Bitcoin’s price recently exploded, surpassing $98,000. This has sparked a heated debate: is $100,000 next, or is this a short-lived pump about to crash?

High Leverage, High Risk?

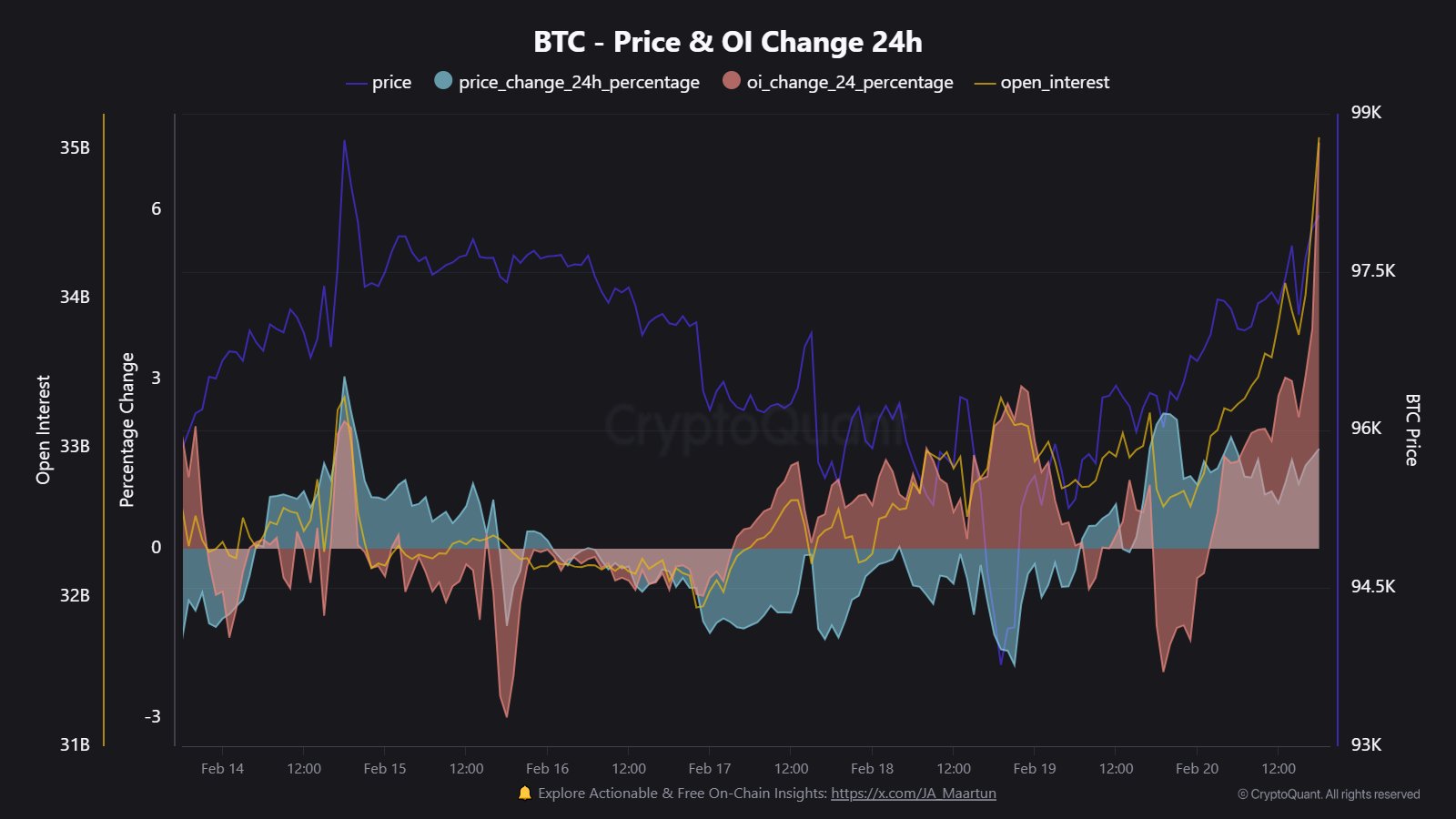

Several market analysts point to a concerning trend: high leverage and a massive increase in open interest (OI). One analyst noted a $2.4 billion jump in Bitcoin’s OI in just 24 hours, warning of a “leverage-driven pump.” This means a lot of people are betting big on Bitcoin’s continued rise, which could lead to a sharp correction if the price drops. Another analyst observed a surge in new long positions (bets that the price will go up), further fueling the price increase. However, they noted that this increase is largely driven by futures contracts, rather than actual buying of Bitcoin itself.

Spot Buying vs. Futures: A Cautious Outlook

While the price is climbing, some analysts are worried. They’ve noticed a significant gap between the increase in futures-based open interest and actual spot buying (people directly purchasing Bitcoin). They suggest that without fresh news or catalysts, it might be difficult for Bitcoin to sustain a price above $100,000. One analyst even mentioned that a planned large buy order might be partially responsible for the price increase, but this alone may not be enough to sustain the rally.

Is This the End of a Cycle?

One analyst offered a cyclical perspective. They suggest Bitcoin might be completing one multi-week cycle and starting another. Historically, these cycles have seen significant price movements (90-105%), but this doesn’t necessarily mean the current price is a peak; it could just be the start of a new upward trend.

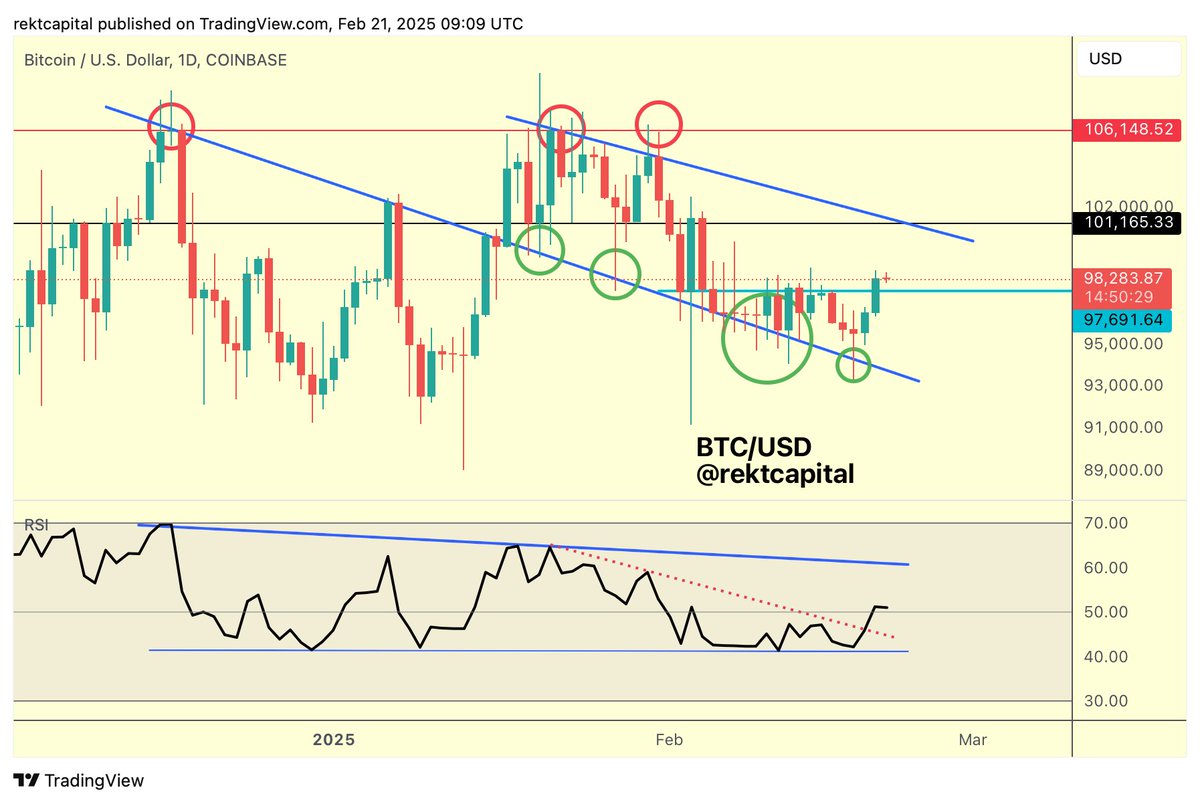

Technical Analysis: Retesting Support Levels

Technical analysts are also weighing in. One focused on Bitcoin’s daily close above $97,700, suggesting that a successful retest of this level as support could lead to a move beyond $100,000. They also pointed to a positive shift in Bitcoin’s relative strength index (RSI), further supporting a bullish outlook. A successful retest of the $97,700 level as support would strengthen the case for a rally towards $101,000.

The Bottom Line

As of writing, Bitcoin was trading around $98,645. While the price has broken through a significant psychological barrier, the underlying market dynamics raise concerns about the sustainability of this rally. The high leverage and the disparity between futures trading and spot buying suggest a potential for a sharp correction. However, positive technical indicators and the possibility of a new upward cycle offer a counterpoint, making the future price movement uncertain.