Bitcoin’s price recently climbed above $99,000, but experts are raising concerns about how long this upward trend will last. One key indicator points to potential trouble.

Open Interest: A Warning Sign?

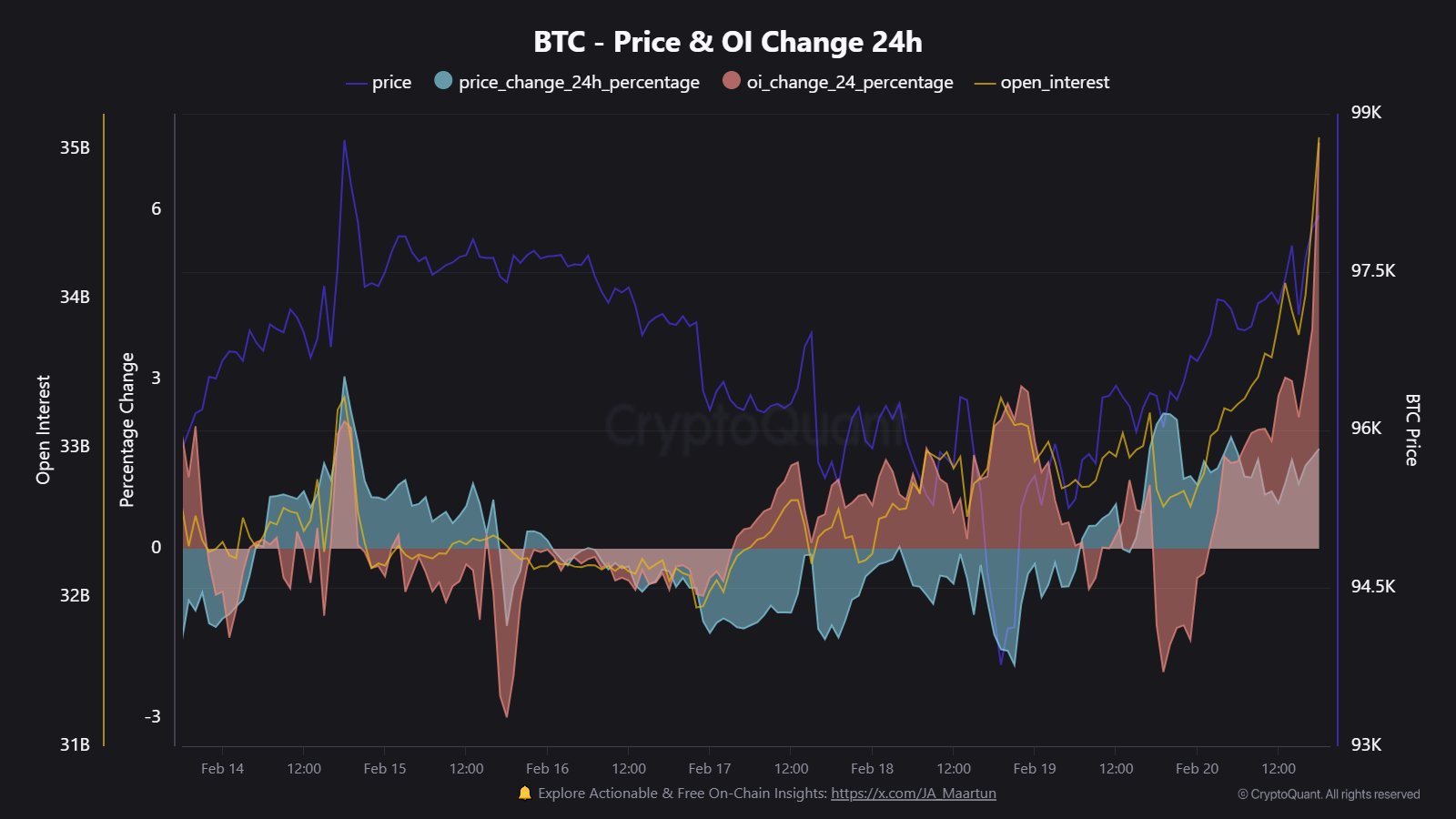

A recent analysis of Bitcoin’s “Open Interest” – the total number of open derivative contracts – reveals a significant spike coinciding with the price surge. This means more people are betting on Bitcoin’s price, using leverage (borrowed money). While some speculation is normal, a large increase often leads to higher volatility and increased risk. A sudden drop in Open Interest, on the other hand, suggests traders are closing their positions, either voluntarily or because they’ve been liquidated (forced to sell due to losses).

The chart shows a dramatic increase in Open Interest, with a 24-hour percentage change hitting 7.2% at its peak. This rapid increase is a cause for concern, as it suggests a potentially unstable market fueled by excessive leverage. Such spikes often precede price corrections, meaning the recent rally could be short-lived and volatile.

Low Volatility: A Calm Before the Storm?

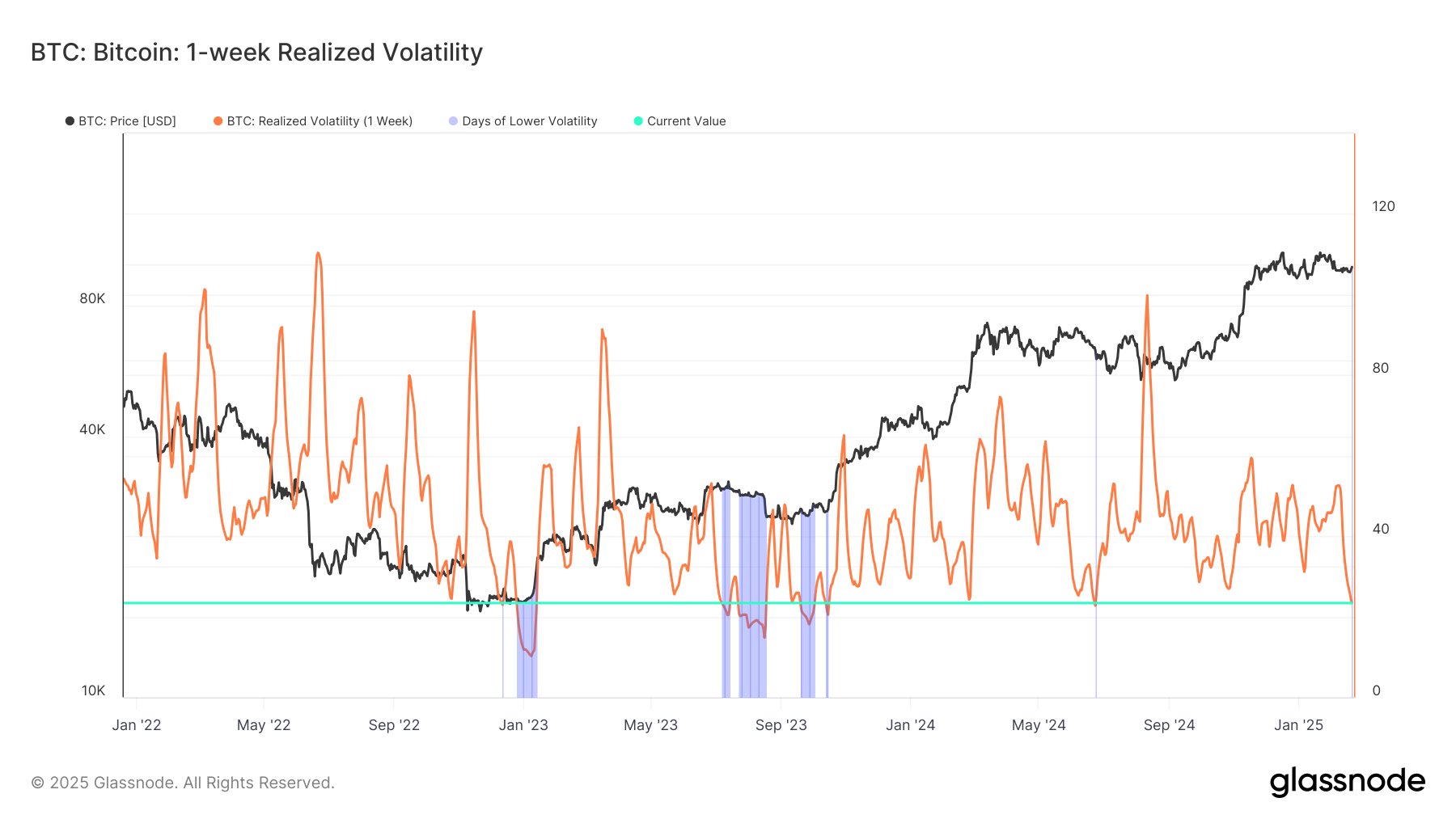

Another indicator, the 1-week Realized Volatility (measuring price swings over the past week), shows a significant drop. This means Bitcoin’s price has been trading within a very narrow range recently. Historically, such low volatility periods have often been followed by major price movements, either up or down. Data suggests this has only happened a few times in the past four years, preceding significant market shifts.

The Bottom Line

Bitcoin’s recent price jump is impressive, but the combination of a soaring Open Interest and unusually low Realized Volatility suggests the rally might be unsustainable. The market could be primed for a period of significant volatility, meaning the price could either continue to rise or experience a sharp correction. Traders should be aware of this increased risk.