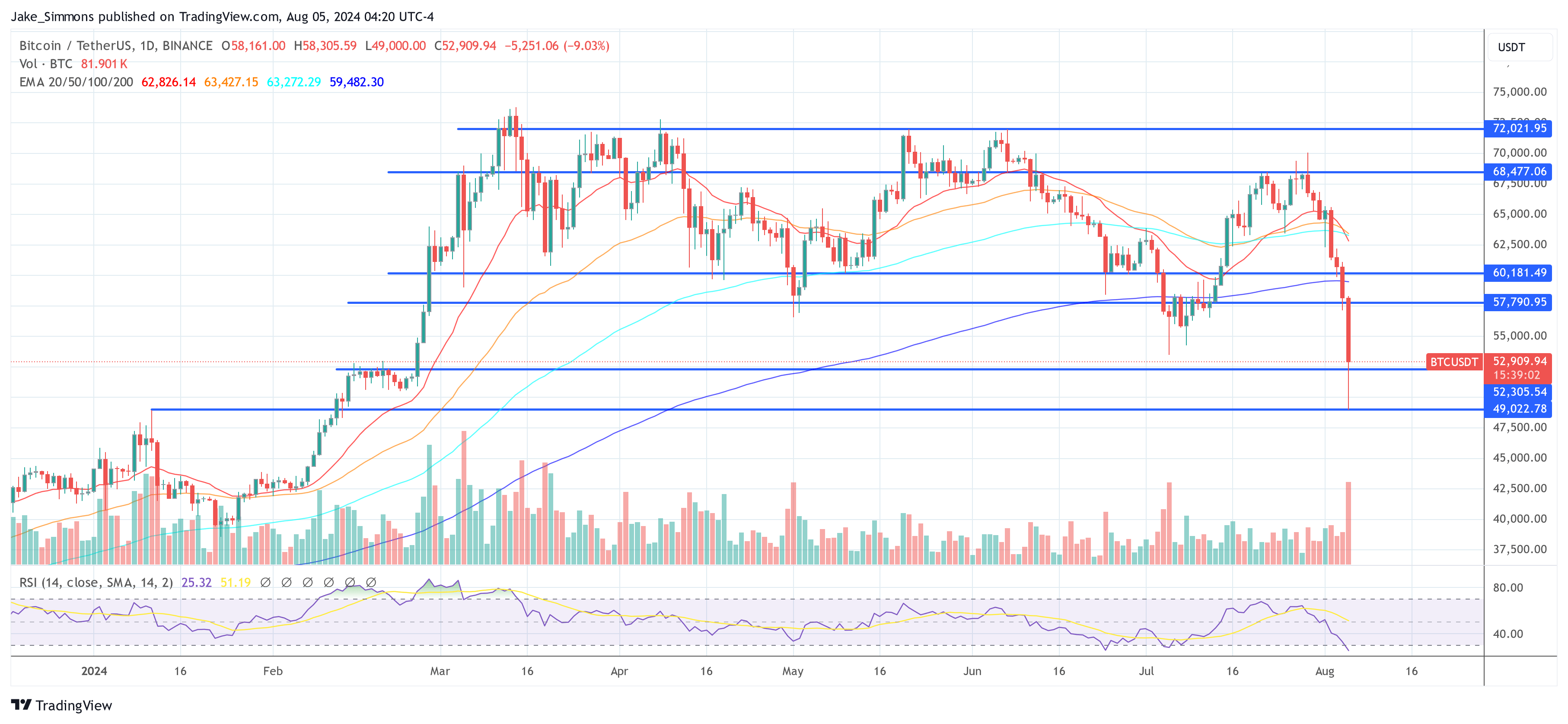

Bitcoin has taken a nosedive, dropping 26% from its recent high of $70,000 to a low of $49,000. Ethereum also saw a major drop, falling 39%. This wasn’t just a Bitcoin thing, though – the whole crypto market took a hit.

Recession Fears Spark Volatility

The initial trigger for this market meltdown seems to be growing fears of a US recession. A weak jobs report fueled concerns, and even Warren Buffett’s Berkshire Hathaway selling off a chunk of its Apple stock added to the jitters. This move was seen as a way to protect against potential market downturns.

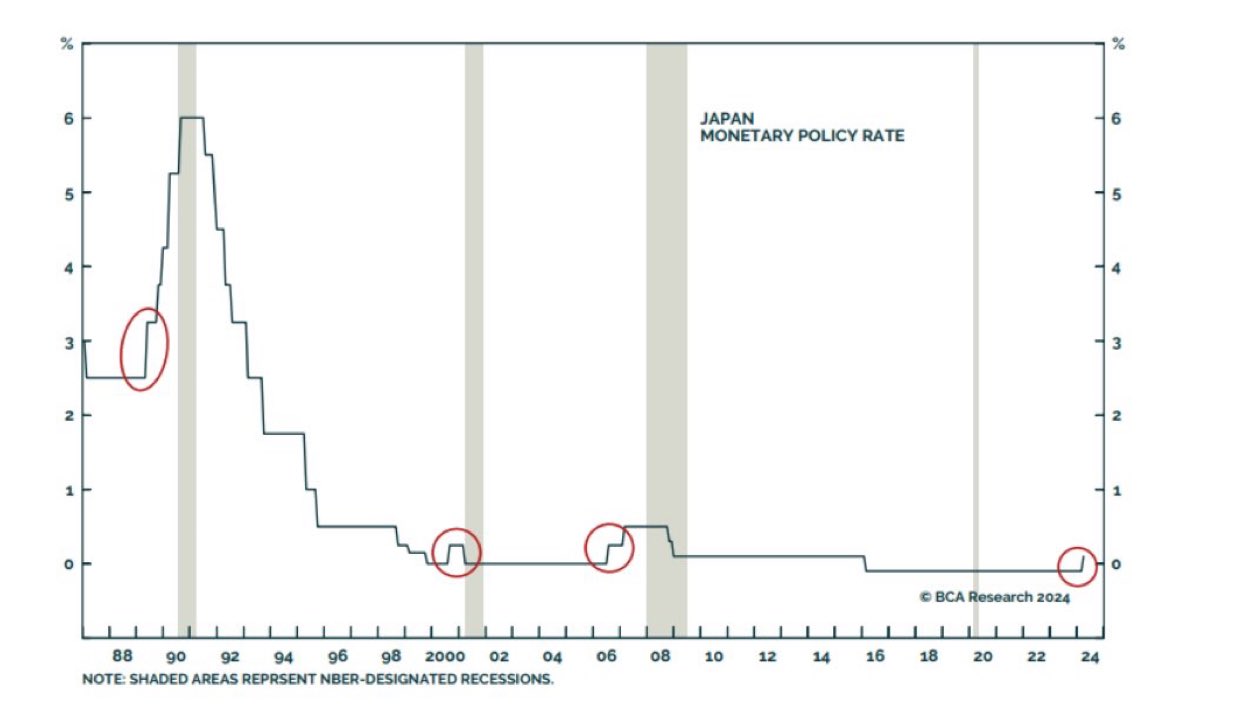

The Bank of Japan raising its interest rates also sent shockwaves through the market. Historically, these rate hikes have been followed by global recessions.

Yen Carry Trade Unwind

The Japanese yen strengthened significantly after the interest rate hike, putting pressure on traders who had been borrowing yen at low rates to buy US assets. This “yen carry trade” unwinding likely contributed to the decline in US stocks and spilled over into the crypto market.

Jump Trading and Large Sellers

There were some unusual sell orders on major exchanges, particularly on a Sunday, suggesting coordinated action by big players. Jump Trading, a major market maker, was rumored to be unloading Ethereum, potentially due to a strategic exit from the crypto market or a need for liquidity.

Liquidation Cascade Amplifies the Crash

The market saw a huge increase in liquidations, with over $1 billion worth of crypto being liquidated in just 24 hours. These forced liquidations, triggered by margin calls and stop-loss orders, pushed prices even lower.

Other Factors

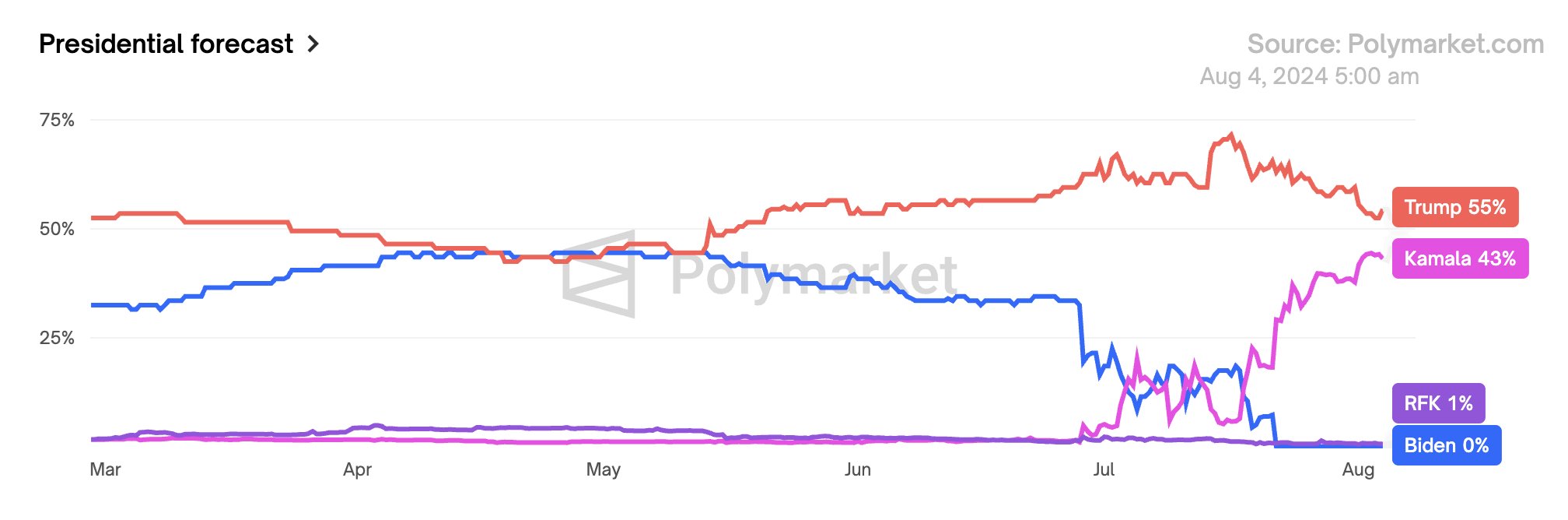

- Trump Momentum Fades: The market seems to be favoring a Trump win, as he has expressed support for Bitcoin. A shift in the political landscape towards Kamala Harris could have contributed to the sell-off.

- Mt. Gox Distributions: The ongoing distribution of Bitcoins from the defunct Mt. Gox exchange continues to add selling pressure to the market.

Despite the recent drop, Bitcoin has bounced back slightly and is currently trading above $52,000. However, the market remains volatile, and it’s unclear what the future holds.  /p>

/p>