A crypto analyst, Akademik, predicts further Bitcoin price drops. Their analysis suggests a potential crash to as low as $80,000, or even $60,000.

Short-Term Bearish Outlook

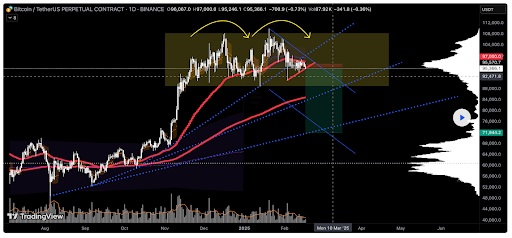

Akademik’s TradingView post outlines a short-term bearish trading strategy for Bitcoin. They believe the current downtrend will continue, suggesting traders short Bitcoin, potentially entering at specific trend levels based on trading volume. Bitcoin recently dipped below $95,000 before recovering slightly, supporting this bearish outlook.

Another analyst, Ali Martinez, points to a significant supply wall at $97,000, exceeding the support at $94,500. This imbalance suggests a higher probability of further price drops before any significant rally. Martinez also notes that historically, decreased Bitcoin mining activity precedes prolonged price corrections, adding to the bearish sentiment.

Long-Term Bullish Sentiment?

Despite the short-term bearish predictions, some analysts maintain a long-term bullish outlook for Bitcoin. Titan of Crypto, for example, believes Bitcoin is currently consolidating and that as long as it stays within this range, there’s no clear short-term direction.

Martinez also suggests the market is in a “depression” phase of its cycle. This implies a final pump before the cycle concludes, potentially followed by a “sucker’s rally” in the subsequent “disbelief” phase.

Current Price and Conclusion

At the time of writing, Bitcoin is trading around $95,300, slightly down over the last 24 hours. While the short-term outlook appears bearish, with predictions of significant price drops, some analysts remain optimistic about Bitcoin’s long-term potential.