A financial expert is predicting Bitcoin could become as important as gold in the global economy, sparking a lot of debate. This idea is getting even more attention now that there’s talk of the US creating a huge Bitcoin reserve.

Bitcoin’s Potential Role in Global Finance

Matthew Sigel, a digital asset expert, thinks Bitcoin could massively change global finance. He suggests that if the US government created a strategic reserve of around 1 million Bitcoins, it would essentially make Bitcoin a new type of currency. This is similar to how countries used to stockpile gold to boost their economies. Sigel believes this could put the US at the forefront of this new financial era, with Bitcoin replacing gold as the ultimate reserve asset. He calls this a shift to a “Digital Standard.”

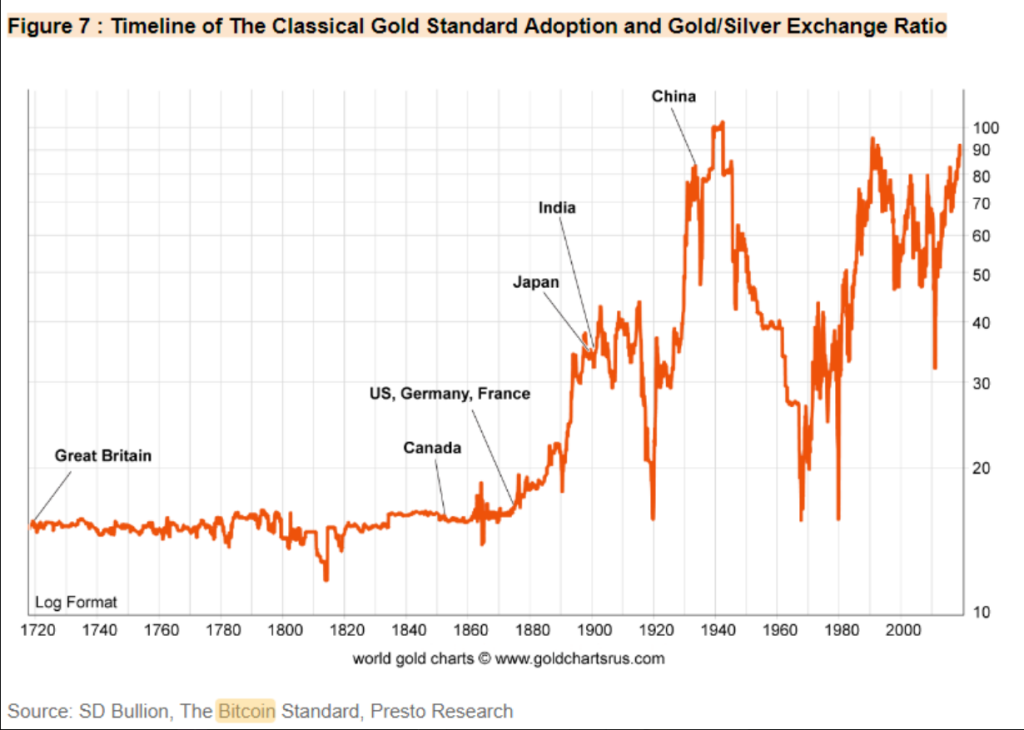

Bitcoin vs. Gold: A Historical Comparison

Comparing Bitcoin to gold isn’t new, but it’s become a hot topic as governments explore digital currencies. Gold is a traditional safe haven and store of value, but Bitcoin has some unique advantages. Being digital, it’s much faster and easier to transfer than gold, and it’s less vulnerable to theft. Plus, unlike gold which is constantly being mined, Bitcoin’s supply is capped at 21 million coins, making it inherently scarce. This scarcity is appealing to people worried about inflation and economic uncertainty.

Global Reactions and Concerns

The potential of Bitcoin is causing a global stir. Countries like El Salvador have already adopted Bitcoin as legal tender, and others are considering similar moves. However, not everyone is on board. While Bitcoin offers benefits like decentralization and resistance to government control, its price volatility is a major concern for many economists. This volatility contrasts sharply with gold’s more stable value. Therefore, investors and policymakers need to carefully consider these differences.

The Future of Money

Sigel’s comments highlight a growing interest in how Bitcoin could reshape global finance. Whether it will truly become a global standard alongside gold remains to be seen. The coming years will be crucial in determining how Bitcoin and gold evolve and interact in our increasingly digital world, ultimately shaping the future of money.