Bitcoin is seeing a surge in long-term investment. A recent report by CryptoQuant analyst Burak Kesmeci shows that addresses holding Bitcoin are accumulating at an incredible rate. These addresses, which represent individual and institutional investors, have been steadily buying Bitcoin and holding onto it, even during market uncertainty.

The Rise of Bitcoin Accumulation in 2024

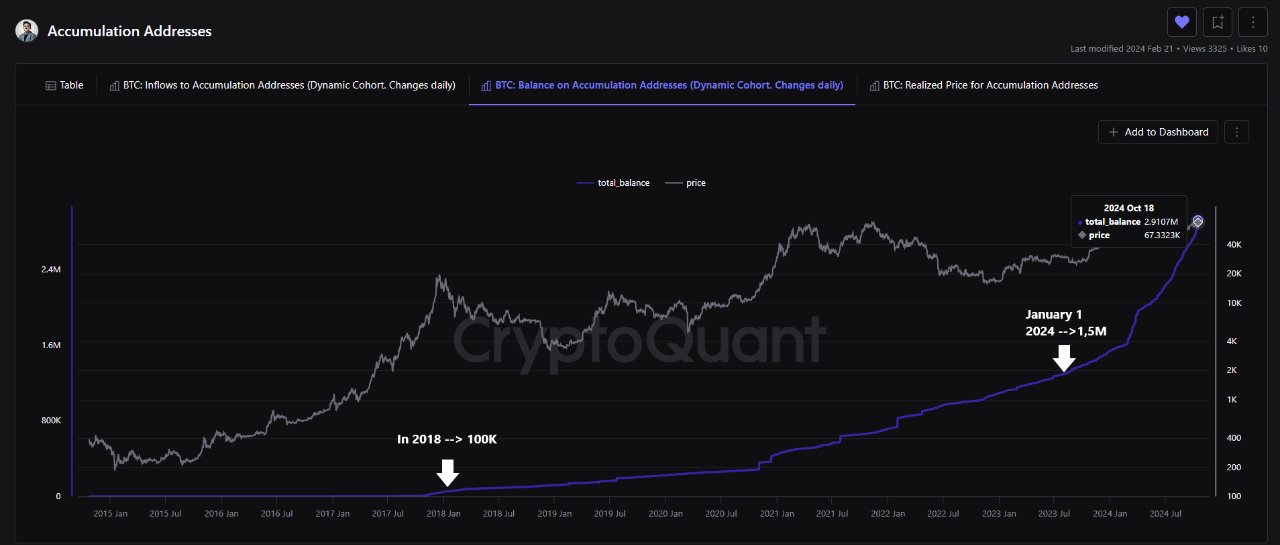

These “accumulation addresses” are different from typical investors. They’ve never sold any Bitcoin, only bought more. This shows they’re fully committed to holding Bitcoin for the long term, regardless of short-term price fluctuations.

These addresses held 1.5 million Bitcoin in January 2024. But in just 10 months, that number has almost doubled to 2.9 million Bitcoin. This rapid accumulation is a clear sign of confidence in Bitcoin’s future.

What Does This Mean for the Bitcoin Market?

The analyst predicts that these addresses could hold over 3 million Bitcoin by the end of 2024. That would be worth over $210 billion if Bitcoin reaches $70,000.

This kind of accumulation could have a big impact on the Bitcoin market. It means there’s less pressure to sell, which could lead to a sustained price rally.

So, what does this mean for you? If these “Bitcoin whales” are confident in Bitcoin’s future, maybe it’s time to take a closer look at your own investment strategy. /p>