Bitcoin’s big players are acting differently this time around. They’re not cashing out as much as they usually do during bull markets, which has some people wondering what’s going on.

Whales Are Holding Back on Profits

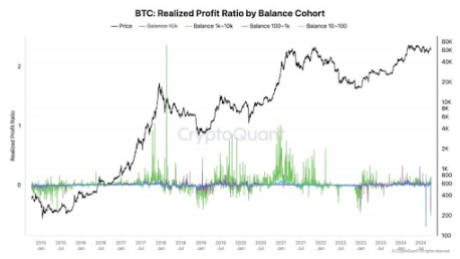

According to CryptoQuant founder Ki Young Ju, Bitcoin whales are taking much smaller profits than they have in previous bull runs. He believes this means they think the bull market is far from over.

Some analysts argue that whales are just spreading their Bitcoin across different wallets, making it look like they’re selling less. But Ju insists that even with this, the profit-taking rate is still lower than ever before.

He also points out that the whales who are selling now are doing so with very little profit, suggesting they might be newer players who are less confident.

Whales Are Accumulating More Bitcoin

Instead of taking profits, whales are actually buying more Bitcoin. This is leading to a huge increase in Bitcoin leaving exchanges, which is a sign that people are holding onto their coins.

New whales are also entering the market at a rate we’ve never seen before. This suggests that they believe Bitcoin is still a good investment.

When Will the Bull Market Peak?

Analysts are predicting that the Bitcoin market will peak sometime in 2025. Some think it will happen in September or October, while others believe it could be as early as May or June.

The fact that Bitcoin hit a new all-time high before the halving event suggests that this bull market is moving faster than usual. This means the peak could come sooner than expected.

Overall, it seems like Bitcoin whales are confident in the future of Bitcoin. They’re not selling their coins, and they’re even buying more. This suggests that the bull market might still have some legs left. /p>

/p>