Bitcoin (BTC) has been on a rollercoaster ride lately. After hitting a new high of $73,620, it took a tumble, dropping below the $70,000 mark. This decline is about 5.7% and has left many wondering what caused it. Here are a few key reasons:

Election Uncertainty

The timing of Bitcoin’s drop coincides with a tightening race in the US election. Bitcoin has been seen as a “Trump hedge” due to his support for the cryptocurrency sector. Trump has even proposed creating a “strategic Bitcoin reserve” if he wins. As his lead in the polls narrowed, investors seem to have become more cautious, leading to a risk-off sentiment that contributed to the price decline.

Stock Market Jitters

The correlation between Bitcoin and traditional markets can’t be ignored. The S&P 500 has been struggling, hitting its lowest point since October 9th. This has also impacted investor sentiment in the crypto space. Analysts are noting that even though major tech companies like Apple are reporting strong earnings, their stock prices are still dropping. This suggests a broader market de-risking ahead of the election, which could be impacting Bitcoin.

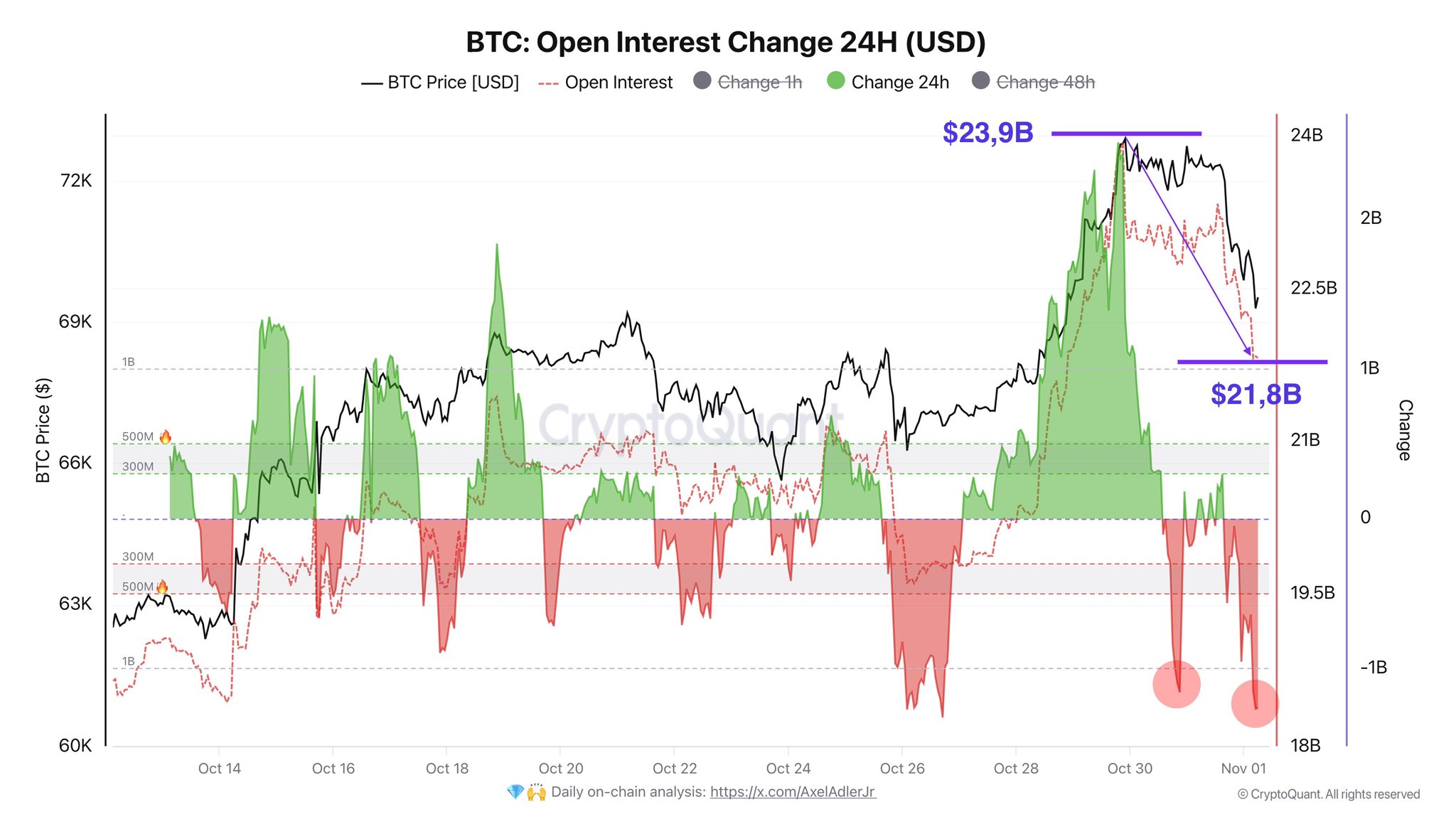

Leverage Unwinding

A significant unwinding of leveraged positions in the crypto market has also played a role in Bitcoin’s price drop. This correction is seen as a healthy response to an overextension driven by leverage. Analysts are pointing to a surge in futures open interest for Bitcoin, Ethereum, and Solana, which crossed $50 billion for the first time. This led to a significant reduction in open interest, indicating a large-scale leverage flush out. Over the past 24 hours, millions of dollars worth of positions were liquidated, with the largest single liquidation order reaching over $11 million.

What’s Next?

While the price of Bitcoin has taken a dip, it’s still trading above $69,000. Analysts are advising caution, but also noting that this pullback could be a good opportunity for investors to buy at a lower price. The coming days will be crucial for Bitcoin, as the election results and the overall market sentiment will likely influence its future trajectory.