The introduction of Bitcoin exchange-traded funds (ETFs) in the United States has sparked mixed reactions. While there was an initial surge in investment, recent data shows a decline in overall Bitcoin wallet activity.

Diminishing Enthusiasm

Data from Santiment reveals a consistent reduction in the number of crypto wallets holding any amount of Bitcoin since the ETF approval. This suggests a potential retreat from direct Bitcoin ownership, possibly due to uncertainty and doubt (FUD).

IntoTheBlock’s analysis shows a significant decrease in daily active and new addresses, indicating a diminishing level of user engagement.

Conflicting Narratives

Notable figures like Anthony Scaramucci downplay pessimism, highlighting the substantial $5 billion ETF debut. However, financial institutions like LPL Financial advocate for a cautious approach.

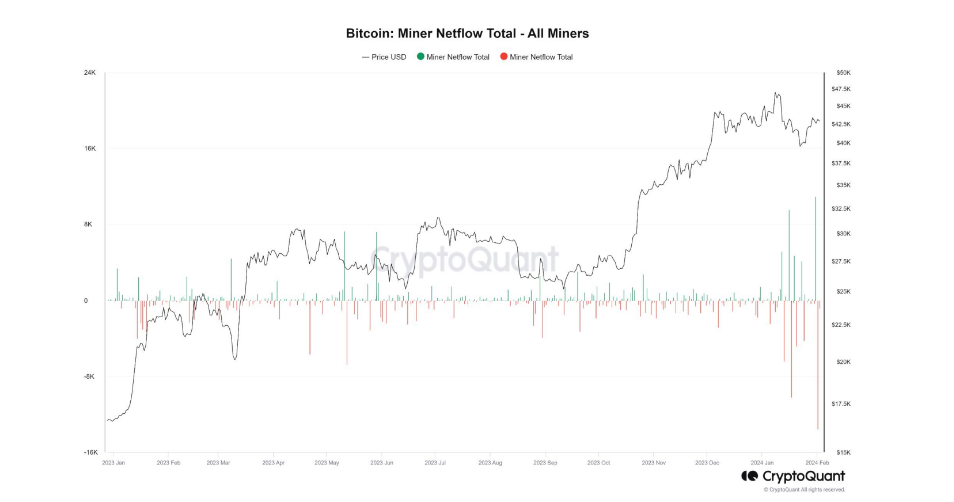

Bitcoin Miners On The Move

The launch of Bitcoin ETFs has also impacted crypto miners. Bitfinex Alpha reports a noteworthy development, with over $1 billion worth of Bitcoin flowing from miner wallets to exchanges in the first 48 hours of trading – a six-year high in miner outflow.

Uncertain Future

The initial investment in Bitcoin ETFs showed promise, but the subsequent drop in wallet activity and the surge in miner selling activities raise questions about the long-term implications of these financial products. The true narrative remains obscured by various factors, including the limited timeframe analyzed and the influence of broader economic conditions.