Market analyst Miya has a bold prediction: Bitcoin will reach $110,000 by year’s end. She bases this on her analysis of current economic conditions and believes a stock market downturn will actually boost Bitcoin’s price.

Why $110,000 Bitcoin? A Flight to Safety?

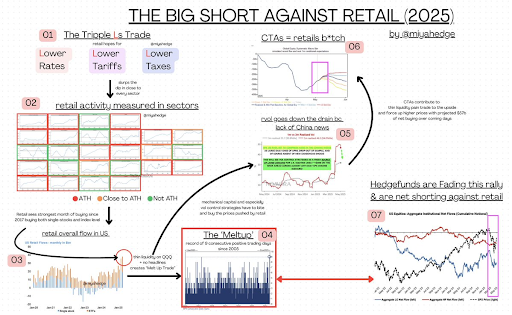

Miya’s analysis, titled “The Big Short against Retail,” forecasts a drop in the S&P 500 to 4,700 while Bitcoin soars. She anticipates a rough summer for the stock market, leading investors to seek safer havens – like Bitcoin. She sees this as a “flight to safety.”

The Looming Stock Market Crash

Miya points to several factors suggesting an impending stock market crash:

- Trump’s Promises: Donald Trump’s promises of lower interest rates, tariffs, and taxes have fueled a recent nine-day stock market rally. Traders are betting on these promises coming true.

- Retail Investor Complacency: This rally has created a false sense of security among retail investors, who are heavily invested in the market. Miya warns this complacency is dangerous.

- Hidden Economic Weakness: Miya argues that recent positive earnings reports from major tech companies (“Magnificent 7”) are misleading. The true impact of tariffs and other economic factors hasn’t fully materialized yet.

Miya believes the current market optimism is unsustainable and a significant correction is coming. She sees Bitcoin as a safe haven during this downturn. The “containership recession trade” is expected to hit the US soon, further fueling this prediction.

Bitcoin as a Hedge

In short, Miya’s prediction rests on the idea that Bitcoin will act as a hedge against a coming stock market crash. As investors flee the stock market, they’ll pour money into Bitcoin, driving its price up significantly. At the time of this writing, Bitcoin is trading around $96,500.