A top fund manager is predicting a massive surge in Bitcoin’s price. Matt Hougan, Chief Investment Officer of Bitwise Asset Management, believes Bitcoin will not only surpass gold but reach a staggering $1 million per coin by 2029. He bases this bold prediction on several key factors.

Institutional Adoption Takes Off

Hougan points to the explosive growth of Bitcoin exchange-traded funds (ETFs) as a major driver. He highlights that the inflow of capital after the ETFs launched in early 2024 was far beyond expectations. These ETFs raked in a whopping $37 billion in their first year, dwarfing the previous record of $5 billion. He believes this is just the beginning, as many financial advisors are still unable to even discuss Bitcoin investments with their clients. Once this changes, the influx of money will likely accelerate even further.

The ETF Competition is a Good Thing

While many companies launched Bitcoin ETFs, Hougan sees this competition as positive. It’s driven down fees to incredibly low levels, benefiting investors. Bitwise, he says, focuses on both institutional investors and those deeply involved in crypto, offering a unique approach.

Stablecoins: A “Killer App”

Hougan also highlights the rapid growth of stablecoins as a significant factor. He calls them a “killer app” due to their potential to revolutionize global payments by offering cheaper and faster transactions. He anticipates a multi-trillion dollar stablecoin market in the years to come, assuming supportive regulations are put in place.

Corporations are Getting Involved

Corporate interest in Bitcoin is also growing, though it faces hurdles like complex accounting rules. Despite this, companies bought hundreds of thousands of Bitcoin last year, and Hougan expects this trend to continue as these issues are resolved. Interestingly, his firm’s surveys show a significant gap between advisors who personally own Bitcoin (over 50%) and those who can officially recommend it to clients (15-20%). This gap is expected to close.

Regulatory Changes are Key

Hougan stresses the importance of shifting regulatory attitudes in Washington. He notes that the previously hostile environment, with banks refusing to work with crypto companies, significantly hampered growth. The more relaxed stance now is a game-changer, removing a major obstacle for investment. He also sees bipartisan support for stablecoin legislation as a positive sign.

Bitcoin as a Hedge Against Uncertainty

Hougan believes Bitcoin is well-positioned to thrive in uncertain economic times, whether facing runaway inflation or a deflationary crash. He argues that even a small Bitcoin allocation acts as a hedge against potential economic instability. Many of Bitwise’s clients are exploring ways to generate yield on their Bitcoin holdings without selling, showcasing strong conviction in the asset.

The Bottom Line: Scarcity and Demand

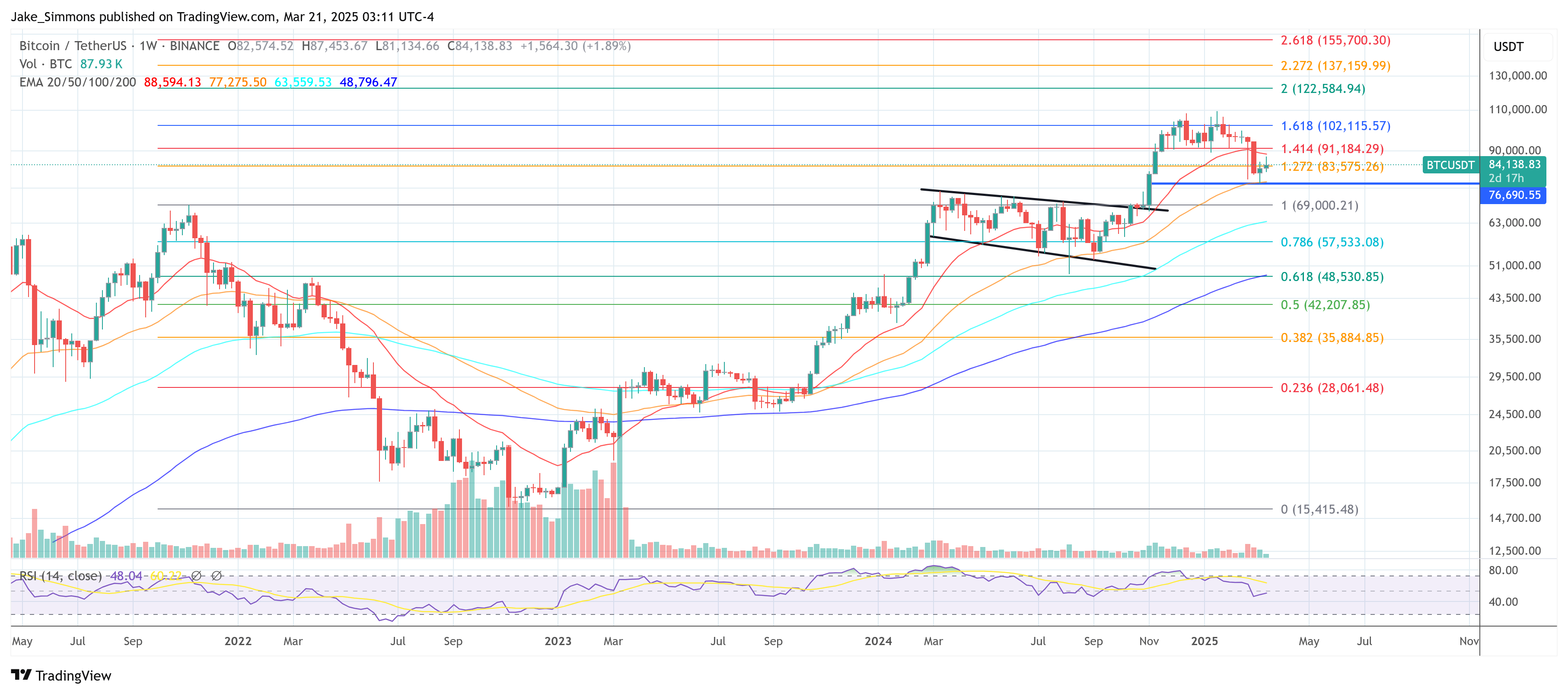

Ultimately, Hougan’s prediction rests on Bitcoin’s limited supply and the ever-increasing demand. With more buyers than newly mined Bitcoin, the price is likely to continue its upward trajectory. While acknowledging daily price volatility, he remains confident in the long-term fundamentals, predicting Bitcoin will hit $1 million by 2029. At the time of this writing, Bitcoin was trading at approximately $84,138.