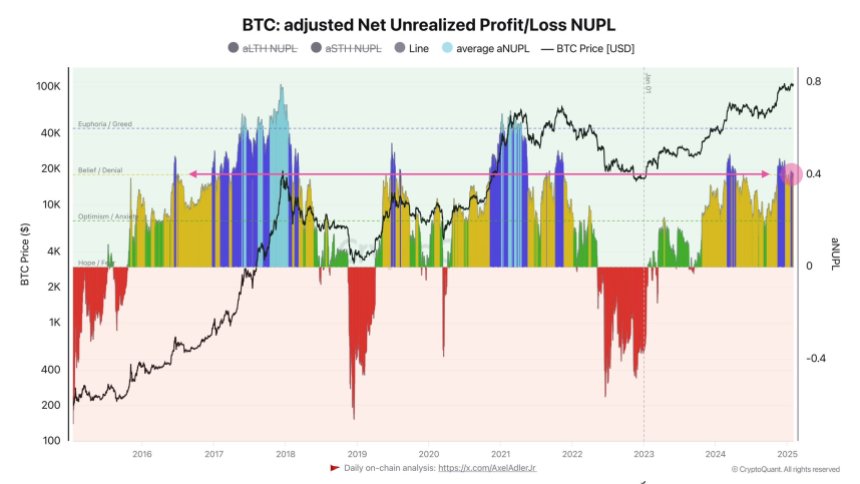

Analyst Axel Adler Jr. thinks Bitcoin’s still got plenty of upside. He’s looking at a metric called aNUPL (adjusted Net Unrealized Profit/Loss) to gauge market sentiment, and what he sees is bullish.

What is aNUPL and What Does it Say About Bitcoin?

aNUPL is a fancy way of measuring whether Bitcoin investors are feeling greedy or cautious. It looks at profits and losses, but also considers how long people have been holding their Bitcoin. A high aNUPL suggests a lot of speculative profit-taking – a bubble. A low aNUPL indicates a more stable, controlled market.

Right now, Bitcoin’s aNUPL is at 0.4. That’s healthy, according to Adler. It’s nowhere near the 0.7-0.8 levels seen at the peak of previous bull runs. This suggests there’s still plenty of room for growth before Bitcoin gets “overheated.”

Bitcoin’s Current State: Numbers and Trends

Bitcoin’s currently trading around $100,824, down slightly from yesterday. But other indicators are positive:

- RSI (Relative Strength Index): At 50.43, it’s comfortably below the “overbought” zone, suggesting more upward movement is possible.

- 100-Day Simple Moving Average: This is significantly below the current price, a classic bullish signal.

What’s Next for Bitcoin?

Bitcoin faces a key resistance level around $106,000. Breaking through that could send it back towards its all-time high near $109,114. Failure to break through could mean more sideways trading.

Long-term, the outlook remains bullish. Analysts are predicting prices anywhere between $150,000 and $350,000 before this bull run ends. This optimism is fueled by historical trends and the generally positive stance of the current administration towards crypto.