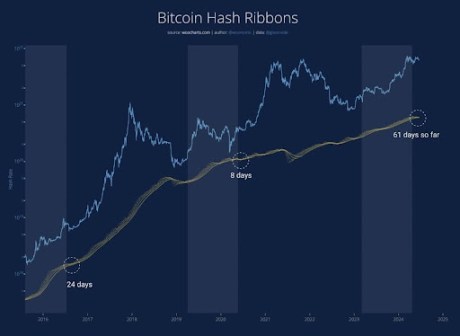

Miner Capitulation as a Bullish Indicator

Crypto expert Willy Woo believes Bitcoin’s price may have bottomed out, signaling a potential market reversal. Miner capitulation, where miners sell off their holdings, has historically indicated a subsequent price surge.

Technical Analysis Suggests Price Reversal

Woo’s analysis shows a TD9 reversal signal on Bitcoin’s daily chart, suggesting a possible change in trend. If this plays out, Bitcoin could start to correct upwards.

Cautious Optimism

While Woo is optimistic, he cautions that Bitcoin’s recovery is not guaranteed. Speculative activity and weak miners still need to be flushed out of the market.

Liquidations and Hash Rates

Woo emphasizes that liquidations are necessary for a major price pump in Bitcoin. Additionally, weak miners need to exit the market and hash rates need to recover for a sustained recovery.

Price Target and Miner Capitulation

Woo initially set a price target of $62,000 for Bitcoin, but speculators’ long positions led to more liquidations and a lower price target of $58,000. Ongoing miner capitulation is also contributing to downward pressure.

$54,000 as a Potential Support Level

Woo suggests that $54,000 could be the next layer of liquidations. If Bitcoin falls below this level, it could enter a bearish phase.