Spot Bitcoin ETF Inflows Surge

Bitcoin Spot ETFs are making a strong comeback, with inflows reaching new heights. The price of BTC has seen a significant 8% increase in the last 24 hours, creating a surge of excitement in the market. Several factors may be driving this growth, but institutional investors appear to be playing a crucial role.

Daily Inflows Cross $400 Million

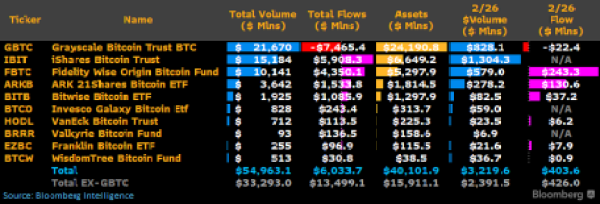

According to Bloomberg analyst James Seyffart, Spot BTC ETF inflows continue to climb steadily. A screenshot shared by Seyffart reveals that inflows into Spot BTC ETFs have surpassed $400 million. The Fidelity Wise Origin Bitcoin Fund leads the charge with $243.3 million in inflows, accounting for over 50% of the total. The ARK 21Shares Bitcoin ETF follows closely with substantial inflows of $130.6 million.

Other funds, including the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the WisdomTree Bitcoin Fund, have also experienced minor inflows. However, the Grayscale Bitcoin Trust (GBTC) continues to face outflows, with a loss of $22.4 million in the past 24 hours.

Gunning for a New Record

The recent inflows into Bitcoin Spot ETFs reflect the growing demand for these products in the market. As institutional investors gain more exposure to Bitcoin, demand is expected to rise, particularly as the BTC price continues to perform well.

While the current inflow volumes may not be the highest single-day inflows, they are still significant compared to previous records. Seyffart highlights that the daily record was set on the first day of trading, with inflows reaching $655 million. The second-largest single-day net flow was recorded earlier this month on February 13, with $631 million.

BTC Price Retraces After Reaching New High

At the time of writing, the BTC price is experiencing a slight retracement after reaching a new 2-year high of $57,000. It has seen an 8.58% gain in the last 24 hours, trading at $55.900, according to data from CoinMarketCap.