The German government recently sold off a huge chunk of its Bitcoin holdings, worth about $3 billion. This move has sparked controversy, with many people criticizing the decision.

A Controversial Sell-Off

The German government claimed the sale was an “emergency” measure related to a criminal investigation. However, the timing of the sale, which coincided with a significant drop in Bitcoin’s price, has raised eyebrows. Many believe the sale actually contributed to the price decline.

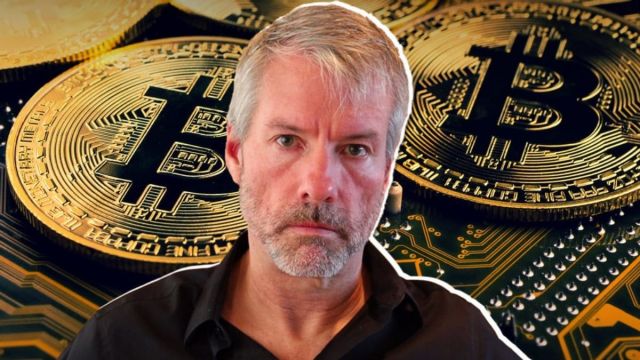

Saylor Speaks Out

Michael Saylor, a prominent Bitcoin advocate and CEO of MicroStrategy, was quick to criticize the German government’s actions. He took to social media to express his disapproval, saying in German, “It’s not an emergency until you run out of Bitcoin.”

Saylor’s statement highlights his strong belief in Bitcoin’s potential and his view that selling it off is a mistake. He has been a vocal supporter of Bitcoin, even investing billions of dollars of his company’s funds into the cryptocurrency.

A Growing Trend?

Other critics, like German lawmaker Joana Cotar, have also voiced their disapproval. Cotar believes Bitcoin should be held as a reserve asset and regrets the government’s decision to sell. She argues that the sale was unnecessary, especially as more and more financial institutions are starting to embrace Bitcoin.

The German government’s decision stands in stark contrast to El Salvador’s approach. El Salvador adopted Bitcoin as legal tender in 2021 and has been actively investing in the cryptocurrency. This difference in approach highlights the ongoing debate about the role of Bitcoin in national economies.

What’s Next?

Saylor’s criticism and the wider debate surrounding the German government’s actions will likely continue to unfold in the coming weeks. It remains to be seen how this situation will impact the future of Bitcoin and its adoption by governments and institutions around the world.