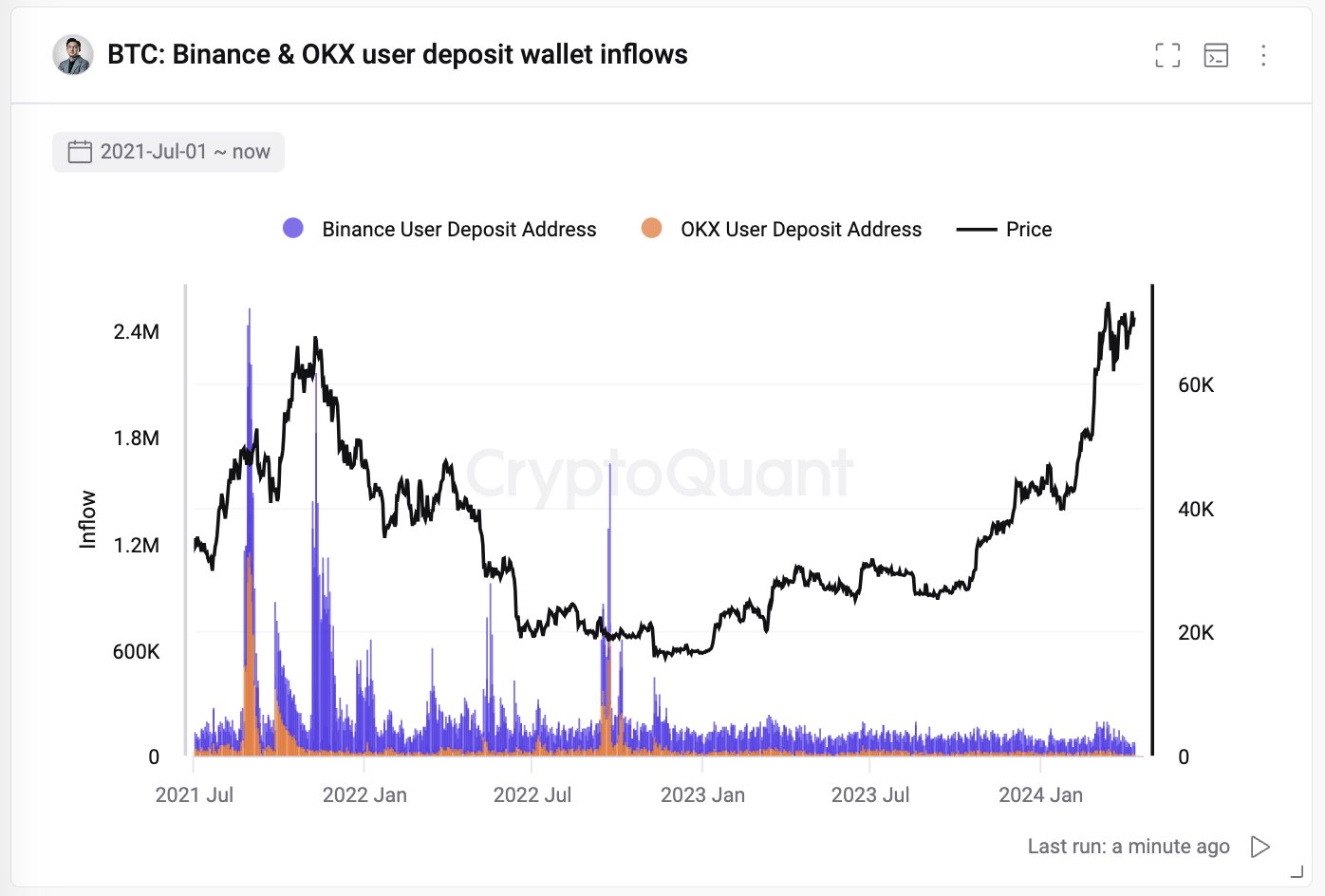

Exchange Deposits Remain Low

Data shows that Bitcoin deposits on major exchanges like Binance and OKX have been low recently. This suggests that large holders, or “whales,” are not eager to sell.

Bullish or Neutral Signal?

Low exchange inflows can indicate either bullish or neutral sentiment for Bitcoin. If outflows are also low, it suggests a lack of selling pressure. However, if outflows are high, it could be a bearish sign.

Whales Uninterested in Selling

The current low inflows suggest that whales are not actively selling their Bitcoin. Even the recent rally to an all-time high did not trigger significant selling.

Comparison to 2021 Bull Run

In contrast to the 2021 bull run, which saw high exchange inflows, the current rally has been characterized by low inflows. This could indicate that the rally may not be near a top yet.

Impact of Spot ETFs

The emergence of spot exchange-traded funds (ETFs) has provided an alternative way to invest in Bitcoin. This may reduce the importance of cryptocurrency exchanges in the market.

Current Price

As of writing, Bitcoin is trading around $70,400, up 5% over the past week.