Banking Crisis Boosts Bitcoin

Bitcoin, the digital currency, is making waves as the US banking system faces challenges. Some believe Bitcoin will skyrocket in value, while others remain cautious.

Bitcoin: A Safe Haven?

Bitcoin supporters argue that it’s a stable investment in uncertain times. Unlike traditional investments tied to banks, Bitcoin has a limited supply and is decentralized. This makes it a potential safe haven for investors worried about the banking system.

In March 2023, Bitcoin’s price surged 40% after the collapse of banks like Silicon Valley Bank. This suggests that Bitcoin could act as an “uncorrelated asset,” protecting investors from financial turmoil.

Banking System Concerns

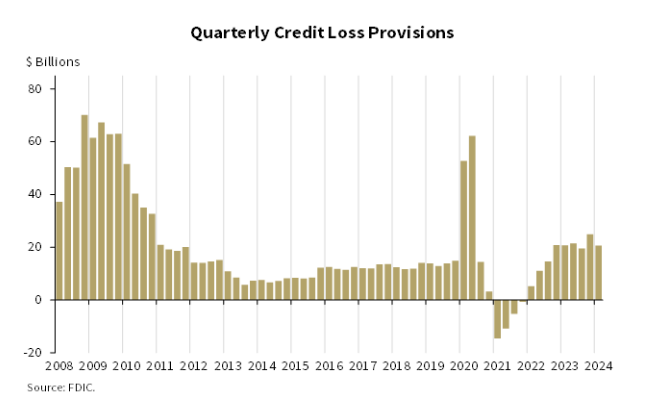

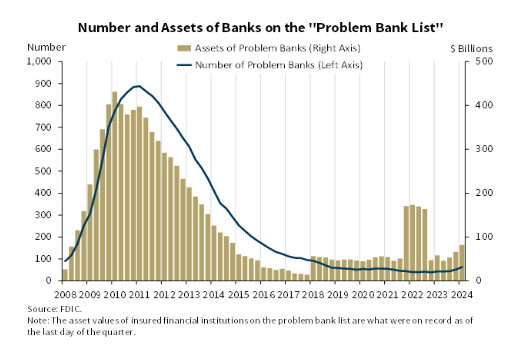

The Federal Deposit Insurance Corporation (FDIC) has reported growing concerns about the health of US banks. Unrealized losses on securities have reached over $500 billion, and the number of “problem banks” has increased.

Million-Dollar Dream or Fantasy?

While Bitcoin’s potential for growth is undeniable, the ambitious target of $1 million per coin faces challenges. Experts warn that such a surge could come at the cost of a severe economic crisis, which may not benefit Bitcoin in the long run.

Correlation with Other Assets

Bitcoin’s correlation with other assets is not always stable. While it can sometimes act independently, it has also shown strong correlation during market downturns. This raises questions about its ability to completely decouple from the traditional financial system.

M2 Money Supply

The recent increase in the M2 money supply, which represents the total money in circulation, has historically coincided with Bitcoin price increases. However, the impact of this relationship in a shaky banking environment is uncertain.

Bitcoin’s Future

Bitcoin’s future is uncertain. While the banking crisis may boost its value, a broader economic downturn could have negative consequences. The outcome depends on the severity of the banking and economic challenges.