CryptoQuant’s CEO, Ki Young Ju, is sticking to his prediction that Bitcoin (BTC) is still in a bull market. He shared this on X (formerly Twitter), citing recent price action and on-chain data as evidence.

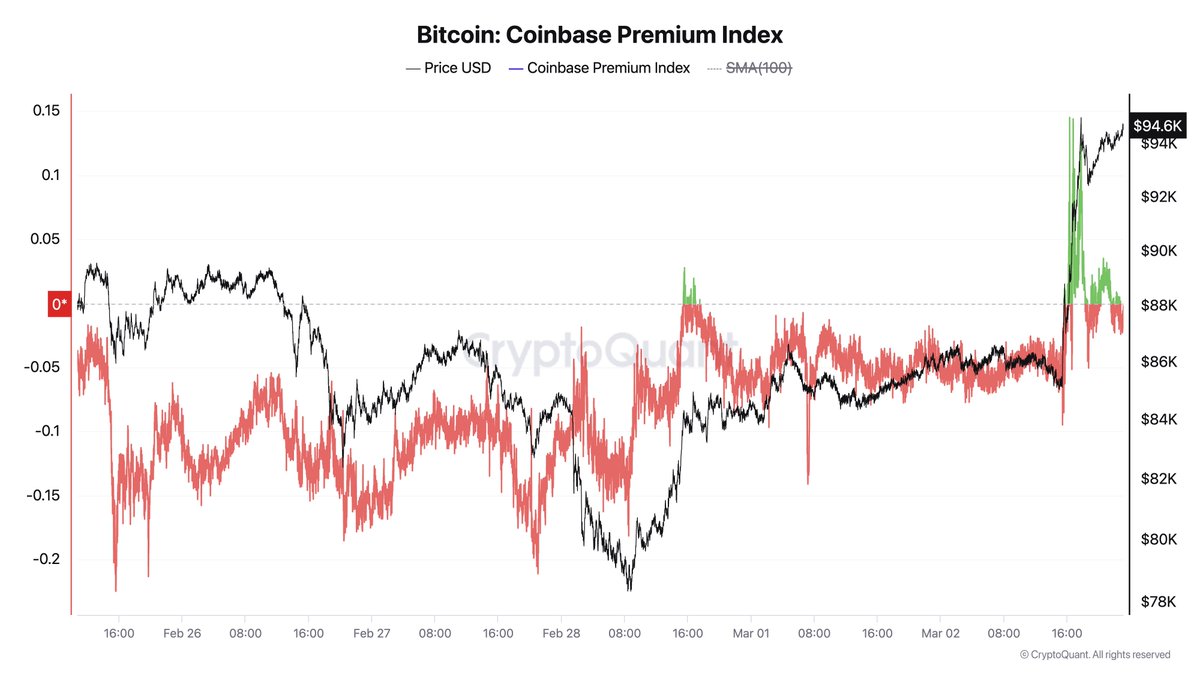

Coinbase Whales and the Bitcoin Surge

Over the weekend, Bitcoin’s price jumped from around $84,000 to nearly $94,000. Ju credits this surge to large investors (“whales”) on Coinbase, a major US cryptocurrency exchange. He believes their activity was a key driver of the price increase.

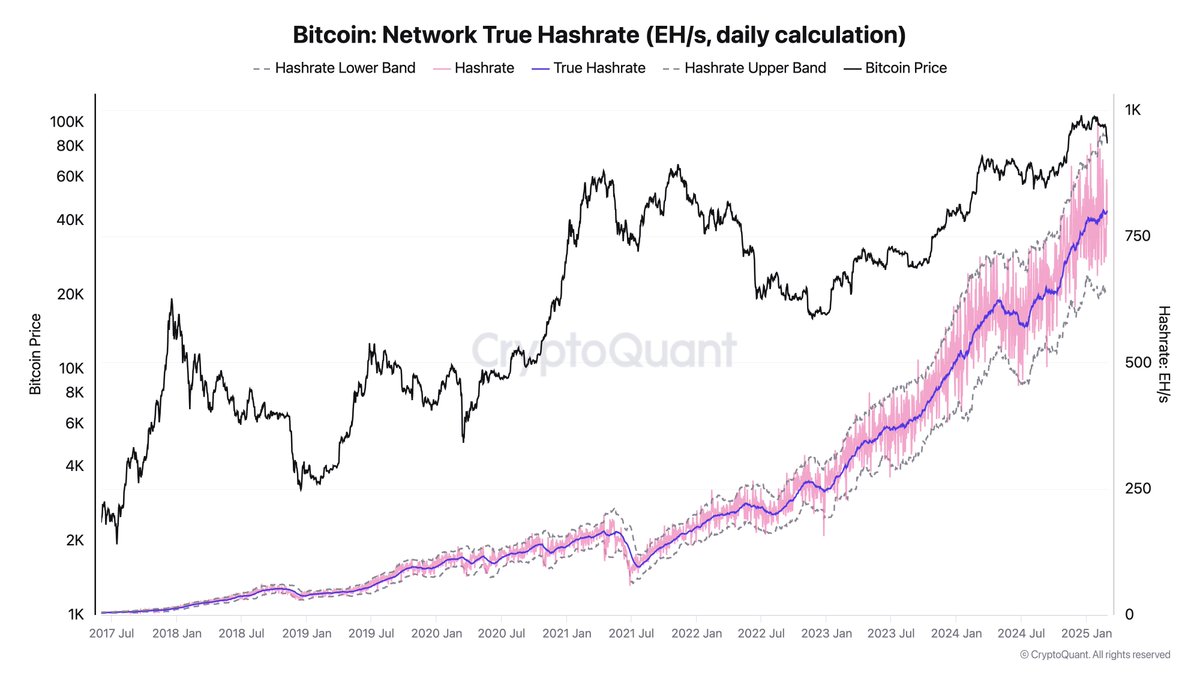

Bullish Indicators: Hash Rate and MVRV

Ju points to several indicators supporting his bullish outlook. One is Bitcoin’s hash rate, a measure of the network’s security. A high hash rate suggests strong network health and is, in Ju’s view, a positive sign. He states that when investment in network security slows, it might be a signal to sell.

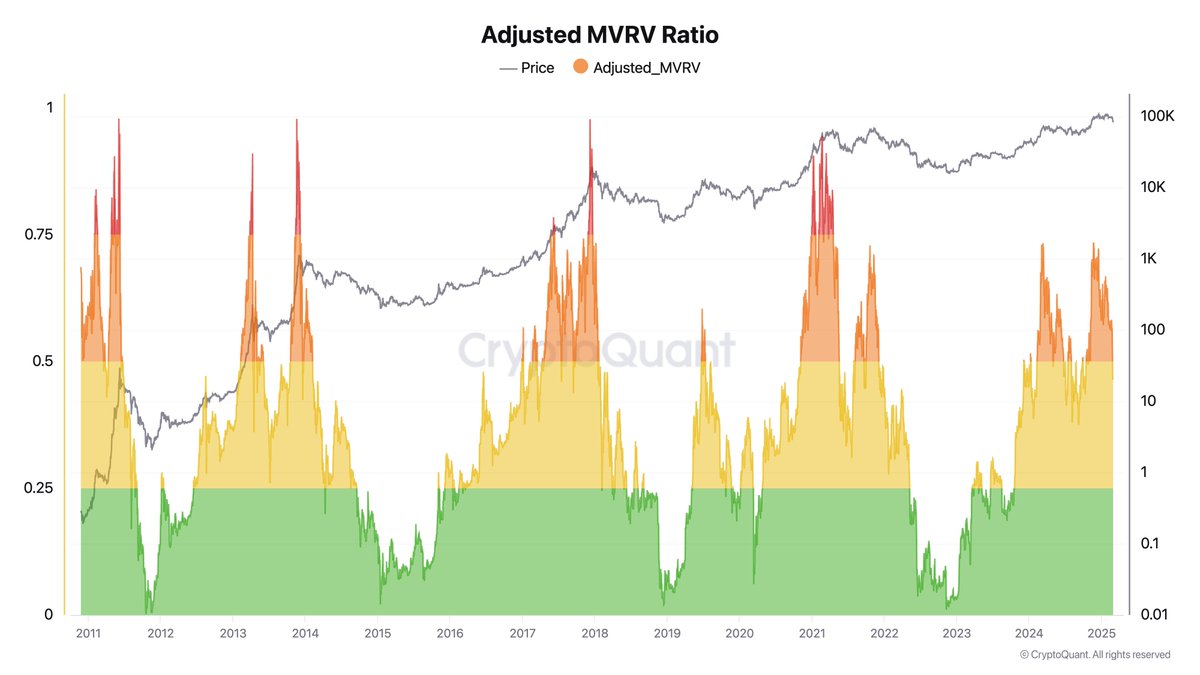

Another indicator is the Market Value to Realized Value (MVRV). This metric compares Bitcoin’s current market cap to its realized cap (the total value of all BTC at their purchase prices). According to Ju, the current MVRV suggests Bitcoin is likely undervalued. He describes the overall on-chain data as feeling “unfinished,” implying further upward potential.

A Monday Dip, But Still Bullish?

While Bitcoin experienced a price correction on Monday, dropping to around $83,284 (a 10.4% decrease in 24 hours), Ju’s bullish stance remains unchanged. He maintains that a significant drop below $75,000 would be needed to invalidate his prediction. He’s confident in his call, despite acknowledging the risk of being wrong.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies.

/p>