Government Sales: Not a Cause for Concern

Despite recent sales of Bitcoin by the US and German governments, industry experts believe these moves could actually be bullish for the market.

Minimal Impact on Market

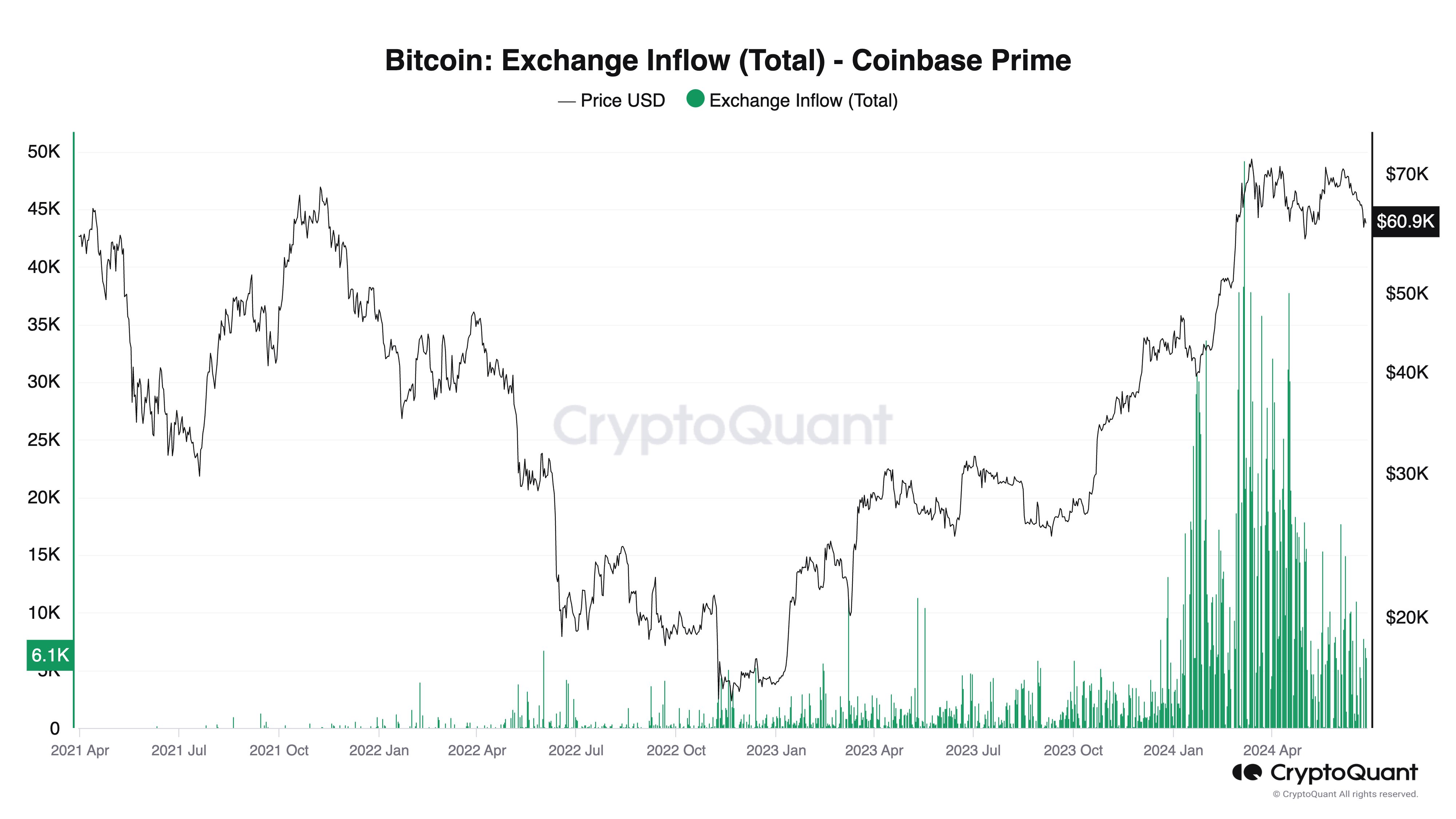

Ki Young Ju, CEO of CryptoQuant, argues that the impact of these sales on the market is likely minimal. He notes that Coinbase Prime typically handles large volumes of Bitcoin liquidity, so these sales are unlikely to cause significant price fluctuations.

Institutional Handling

Crypto analyst Skew explains that government Bitcoin sales are typically handled by institutional desks, which auction the coins off to clients or sell them gradually on the market. This process minimizes the impact on price.

Historical Perspective

Alistar Milne, CIO of Altana Digital, draws parallels to past government asset sales, such as the UK’s sale of gold reserves in the early 2000s. He believes that these sales were ultimately bullish, as the assets were sold at undervalued prices.

Removal of Market Overhang

The completion of these Bitcoin sales could remove a potential overhang on the market, as the threat of future sales is eliminated. This could provide a positive long-term outlook for Bitcoin.

Current Market Conditions

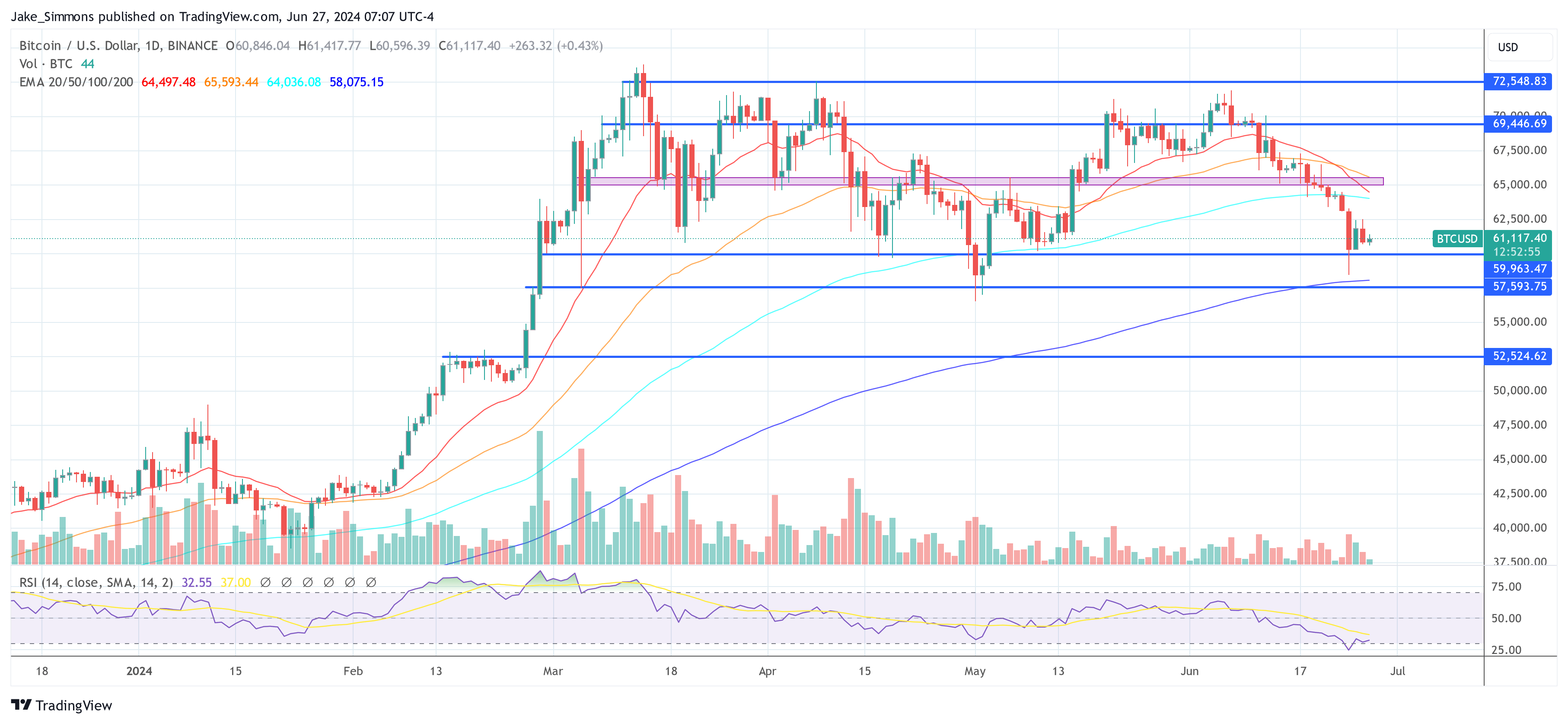

At the time of writing, Bitcoin is trading at $61,117. Despite bearish catalysts, the cryptocurrency has remained resilient, suggesting that the market is not overly concerned about government sales.