Accumulation Activity Slows Down

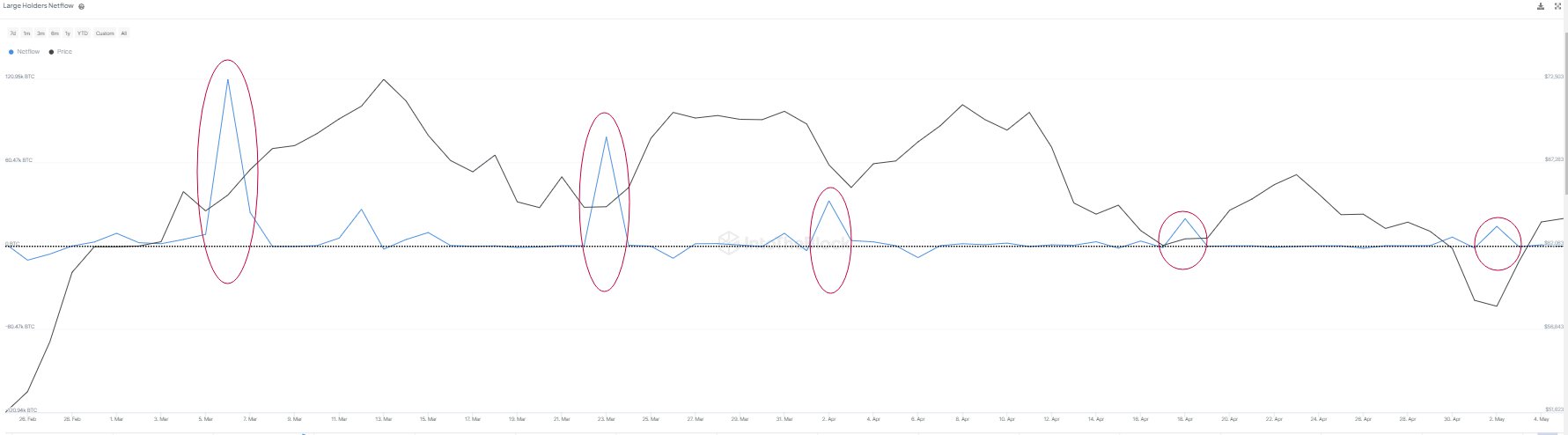

Analytics firm IntoTheBlock has noticed a shift in the behavior of large Bitcoin (BTC) holders, known as whales. Since March, whales have consistently bought BTC during price pullbacks. However, IntoTheBlock reports that whales holding over 1,000 BTC are now showing less enthusiasm for buying dips.

The firm’s netflow metric, which tracks the difference between inflows and outflows of BTC in whale wallets, has declined since its peak in March. This suggests that whales are moving less BTC into their wallets.

Whale Appetite Waning?

IntoTheBlock questions whether this slowdown indicates a waning appetite among whales to buy BTC at lower prices. They note that each accumulation spike by whales has been smaller than the previous one.

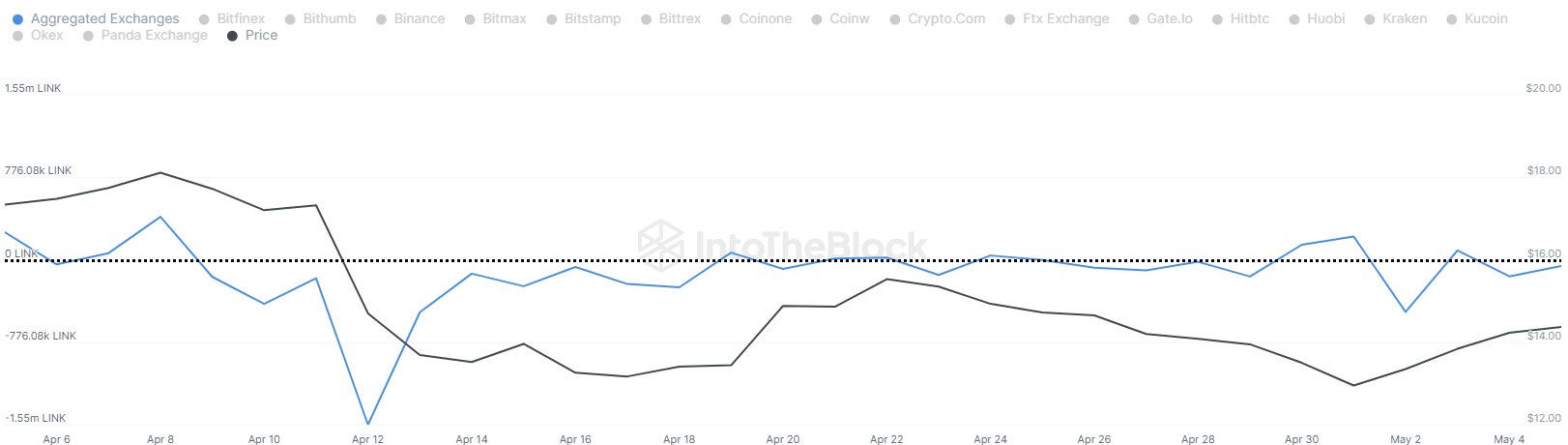

Chainlink Accumulation Despite Price Drop

Meanwhile, IntoTheBlock also highlights the accumulation of Chainlink (LINK) by investors. Despite LINK’s recent price decline, market participants have been actively buying the cryptocurrency.

Over the past month, the net outflow of LINK from exchanges has been negative, indicating accumulation. The total net outflow during this period amounted to nearly 3.6 million LINK.