A crypto analyst, Ted, is optimistic about Bitcoin’s future, predicting a “supply shock of all supply shocks” when the network halves its miner rewards in April 2024.

Bitcoin Halving Event

Ted believes that BTC prices will surge after the Bitcoin halving event in April 2024. This event, scheduled every four years, reduces the number of coins entering the market, making BTC deflationary and potentially increasing prices.

Currently, the Bitcoin network releases 6.25 BTC every 10 minutes, resulting in 900 BTC mined daily. After halving, this number will drop to 450 BTC, leading to a supply shock.

Spot Bitcoin ETFs and Increased Demand

The recent approval of spot Bitcoin exchange-traded funds (ETFs) in mid-January 2024 has further fueled optimism. Spot Bitcoin ETFs allow investors to gain direct exposure to Bitcoin without the hassle of storing private keys.

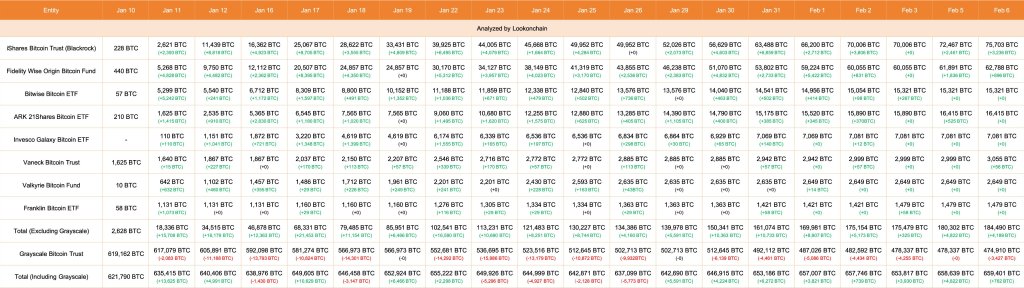

Since their launch, spot Bitcoin ETF issuers have accumulated over 160,000 BTC. If the current daily inflow of 5,800 BTC persists, it could surpass newly mined coins after halving, creating a significant supply shock.

Bitcoin Treasuries and Issuer Holdings

Spot Bitcoin ETF issuers like BlackRock and Fidelity are catching up with MicroStrategy, a business intelligence firm that holds 190,000 BTC. As of February 6, BlackRock, Fidelity, Bitwise, and other issuers control 659,401 BTC, surpassing MicroStrategy’s holdings.

However, this figure includes those held by the Grayscale Bitcoin Trust (GBTC), which is gradually being liquidated.

Analyst’s Outlook

Ted believes that the combination of reduced supply from halving and increased demand from spot Bitcoin ETFs and institutional investors will create a supply shock that could drive Bitcoin’s price significantly higher.