The Theory of Money Supply and Asset Valuation

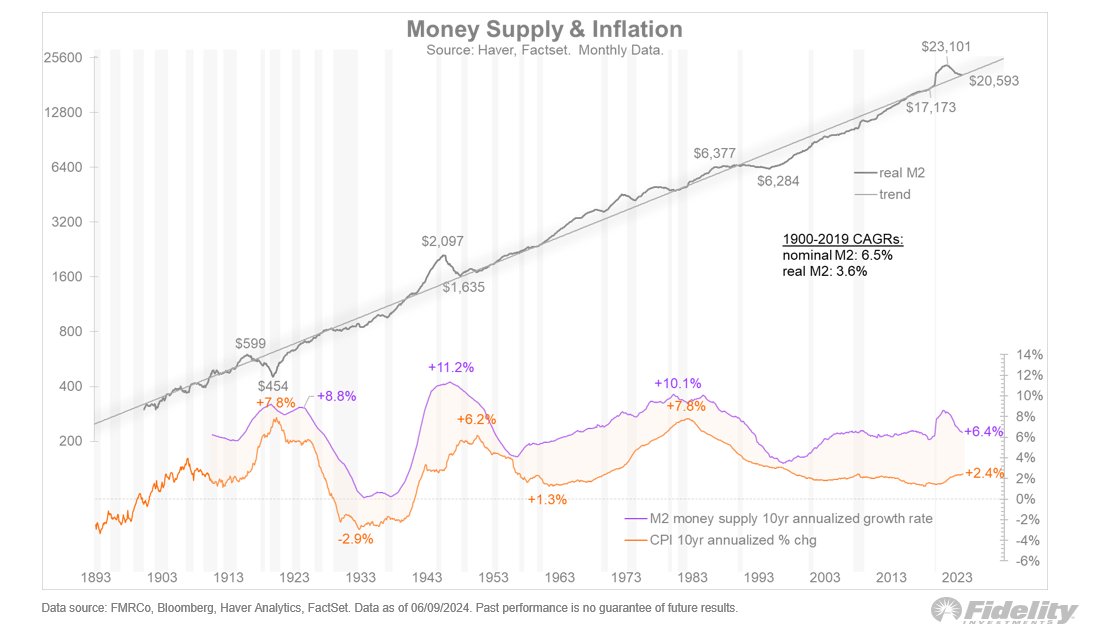

Fidelity’s Jurrien Timmer explains that when governments increase the money supply, it can weaken the currency’s value. He believes that inflation is coming, based on the historical relationship between money supply and inflation.

Bitcoin and Gold as Inflation Hedges

Both Bitcoin and gold are considered inflation-resistant assets. However, Timmer argues that this scenario hasn’t fully materialized yet, even with the Federal Reserve’s recent interest rate hikes.

Bitcoin’s Unique Characteristics

Bitcoin is often called “digital gold” because it shares some monetary qualities with gold. However, it’s also a new technology that Timmer believes could potentially replace gold as a store of value.

Current Market Conditions

While Bitcoin’s price has recently risen, Timmer believes it’s premature to declare it a reliable store of value. He points to the Federal Reserve’s tightening monetary policy, which has slowed the growth of the money supply.

Treasury Yield Correlations

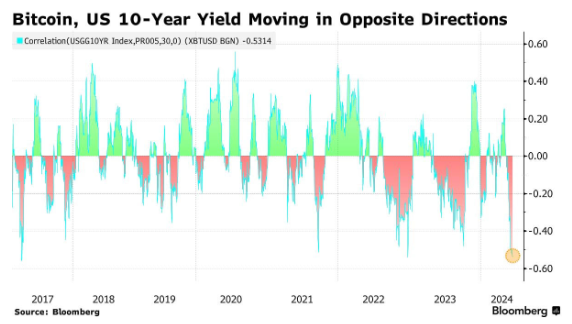

Recent data shows that Bitcoin’s correlation with the 10-year U.S. Treasury bond yield has dropped to its lowest level in 14 years. This suggests that Bitcoin is becoming more independent from traditional financial instruments.

Limitations of Bitcoin and Gold

Timmer acknowledges that both Bitcoin and gold have limitations as stores of value, especially when it comes to economic conditions like money supply and inflation.