Whale Traders in Risk-Averse Mode

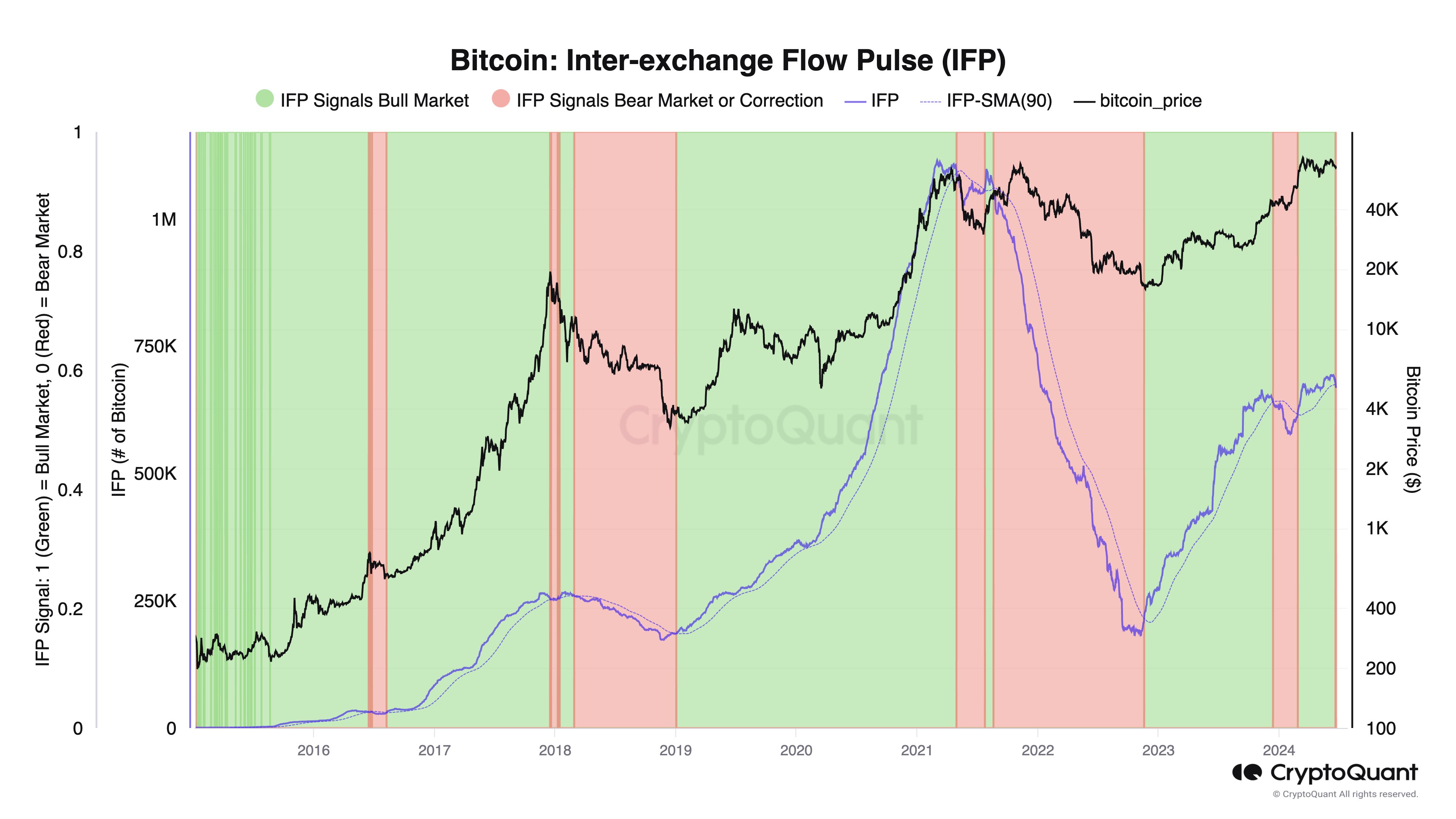

According to Ki Young Ju, CEO of CryptoQuant, the largest Bitcoin (BTC) traders are now adopting a more cautious approach. The interexchange-flow-pulse (IFP) indicator, which tracks the flow of BTC between spot and derivatives exchanges, suggests that whales are entering “risk-off mode.”

When traders deposit assets into derivatives exchanges, they can use them as collateral to take on more risk through leveraged positions. Ju notes that the IFP is currently below its 90-day moving average, indicating that whales are less inclined to take on these risks.

Ethereum Market Heating Up

While Bitcoin faces some headwinds, Ethereum (ETH) is showing signs of strength. CryptoQuant’s Market Value to Realized Value (MVRV) indicator for ETH is rising faster than Bitcoin’s, suggesting that the ETH market is heating up. Historically, when Ethereum surges, other cryptocurrencies tend to follow.