grows. The current price of Bitcoin at the time of writing is approximately $83,388.