Analyst James Van Straten says that the activity of big Bitcoin investors (“whales”) on the Bitfinex exchange is a pretty good predictor of Bitcoin’s price movements.

What the Whales Are Doing

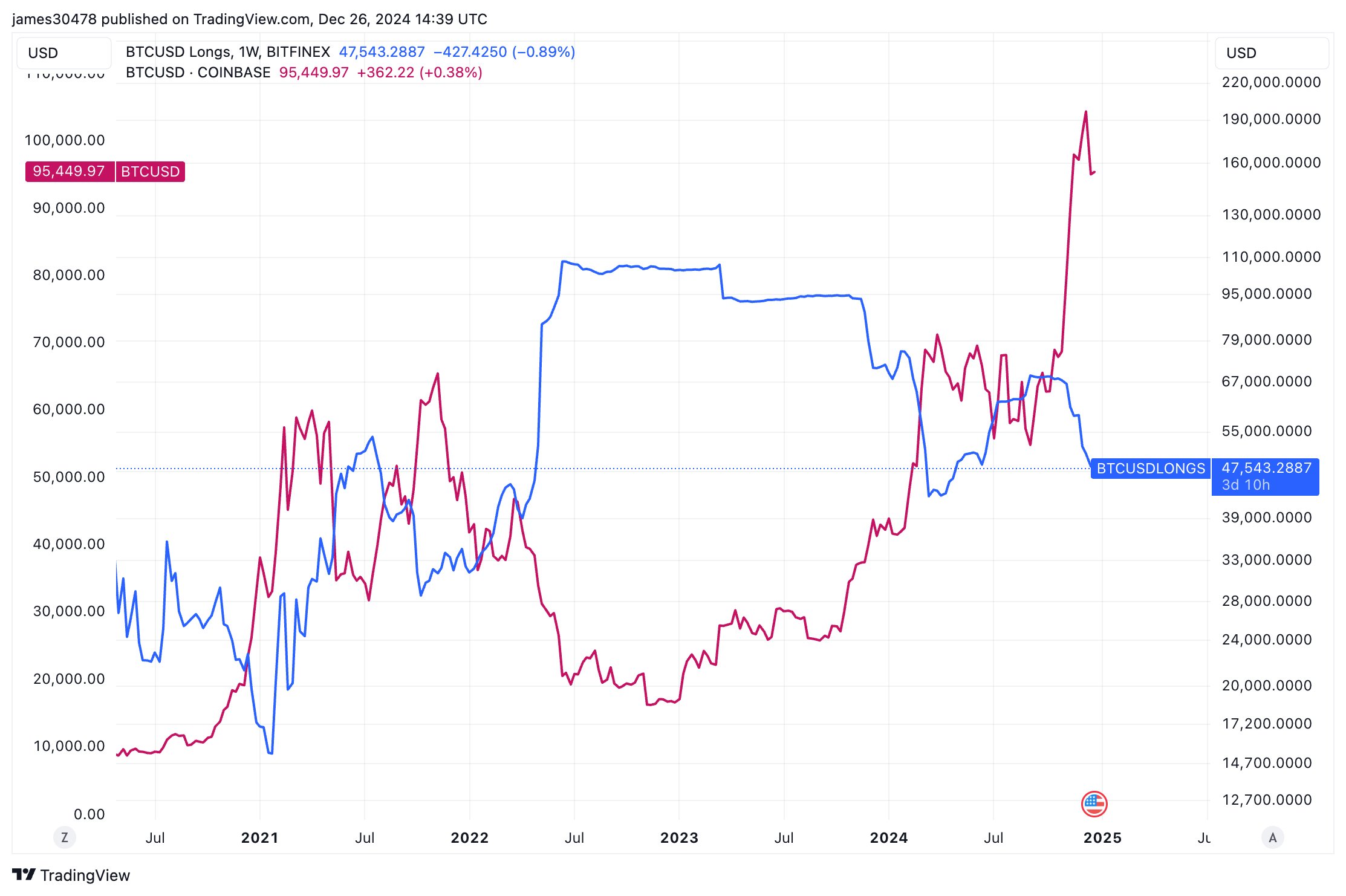

Van Straten looked at the number of long Bitcoin positions (bets that the price will go up) on Bitfinex over the past few years. He found a pattern:

- 2022 Bear Market: Big investors held onto their long positions even when the price was dropping.

- Early 2024 Rally: They started selling off their positions as the price rose, which was followed by a price dip.

- Consolidation: Whales gradually bought more Bitcoin.

- Recent Bull Run: They took profits during the recent price increase, and the price has since fallen again.

- Current Situation: Whale activity suggests they aren’t expecting another big price jump soon, as they haven’t started buying again.

While there’s no guarantee, their past accuracy makes their current behavior worth watching. If Bitcoin is going to rally again, we might see these whales start buying heavily again.

Another Red Flag: Exchange Reserves

Adding to the bearish signals, a lot of Bitcoin has recently flowed into cryptocurrency exchanges. This is usually a bad sign, as people often deposit Bitcoin to exchanges before selling it. A recent influx of 20,000 BTC could put further downward pressure on the price.

Bitcoin’s Current Price

Bitcoin’s price has been pretty flat recently, hovering around $96,000.