Bitcoin’s price has been stuck in a range this year, leaving many wondering if the bull run is over. While experts debate the future, some on-chain data offers a glimmer of hope.

Whales Are Holding On

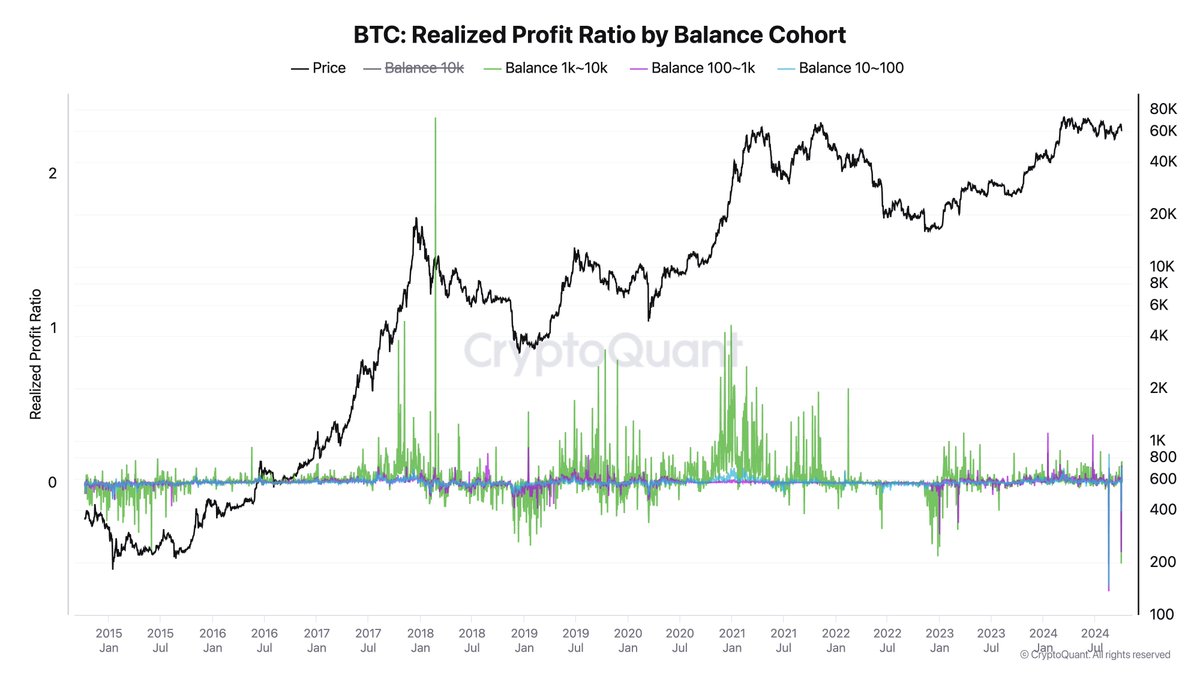

CryptoQuant CEO Ki Young Ju has pointed out that Bitcoin whales (large investors) have taken less profit this cycle than in previous bull runs. This suggests they still believe in Bitcoin’s long-term potential.

The data comes from the Realized Profit Ratio by Balance Cohort metric, which measures how much profit investors are making when they sell their Bitcoin. A high ratio means whales are selling, while a low ratio means they’re holding on.

The current low ratio indicates that whales are not selling, suggesting the bull run may not be over.

Smaller Investors Are Returning

Another positive sign comes from Santiment, which tracks on-chain data. They’ve noticed an increase in “Dolphin” addresses, which hold between 0.1 and 10 BTC. These investors were selling earlier in the year, but they’re now buying back in.

This suggests that smaller investors are becoming more confident in Bitcoin, which could further boost the price.

Overall, the data suggests that the bull run may not be over yet. Whales are holding on, and smaller investors are returning to the market. This could be a positive sign for Bitcoin’s future. /p>