Despite four days of Bitcoin exchange-traded funds (ETFs) losing money, the Bitcoin price has climbed back above $66,000.

Grayscale ETF Outflows

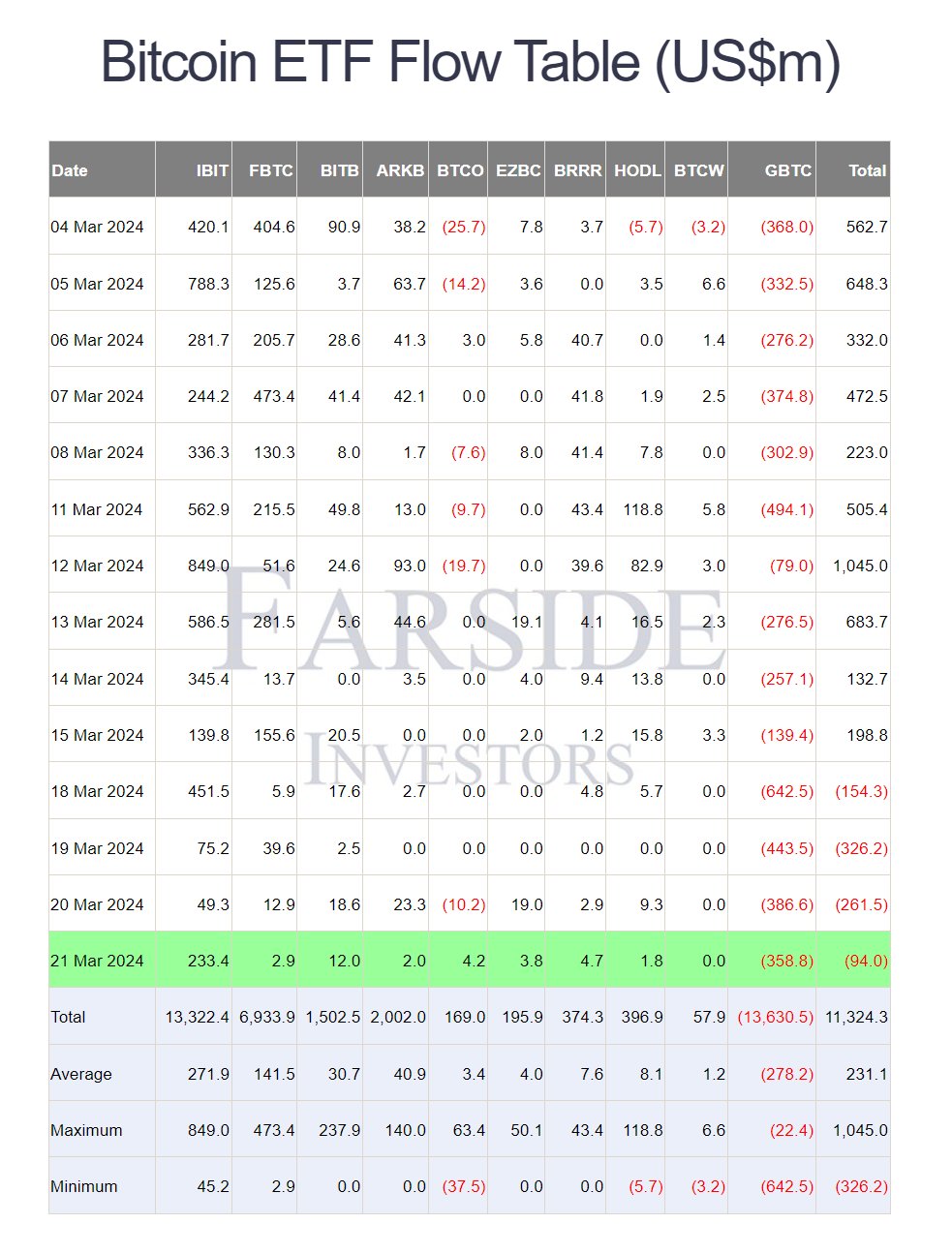

Grayscale’s ETF (GBTC) had a huge outflow yesterday, losing $358 million in a single day. This brings GBTC’s total outflow to $13.63 billion.

BlackRock ETF Inflows

In contrast, BlackRock’s Bitcoin ETF (IBIT) gained $233 million yesterday, bringing its total inflow to $13.32 billion.

Other ETF Performance

Other ETFs have had mixed results:

- Fidelity’s FBTC: Average daily inflow of $141.5 million, but only $2.5 million yesterday.

- Ark Invest’s ETF: Average inflow of $40.9 million, but only $2.0 million yesterday.

- Bitwise’s BITB: Average inflow of $30.7 million, but only $12 million yesterday.

Market Outlook

- Bitcoin Price Stagnation: Some experts are concerned about the potential for a correction, as Bitcoin has been hovering around the same price for a while.

- Grayscale’s Role: Grayscale’s large outflows have contributed to the recent price stagnation.

- Analyst Opinions: Some analysts believe that the outflows are temporary and that inflows will resume soon. Others expect Grayscale’s holdings to continue to decline.

Conclusion

While the ETF outflows are concerning, it’s important to note that most investors are still holding onto their Bitcoin. Once Grayscale’s outflows stop, even small inflows from other ETFs could have a significant impact on the price.