On Tuesday, Bitcoin’s price took a dip from $49,900 to $48,300 after the release of US inflation data. The data came in higher than expected, with the headline CPI at 3.1% instead of 2.9% and the core CPI at 3.9% instead of 3.7%. This led to a negative reaction in the traditional financial market, dragging Bitcoin down with it.

However, Bitcoin quickly recovered and rose above $51,500, marking a new yearly high. There are four key reasons for this surge:

1. Record-Breaking Bitcoin ETF Inflows:

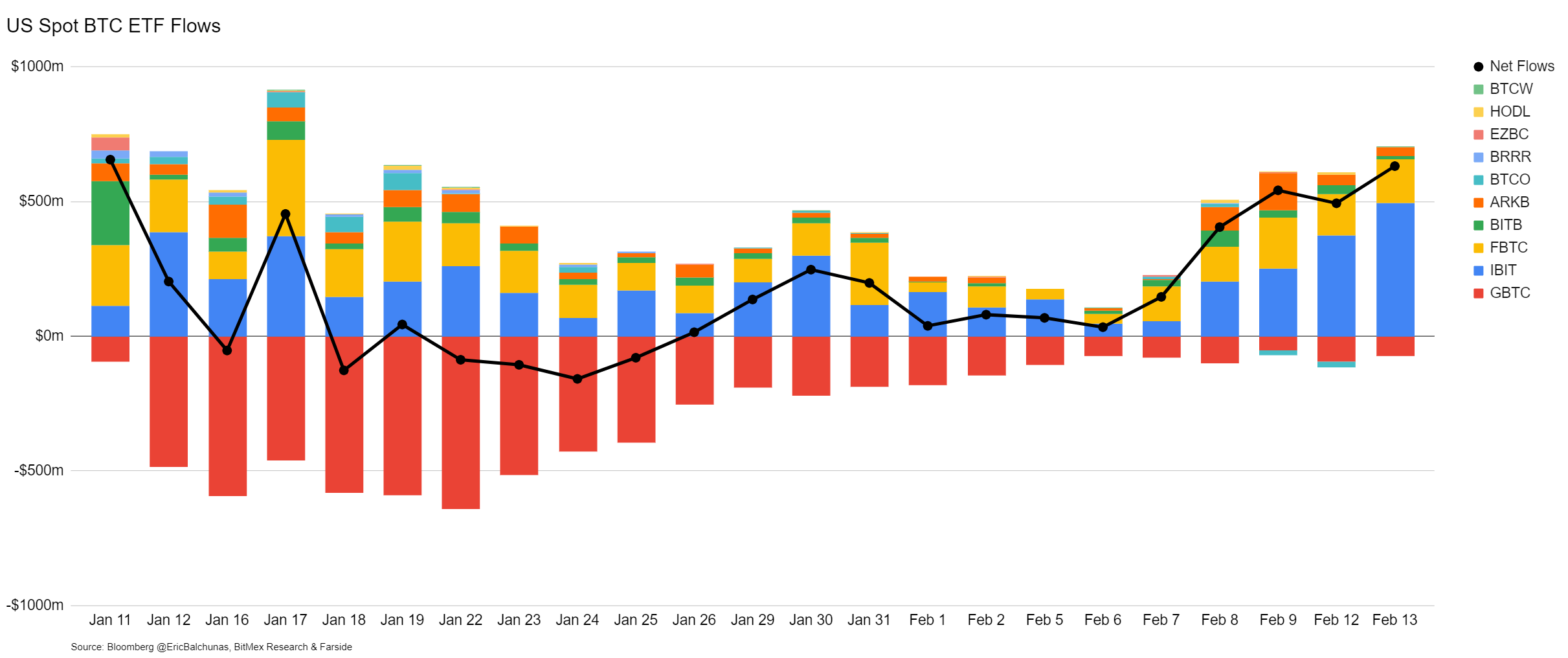

There has been a significant surge in Bitcoin ETF (Exchange-Traded Fund) inflows, reflecting a shift in investor sentiment and market dynamics. On Tuesday, the net Bitcoin ETF spot reached $631 million, with The Nine leading the charge with an $704 million influx. Key players like Blackrock and Fiderity have contributed to this influx, with Blackrock experiencing nearly half a billion dollars in flows and Fiderity $164 million.

The overall net flow over four trading days has been $2.07 billion, averaging over half a billion per day, highlighting the sustained demand for Bitcoin. This demand is largely new capital, as GBTC outflows have remained stable, indicating that these are not merely rotations from GBTC.

2. Genesis GBTC Liquidation concerns Alleviated:

Fears of a Bitcoin crash similar to FTX’s sale of GBTC, triggered by Genesis’s planned liqudation of Grayscale Bitcoin Trust (GBTC) shares, have been alleviated. The proposed Chapter 11 settlement involves in-kind repayments to creditors, reducing direct selling pressure on Bitcoin. This strategy aligns with the interests of long-term Bitcoin holders and could potentially limit market volatility.

3. OTC Demand Exceeds Supply:

There has been a robust demand for Bitcoin at OTC (Over-the-Counter) desks, with demand exceeding supply. This is an indication of large players accumlating Bitcoin, which is a positive signal for its price outlook.

4. Futures and Spot Market Dynamics:

Analysis of futures and spot market indicators suggest a continuation of Bitcoin’s bull run. The reset in open interest and the decrease in funding rates indicate that the market has absorbed the shock and is primed for upward movement.

In conclusion, the combination of record ETF infows, alleviated concerns over Genesis’s GBTC liqudation, strong OTC demand, and favorable futures and spot market dynamics, provide a compelling case for Bitcoin’s potential rally.